Square Enix 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 SQUARE ENIX CO., LTD.

Segment Information

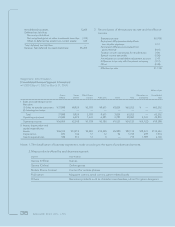

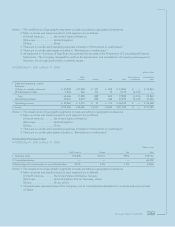

[Consolidated Business Segment Information]

• FY2003 (April 1, 2003 to March 31, 2004)

Millions of yen

Games Games Mobile Phone Eliminations or Consolidated

(Offline) (Online) Content Publication Others Total unallocated total

I Sales and operating income

Net sales

(1) Sales to outside customers ¥37,988 ¥8,924 ¥2,793 ¥9,671 ¥3,824 ¥63,202 ¥ — ¥63,202

(2) Intersegment sales ————————

Total 37,988 8,924 2,793 9,671 3,824 63,202 — 63,202

Operating expenses 21,583 6,575 1,633 6,491 2,797 39,081 4,722 43,803

Operating income ¥16,404 ¥2,348 ¥1,159 ¥3,180 ¥1,027 ¥24,120 ¥ (4,722) ¥19,398

II Assets, depreciation and

capital expenditures

Assets ¥55,104 ¥14,215 ¥2,583 ¥14,225 ¥5,980 ¥92,110 ¥18,523 ¥110,633

Depreciation 870 742 17 12 92 1,735 239 1,974

Capital expenditures 188 513 12 0 — 715 1,989 2,704

Notes: 1. The classification of business segments is made according to the types of products and services.

2. Major products offered by each business segment

Segment Major Products

Games (Offline) Games

Games (Online) Online games

Mobile Phone Content Content for mobile phones

Publication Magazine comics, serial comics, game-related books

Others Derivative products such as character merchandise, school for game designers

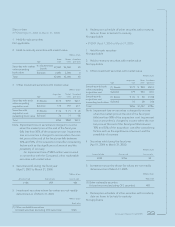

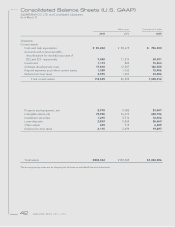

Net deferred tax assets 5,209

Deferred tax liabilities

Non-current liabilities

Net unrealized gains on other investment securities (324)

Offset to deferred tax assets (non-current assets) 324

Total deferred tax liabilities −

Balance: Net deferred tax assets (liabilities) ¥5,209

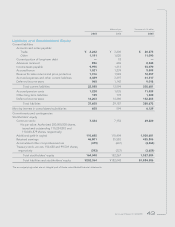

2. Reconciliation of the statutory tax rate and the effective

tax rate

Statutory tax rate 40.70%

Permanent differences excluded from

non-taxable expenses 0.17

Permanent differences excluded from

gross revenue (0.01)

Taxation on per capita basis for residents tax 0.04

Special income tax credits (0.56)

Amortization on consolidation adjustment account 2.43

Difference in tax rate with the parent company (1.17)

Other (0.49)

Effective tax rate 41.11%