Square Enix 2005 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2005 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 SQUARE ENIX CO., LTD.

Total Liabilities

Years ended March 31 Millions of yen

2004 2005 Change

¥13,338 ¥22,103 ¥8,764

Primarily due to the temporary difference in valuation

allowance of movie assets, etc., assumed from the former

SQUARE being dissolved, accrued expenses increased

¥8,681 million. As a result, total liabilities at fiscal 2005

year-end were ¥22,103 million.

As of fiscal 2005 year-end, we had no interest-bearing

liabilities.

Shareholders’ Equity

Years ended March 31 Millions of yen

2004 2005 Change

Common stock ¥07,154 ¥007,433 ¥00,278

Capital surplus reserve 36,393 36,673 280

Retained earnings 53,931 65,561 11,630

Unrealized gain on revaluation

of securities 363 472 108

Foreign currency translation

adjustment (898) (807) 90

Treasury stock (245) (401) (156)

Total shareholders’ equity ¥96,700 ¥108,933 ¥12,232

As of fiscal 2005 year-end, total shareholders’ equity totaled

¥108,933 million, an increase of ¥12,232 million. The increase

in common stock and capital surplus reserve is due to stock

options being exercised.

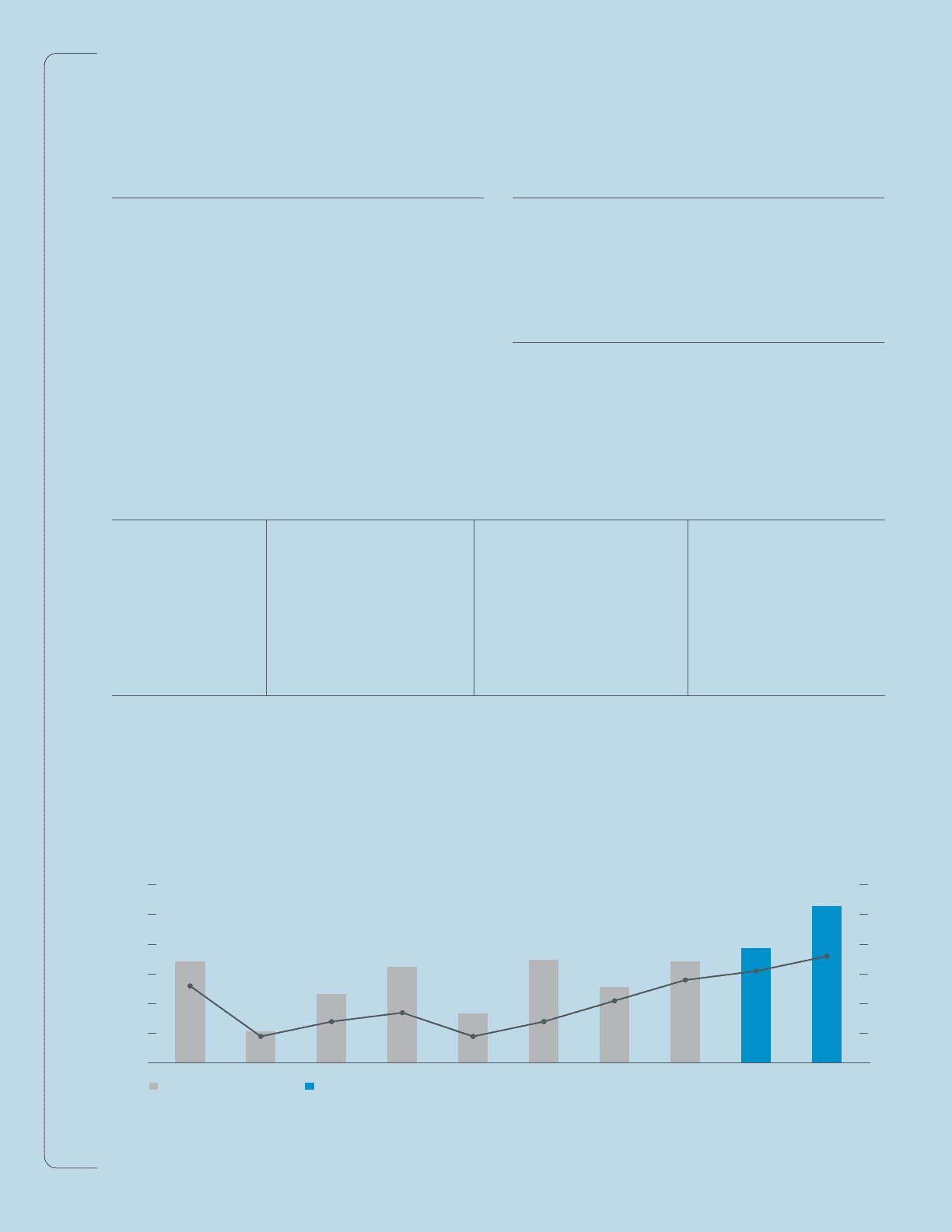

Sales and Operating Income

Years ended March 31 Millions of yen

2004 Composition 2005 Composition Change Percent change

Net sales ¥63,202 100.0% ¥73,864 100.0% ¥10,662 16.9%

Gross profit 41,117 65.1 48,161 65.2 7,043 17.1

Reversal of allowance for

sales returns 1,420 2.2 1,569 2.1 149 10.5

Provision for allowance for

sales returns 1,569 2.5 1,316 1.8 (253) (16.1)

Net gross profit 40,968 64.8 48,414 65.5 7,446 18.1

Selling, general and

administrative expenses 21,569 34.1 21,975 29.7 406 1.8

Operating income 19,398 30.7 26,438 35.8 7,040 36.3

In fiscal 2005, apart from our “Others businesses,” we were

able to post an increase in both income and profit in all our

business segments. In particular, our Games (Online) and

Mobile Phone Content business segments, which both have

business models based on membership fees, showed large

increases. Even in the competitive market environment we

have faced during the two years since our merger, we have

been able to show results where increases in sales have

lead to corresponding increases in our operating profit

ratio.

30,000

25,000

20,000

15,000

10,000

5,000

0

60

50

40

30

20

10

0

Millions of yen %Years ended March 31

Notes: 1. The former ENIX did not prepare consolidated financial statements for the period between FY1995 and FY2000. The former ENIX figures for this period are, therefore,

disclosed on a non-consolidated basis.

2. Above figures and ratios have been calculated using the simple addition of the former ENIX and the former SQUARE by FY2002.

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005

Trends of Operating Income and Operating Income Margin

17,107

26%

5,370

9%

11,637

14%

16,224

17%

8,355

9%

17,411

14%

12,890

21%

17,197

28%

19,398

31%

26,438

36%

Former ENIX + Former SQUARE SQUARE ENIX