Salesforce.com 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

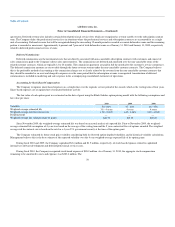

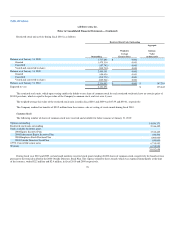

Company expects this stock compensation balance to be amortized as follows: $115.8 million during fiscal 2011; $89.3 million during fiscal 2012; $52.5

million during fiscal 2013 and $26.0 million during fiscal 2014. The expected amortization reflects only outstanding stock awards as of January 31, 2010 and

assumes no forfeiture activity. The Company expects to continue to issue share-based awards to its employees in future periods.

Warranties and Indemnification

The Company's enterprise cloud computing application service is typically warranted to perform in a manner consistent with general industry standards

that are reasonably applicable and materially in accordance with the Company's online help documentation under normal use and circumstances.

The Company's arrangements generally include certain provisions for indemnifying customers against liabilities if its products or services infringe a

third-party's intellectual property rights. To date, the Company has not incurred any material costs as a result of such indemnifications and has not accrued any

liabilities related to such obligations in the accompanying consolidated financial statements.

The Company has also agreed to indemnify its directors and executive officers for costs associated with any fees, expenses, judgments, fines and

settlement amounts incurred by any of these persons in any action or proceeding to which any of those persons is, or is threatened to be, made a party by

reason of the person's service as a director or officer, including any action by the Company, arising out of that person's services as the Company's director or

officer or that person's services provided to any other company or enterprise at the Company's request. The Company maintains director and officer insurance

coverage that would generally enable the Company to recover a portion of any future amounts paid. The Company may also be subject to indemnification

obligation by law with respect to the actions of its employees under certain circumstances and in certain jurisdictions.

Advertising Expenses

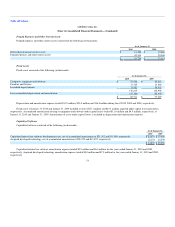

Advertising is expensed as incurred. Advertising expense was $50.8 million, $43.7 million and $25.6 million for fiscal 2010, 2009 and 2008,

respectively.

Subsequent Events

The Company evaluated subsequent events through the date this Annual Report on Form 10-K was filed with the SEC.

New Accounting Pronouncements

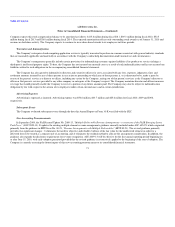

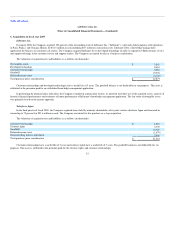

In September 2009, the FASB issued Update No. 2009-13, "Multiple-Deliverable Revenue Arrangements—a consensus of the FASB Emerging Issues

Task Force" (ASU 2009-13). It updates the existing multiple-element revenue arrangements guidance currently included under ASC 605-25, which originated

primarily from the guidance in EITF Issue No. 00-21, "Revenue Arrangements with Multiple Deliverables" (EITF 00-21). The revised guidance primarily

provides two significant changes: 1) eliminates the need for objective and reliable evidence of the fair value for the undelivered element in order for a

delivered item to be treated as a separate unit of accounting, and 2) eliminates the residual method to allocate the arrangement consideration. In addition, the

guidance also expands the disclosure requirements for revenue recognition. ASU 2009-13 will be effective for the first annual reporting period beginning on

or after June 15, 2010, with early adoption permitted provided that the revised guidance is retroactively applied to the beginning of the year of adoption. The

Company is currently assessing the future impact of this new accounting pronouncement to its consolidated financial statements.

71