Square Enix 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

Annual Report 2005

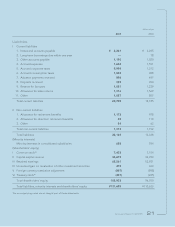

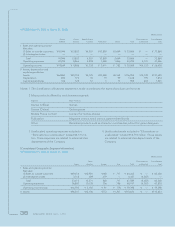

* Assets and Liabilities Transferred from SQUARE CO., LTD.,

due to the Merger

Category Millions of yen

Assets

Current assets ¥36,490

Cash and deposits 16,931

Accounts receivable–trade 11,438

Finished goods 45

Merchandise 11

Content production account 3,402

Suppliers 77

Prepaid expenses 375

Accounts receivable–other 483

Income taxes receivable 537

Deferred tax assets 2,980

Other current assets 217

Allowance for doubtful accounts (10)

Fixed assets ¥14,370

Property and equipment 3,759

Buildings and structures 621

Tools and fixtures 2,663

Land 421

Construction in progress 53

Intangible assets 1,027

Goodwill 250

Trademarks 45

Telephone rights 6

Software 636

Software production account 88

Investments and other assets 9,584

Investment securities 1,345

Investment in subsidiaries 3,376

Long-term loans receivable 4

Long-term prepaid expenses 5

Investment in consortiums 560

Leasehold deposits 590

Deferred tax assets 3,383

Other investments 316

Allowance for doubtful accounts (0)

Total assets ¥50,860

Liabilities

Current liabilities ¥13,489

Accounts payable–trade 1,717

Current portion of long-term debt 22

Accounts payable–other 2,808

Payables arising due to merger 4,153

Income taxes payable 4

Consumption tax payable 422

Accrued expenses 1,248

Advances received 594

Deposits received 83

Reserve for bonuses 463

Allowance for sales returns 893

Reserve for office relocation costs 1,074

Other current liabilities 3

Fixed liabilities ¥00,359

Long-term debt 18

Long-term deposits received 39

Reserve for retirement benefits 301

Total liabilities ¥13,848

Net worth ¥37,012

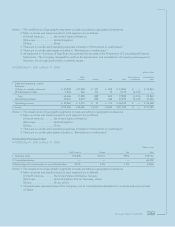

Notes to Consolidated Balance Sheets

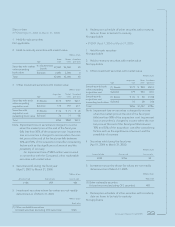

• FY2003 (April 1, 2003 to March 31, 2004)

*1 Investment in non-consolidated subsidiaries and

affiliates

Investment securities ¥341 million

Investments and other assets ¥4 million

*2 Number of shares of outstanding:

Common stock 110,130,418

*3 Number of shares of treasury stock:

Common stock 99,539

*4 Contingent liabilities for guarantees

The Company has issued a revolving guarantee to a

maximum limit of US$15 million on behalf of consoli-

dated subsidiary SQUARE ENIX U.S.A., INC., in favor of

SONY COMPUTER ENTERTAINMENT AMERICA INC.

As of March 31, 2004, the liability outstanding under the

guarantee was US$432 thousand (¥45 million).

• FY2004 (April 1, 2004 to March 31, 2005)

*1 Investment in non-consolidated subsidiaries and

affiliates

Investment securities ¥151 million

Investments and other assets ¥4 million

*2 Number of shares of outstanding:

Common stock 110,385,543

*3 Number of shares of treasury stock:

Common stock 150,650

*4 Contingent liabilities for guarantees

The Company has issued a revolving guarantee to a

maximum limit of US$15 million on behalf of consoli-

dated subsidiary SQUARE ENIX INC., in favor of SONY

COMPUTER ENTERTAINMENT AMERICA INC. As of

March 31, 2005, there is no liability outstanding under

the guarantee.

Notes to Consolidated Statements of Income

• FY2003 (April 1, 2003 to March 31, 2004)

*1 Selling, general and administrative expense includes

R&D costs of ¥7 million.

*2 Breakdown of gain on sale of property and equipment

—————

*3 Breakdown of loss on sale of property and equipment

Tools and fixtures ¥123 million

*4 Breakdown of loss on disposal of property and equipment

Tools and fixtures ¥159 million

Software 39 million

Total ¥198 million

*5 Loss on investment securities is due to the significant

decline in market prices of marketable securities.