Square Enix 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

Annual Report 2005

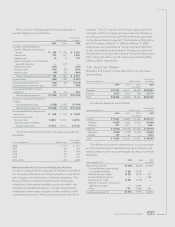

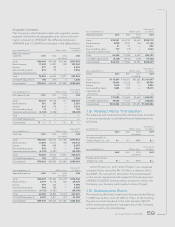

Reconciliation of beginning and ending balances of

benefit obligations are as follows:

Thousands of

Millions of yen U.S. dollars

2005 2004 2005

Change in benefit obligation:

Benefit obligation at beginning

of year ¥(0,983 ¥(0,199 $(09,161

Service cost 214 227 1,992

Interest cost 16 8147

Benefit obligation transferred from

acquired company —675 —

Prior service costs (101) —(939)

Actuarial gains (104) (94) (965)

Benefits paid (40) (32) (369)

Benefit obligation at end of year ¥(0,968 ¥(0,983 $(09,027

Funded status (968) (983) (9,027)

Unrecognized actuarial loss (180) (76) (1,673)

Unrecognized prior service costs (101) —(939)

Unrecognized FAS87 transition

obligation 21 24 200

Net amount recognized ¥(1,228) ¥(1,035) $(11,439)

Amount recognized in the balance

sheet is:

Accrued pension costs (1,228) (1,035) (11,439)

Net amount recognized ¥(1,228) ¥(1,035) $(11,439)

Accumulated benefit obligation at

end of year ¥(0,845 ¥(0,513 $(07,868

Actuarial assumption:

Discount rate 1.652% 1.611% 1.652%

Assumed rate of increase in

compensation level 4.101% 4.370% 4.101%

The future benefit payments for the plan are expected

as follows:

Thousands of

Years ending March 31 Millions of yen U.S. dollars

2006 ¥077 $0,717

2007 80 753

2008 82 769

2009 81 755

2010 77 721

2011–2015 303 2,828

Retirement Benefit to Directors and Statutory Auditors

In order to prepare for the payment of retirement benefit to

the Company’s directors and statutory auditors in the future,

the Company internally funds a retirement allowance. The

Board of Directors determined the certain formula for

calculation of retirement benefits, pursuant to which, the

benefits are calculated based on a certain fixed amount

multiplied by the number of years of office and the coeffi-

cient predetermined by the Board according to the title of

directors. The JCC requires shareholders’ approval before

it is paid, and the Company accrues retirement allowance

according to such formula until the benefits are approved

by the shareholders for payment. The balances of ¥55 million

and ¥110 million at March 31, 2005 and March 31, 2004,

respectively, are presented as “other long-term liabilities”

in the consolidated balance sheets. Charges to income for

the directors’ and corporate auditors’ retirement plans were

¥121 million, ¥6 million and ¥7 million (unaudited) in 2005,

2004 and 2003, respectively.

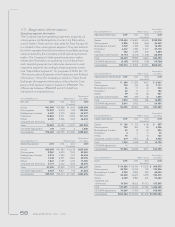

14. Income Taxes

Domestic and foreign income (loss) before income taxes

are as follows:

Thousands of

Years ended March 31 Millions of yen U.S. dollars

2005 2004 2003 2005

(Unaudited)

Domestic ¥21,745 ¥4,577 ¥4,290 $202,484

Foreign 2,547 3,031 (45) 23,714

Total ¥24,292 ¥7,608 ¥4,245 $226,198

Income tax expenses are as follows:

Thousands of

Years Ended March 31 Millions of yen U.S. dollars

2005 2004 2003 2005

(Unaudited)

Current: ¥11,267 ¥(3,600 ¥(3,162 $104,917

Domestic 10,350 1,723 3,162 96,386

Foreign 917 1,877 — 8,531

Deferred: ¥ (1,612) ¥(1,168) ¥(1,240) $ (15,013)

Domestic (1,807) (1,234) (1,240) (16,829)

Foreign 195 66 — 1,816

Total ¥09,655 ¥(2,432 ¥(1,922 $089,904

The differences between the provision for income taxes

and the income taxes computed using Japan statutory tax

rate to pretax income as a percentage of pretax income are

as follows:

2005 2004 2003

Years ended March 31 (Unaudited)

Statutory tax rate (%) 40.70% 42.05% 42.05%

Tax rate difference from foreign

consolidated affiliates (1.23) (2.29) —

Effect of tax rate change (0.86) (0.22) 0.57

Accumulated earnings tax —— 1.86

Investment tax credit (0.58) (2.19 ) —

Reversal of valuation allowance on

deferred tax assets —(3.50) —

Others 1.72 (1.88) 0.81

Income tax expense (%) 39.75% 31.97% 45.29%