Square Enix 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 SQUARE ENIX CO., LTD.

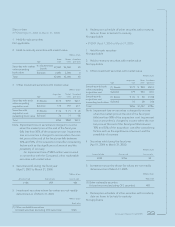

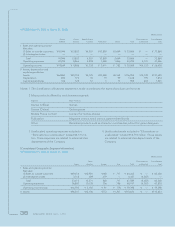

• FY2004 (April 1, 2004 to March 31, 2005)

*1 —————

*2 Breakdown of gain on sale of property and equipment

Tools and fixtures ¥0 million

*3 Breakdown of loss on sale of property and equipment

Tools and fixtures ¥2 million

*4 Breakdown of loss on disposal of property and equipment

Tools and fixtures ¥47 million

Software 2 million

Total ¥50 million

*5 Same as FY2003

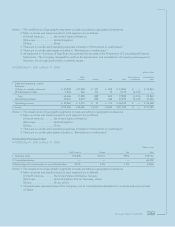

Notes to Consolidated Statements of Cash

Flows

• FY2003 (April 1, 2003 to March 31, 2004)

*1 Reconciliation of cash and cash equivalents on consoli-

dated statements of cash flows to the amounts disclosed

in the consolidated balance sheets is as follows:

(As of March 31, 2004)

Cash and deposits ¥58,676 million

Cash and cash equivalents ¥58,676 million

• FY2004 (April 1, 2004 to March 31, 2005)

*1 Reconciliation of cash and cash equivalents on consoli-

dated statements of cash flows to the amounts disclosed

in the consolidated balance sheet is as follows:

(As of March 31, 2005)

Cash and deposits ¥81,243 million

Cash and cash equivalents ¥81,243 million

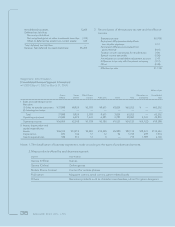

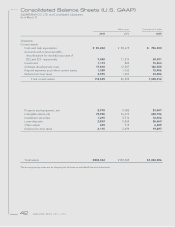

Lease Transactions

• FY2003 (April 1, 2003 to March 31, 2004)

Information related to finance leases other than those that

transfer ownership to the lessee

1. Acquisition cost, accumulated depreciation and net

book value of leased assets

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

Tools and fixtures ¥90 ¥48 ¥41

Total ¥90 ¥48 ¥41

Note: The acquisition cost payment is an insignificant por-

tion of total property and equipment at the end of

the period. Accordingly, the total acquisition cost

includes the interest portion.

2. Ending balance of future lease payments

Due within one year ¥16 million

Due after one year 24 million

Total ¥41 million

Note: The total future lease payment at the end of the period

is an insignificant portion of total property and equip-

ment at the end of the period. Accordingly, the total

future lease payment includes the interest portion.

3. Lease payment and depreciation

Lease expenses payment ¥18 million

Depreciation expense ¥18 million

4. Method of calculation for depreciation

Depreciation is calculated using the straight-line method

over the useful life with no residual value.

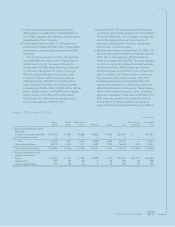

• FY2004 (April 1, 2004 to March 31, 2005)

Information related to finance leases other than those that

transfer ownership to the lessee

1. Acquisition cost, accumulated depreciation and net

book value of leased assets

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

Tools and fixtures ¥74 ¥49 ¥24

Total ¥74 ¥49 ¥24

Note: The total future lease payment at the end of the year

is an insignificant portion of total property and equip-

ment at the end of the year. Accordingly, the total

acquisition cost includes the interest portion.

2. Ending balance of future lease payments

Due within one year ¥14 million

Due after one year 9 million

Total ¥24 million

Note: The total future lease payment at the end of the year

is an insignificant portion of total property and equip-

ment at the end of the year. Accordingly, the total

future lease payment includes the interest portion.

3. Lease payments and depreciation

Lease payments ¥16 million

Depreciation expense ¥16 million

4. Method of calculation for depreciation

Depreciation is calculated using the straight-line method

over the useful life with no residual value.