Square Enix 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

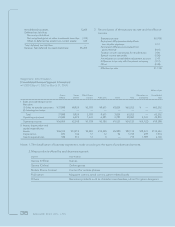

30 SQUARE ENIX CO., LTD.

• FY2004 (April 1, 2004 to March 31, 2005)

A) Accounting treatment of consumption tax

Same as FY2003

B) Accounting treatment of overseas subsidiaries

Same as FY2003

5. Valuation of Assets and Liabilities of

Consolidated Subsidiaries

• FY2003 (April 1, 2003 to March 31, 2004)

All assets and liabilities of consolidated subsidiaries are

revalued on acquisition.

• FY2004 (April 1, 2004 to March 31, 2005)

Same as FY2003

6. Amortization of Goodwill

• FY2003 (April 1, 2003 to March 31, 2004)

Goodwill is amortized over a period of 3 years on a straight-

line basis.

• FY2004 (April 1, 2004 to March 31, 2005)

Goodwill is amortized over a period of 3–5 years on a

straight-line basis.

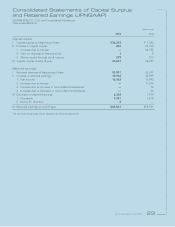

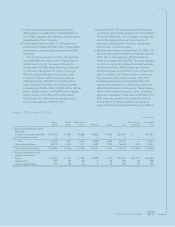

7. Appropriation of Retained Earnings

• FY2003 (April 1, 2003 to March 31, 2004)

The consolidated statement of capital surplus retained earn-

ings is prepared based on earnings (deficit) appropriations

determined during the fiscal year.

• FY2004 (April 1, 2004 to March 31, 2005)

Same as FY2003

8. Scope of Cash and Cash Equivalents in

the Statements of Cash Flows

• FY2003 (April 1, 2003 to March 31, 2004)

Cash and cash equivalents in the consolidated statements

of cash flows is comprised of cash on hand, bank deposits

which are able to be withdrawn on demand and highly liq-

uid short-term investments with an original maturity of three

months or less and with minor risk of significant fluctuations

in value.

• FY2004 (April 1, 2004 to March 31, 2005)

Same as FY2003

Reclassifications

• FY2003 (April 1, 2003 to March 31, 2004)

Not applicable

• FY2004 (April 1, 2004 to March 31, 2005)

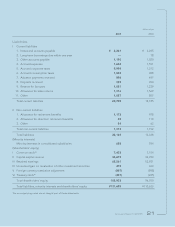

(Consolidated Balance Sheets)

“Goodwill,” which was included in “Intangible assets” in

the previous year, is presented separately in the current

year as the amount became material. In the previous year,

“Goodwill” included in “Intangible assets” was ¥6,361

million.

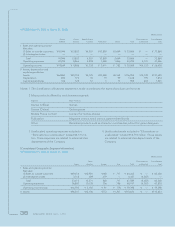

Additional Information

• FY2003 (April 1, 2003 to March 31, 2004)

(Accounting treatment for costs related to the planning and

development of game content paid to third parties)

Until the fiscal year ended March 31, 2003, the Company

expensed the costs related to the planning and develop-

ment of game content when paid to a third party. Effective

from the fiscal year ended March 31, 2004, as a result of

efforts to strengthen the decision-making process in con-

nection to the development of game software and to imple-

ment more stringent selection criteria, such costs incurred

during the development stage are capitalized as “Content

production account” and charged to cost of sales at the

time of sale of related game products. For the fiscal year

ended March 31, 2004, “Content production account”

included such capitalized costs in the amount of

¥3,763 million.

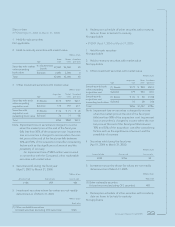

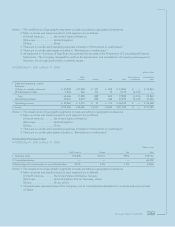

(Accounting for business combination)

On April 1, 2003, ENIX CORPORATION and SQUARE CO.,

LTD., merged and formed SQUARE ENIX CO., LTD. The

merger was effected through the issue of 51,167,293 com-

mon shares and allocated on the basis of one SQUARE

CO., LTD., common share for every 0.85 ENIX CORPORA-

TION common shares. The merger was consummated on

an equal footing by combining the entire control over net

assets and management activities prior to the merger, and

sharing both the post-merger benefits and risks equally. In

addition, it was not possible to determine which entity was

the acquirer. Therefore, this business combination was

accounted for under the pooling-of interests method.

Details of post-merger assets and liabilities are provided

as follows.