Square Enix 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

Annual Report 2005

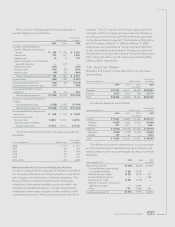

SFAS No. 142 requires an annual test for impairment of

goodwill, and between annual tests if events occur or cir-

cumstances change that would more likely than not reduce

the fair value of a reporting unit below its carrying amount.

In assessing potential impairment of goodwill, the Com-

pany determines the implied fair value of each reporting

unit using discounted cash flow analysis and compares such

values to the respective reporting unit’s carrying amount.

The Company performs its annual test for indication of

goodwill impairment in the fourth quarter of each fiscal year.

Impairment of Long-Lived Assets

The Company evaluates its long-lived assets for impairment

as events or changes in circumstances indicate that the car-

rying amount of such assets may not be fully recoverable.

The Company evaluates the recoverability of long-lived

assets by measuring the carrying amount of the assets

against the estimated undiscounted future cash flows asso-

ciated with them. At the time such evaluations indicate that

the future undiscounted cash flows of certain long-lived

assets are not sufficient to recover the carrying value of

such assets, the assets are adjusted to their fair values

Investment Securities

The Company invests in equity securities and bonds, and

has classified its investment securities as available-for-sale

and held-to-maturity, in accordance with SFAS No. 115

“

Accounting for Certain Investments in Debt and Equity

Securities

.” Investment securities designated as available-

for-sale, whose fair values are readily determinable, are car-

ried at fair value with unrealized gains or losses included as

a component of accumulated other comprehensive income,

net of applicable taxes. Investment securities that are

expected to be held-to-maturity are carried at amortized

cost. Individual securities classified as either available-for-

sale or held-to-maturity are reduced to net realizable value

by a charge to income for other than temporary declines in

fair value. Realized gains and losses are determined on the

moving average cost method and are reflected in income.

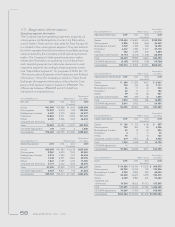

Income Taxes

The Company recognizes deferred taxes using the asset

and liability method. Under the asset and liability method,

deferred income taxes are recognized for the differences

between financial statement and tax bases of assets and lia-

bilities at currently enacted statutory tax rates for the years

in which the differences are expected to reverse. The effect

on deferred taxes for a change in tax rates is recognized in

income in the period that includes the enactment date.

Valuation allowances are established when necessary to

reduce deferred tax assets to the amounts expected to

be realized.

Accounting for Consumption Taxes

The Japanese consumption taxes received and consump-

tion taxes paid are not included in the accompanying con-

solidated statements of income. The consumption taxes

paid are set off against consumption taxes received and

the resultant balance due to Japanese tax authorities are

presented in the consolidated balance sheets as “accrued

expenses and other current liabilities.”

Employee Benefit Plan

The Company and its domestic subsidiaries have defined

benefit retirement plans, which are accounted for in

accordance with SFAS No. 87 “

Employers’ Accounting

for Pensions.

”

Revenue Recognition

The Company recognizes revenue in accordance with

Statement of Position (“SOP”) No. 97-2, “

Software Revenue

Recognition,

” which provides guidance on applying gener-

ally accepted accounting principles in recognizing revenue

on software transactions and Staff Accounting Bulletin

(“SAB”) No. 101, “

Revenue Recognition in Financial State-

ments,

” as amended by SAB No. 104, “

Revenue Recogni-

tion,

” which outline the basic criteria that must be met to

recognize revenue and provides guidance for presentation

of revenue and for disclosure related to revenue recogni-

tion policies in financial statements. The Company recog-

nizes revenue when the price is fixed and determinable,

when there is persuasive evidence of an arrangement, upon

fulfillment of its obligations under any such arrangement

and when determination that collection is probable.

Sales Returns and Allowances and Bad Debt Reserves

The Company’s software distribution arrangements with

customers in Japan do not give customers the right to

return products; however, the U.S. subsidiary, at its discre-

tion, may accept product returns for stock balancing or

defective products, sometimes negotiates accommodations

to customers, including price discounts, credits and product

returns, when demand for specific products falls below

expectations, and accepts returns and grants price protec-

tion in connection with its publishing arrangements. The U.S.

subsidiary estimates potential future product returns, price

protection and sales incentives related to the current period

product revenue. The U.S. subsidiary analyzes historical

returns, current sell-through of distributor and retailer

inventory of its products, current trends in the software

games business segment and the overall economy, changes

in customer demand and acceptance of its products and

other related factors when evaluating the adequacy of the

sales returns and price protection allowances. In addition,