Square Enix 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

Annual Report 2005

2. Analysis of Financial Policy, Capital

Resources and Liquidity

The Group internally finances working capital and capital

investment. As of March 31, 2005, there was no balance of

interest-bearing debt. Cash and cash equivalents totaled

¥81,243 million at the end of this fiscal year.

The Group believes that it is possible to procure the

funds required for working capital and capital investment in

the future to maintain growth based on its sound financial

standing and ability to generate cash through operating

activities.

3. Analysis of Business Performance

for Fiscal 2005

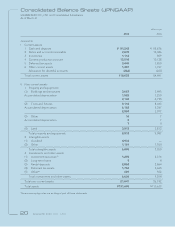

Total Assets

Years ended March 31 Millions of yen

2004 2005 Change

¥110,633 ¥131,695 ¥21,061

Total assets for fiscal 2005 amounted to ¥131,695 million,

an increase of ¥21,061 million compared with the previous

fiscal year. The breakdown of this increase is as follows.

Cash and Time Deposits

Years ended March 31 Millions of yen

2004 2005 Change

¥58,676 ¥81,243 ¥22,567

Net cash provided by operating activities totaled ¥24,873

million.

Under cash flows from investing activities, we posted

proceeds from redemption of investment securities of

¥2,000 million, comprised of redemption of government

bonds. Payments for acquiring property and equipment

decreased ¥1,390 million, primarily due to expenses related

to the moving of our head office posted in the previous

fiscal year. Accordingly, net cash provided by (used in)

investing activities increased ¥574 million.

Net cash used in financing activities decreased ¥2,907

million, mainly due to payments for dividends.

Notes and Accounts Receivable

Years ended March 31 Millions of yen

2004 2005 Change

¥12,046 ¥7,670 ¥(4,375)

Notes and accounts receivable changes according to the

timing of releases. In fiscal 2005, we did not release any

“million-seller” titles. Accordingly, as of March 31, 2005,

notes and accounts receivable came to ¥7,670 million, a

decrease of ¥4,375 million.

Content Production Account

Years ended March 31 Millions of yen

2004 2005 Change

¥10,128 ¥15,510 ¥5,381

As a rule, content development costs for authorized pro-

ductions are capitalized in the content production account

until release. When the content (title) is released, this

amount is then recorded as expenses.

Content development costs for authorized productions

are reevaluated based on the current business environment.

For those titles that we decided not to release as a part of

this reevaluation process, we have posted these as a loss

of write-off of content development account or as an

extraordinary loss.

Costs during the pre-production phase before production

is approved are posted as selling, general and administrative

(SG&A) expenses.

As of March 31, 2005, content production account

increased ¥5,381 million, to ¥15,510 million, as a result of

development underway for several large titles scheduled

for release by the end of March 2006.

Deferred Tax Assets

Years ended March 31 Millions of yen

2004 2005 Change

¥1,850 ¥3,440 ¥1,590

As a result of a temporary increase in corporate tax

payable, deferred tax assets increased ¥1,590 million.

Intangible Assets

Years ended March 31 Millions of yen

2004 2005 Change

¥7,550 ¥6,096 ¥(1,454)

Intangible assets decreased ¥1,454 million, mainly as a

result of ¥1,236 million of goodwill depreciation from the

purchase of UIEvolution Inc., in the previous fiscal year.

Investment Securities

Years ended March 31 Millions of yen

2004 2005 Change

¥3,516 ¥1,295 ¥(2,221)

Mainly as a result of the redemption of government bonds,

investment securities decreased ¥2,221 million.