Salesforce.com 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

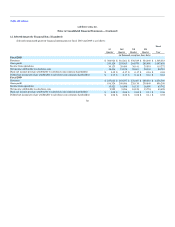

Notes to Consolidated Financial Statements—(Continued)

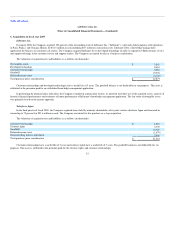

6. Acquisitions in fiscal year 2009

InStranet, Inc.

In August 2008, the Company acquired 100 percent of the outstanding stock of InStranet, Inc. ("InStranet"), a privately-held company with operations

in Paris, France, and Chicago, Illinois for $32.3 million in cash including $0.7 million in transaction costs. InStranet offers a knowledge management

application for business to consumer call centers. The Company acquired InStranet for its developed technology in order to expand its CRM customer service

and support offerings in the customer service and support market. The Company accounted for this as a business combination.

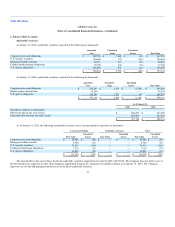

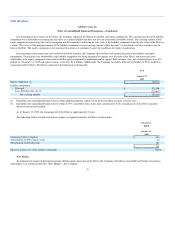

The valuation of acquired assets and liabilities is as follows (in thousands):

Net tangible assets $ 3,863

Developed technology 8,610

Customer relationships 5,950

Goodwill 19,976

Deferred income taxes (6,122)

Total purchase price consideration $ 32,277

Customer relationships and developed technologies have a useful life of 3 years. The goodwill balance is not deductible for tax purposes. This asset is

attributed to the premium paid for an established knowledge management application.

In performing the purchase price allocation, the Company considered, among other factors, its intention for future use of the acquired assets, analysis of

historical financial performance and estimates of future performance of InStranet's knowledge management application. The fair value of intangible assets

was primarily based on the income approach.

Salesforce Japan

In the third quarter of fiscal 2009, the Company acquired shares held by minority shareholders of its joint venture salesforce Japan and increased its

ownership to 72 percent for $21.6 million in cash. The Company accounted for this purchase as a step-acquisition.

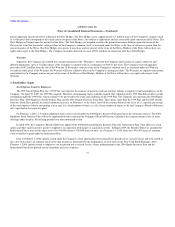

The valuation of acquired assets and liabilities is as follows (in thousands):

Customer relationships $ 1,919

Territory rights 2,196

Goodwill 16,340

Deferred income taxes (1,679)

Noncontrolling interest adjustment 2,848

Total purchase price consideration $ 21,624

Customer relationships have a useful life of 3 years and territory rights have a useful life of 7 years. The goodwill balance is not deductible for tax

purposes. This asset is attributed to the premium paid for the territory rights and customer relationships.

81