Salesforce.com 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

When assets are retired, the cost and accumulated depreciation and amortization are removed from their respective accounts and any loss on such

retirement is reflected in operating expenses. When assets are otherwise disposed of, the cost and related accumulated depreciation and amortization are

removed from their respective accounts and any gain or loss on such sale or disposal is reflected in other income.

Impairment of Long-Lived Assets

The Company evaluates the recoverability of its long-lived assets for possible impairment whenever events or circumstances indicate that the carrying

amount of such assets may not be recoverable. If such review indicates that the carrying amount of long-lived assets is not recoverable, the carrying amount of

such assets is reduced to fair value.

There was no impairment of long-lived assets during fiscal 2010, 2009 and 2008.

The Company evaluates and tests the recoverability of the goodwill for impairment annually in the fourth quarter or more often if and when

circumstances indicate that goodwill may not be recoverable. There was no impairment of goodwill during fiscal 2010 and 2009 and 2008.

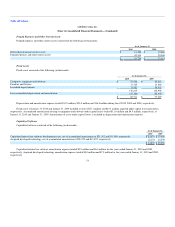

Capitalized Software Costs

For its website development costs and the development costs related to its enterprise cloud computing application service, the company capitalizes costs

incurred during the application development stage. Costs related to preliminary project activities and post implementation activities were expensed as

incurred. Internal use software is amortized on a straight line basis over its estimated useful life, generally three years. Management evaluates the useful lives

of these assets on an annual basis and tests for impairment whenever events or changes in circumstances occur that could impact the recoverability of these

assets.

The Company capitalized $15.1, million $10.2 million and $11.1 million of costs during fiscal 2010, 2009 and 2008, respectively. Amortization

expense totaled $9.9 million, $6.6 million, and $2.7 million during fiscal 2010, 2009 and 2008, respectively.

Comprehensive Income

Comprehensive income consists of net income and accumulated other comprehensive income, which includes certain changes in equity that are

excluded from net income. Specifically, cumulative foreign currency translation adjustments and unrealized gains and losses on marketable securities, net of

taxes of $3.9 million in fiscal 2010 and $0.6 million in fiscal 2009, are included in accumulated other comprehensive income. Accumulated other

comprehensive loss has been reflected in stockholders' equity.

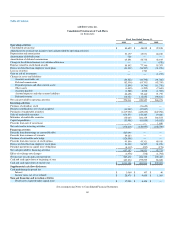

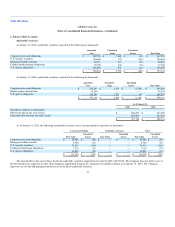

The components of accumulated other comprehensive loss were as follows (in thousands):

As of January 31,

2010 2009

Foreign currency translation and other adjustments $ (7,066) $ (3,957)

Net unrealized gain on marketable securities 5,636 1,052

$ (1,430) $ (2,905)

67