Salesforce.com 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

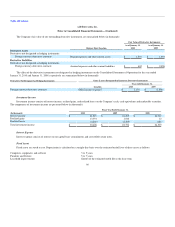

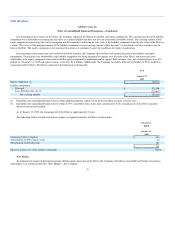

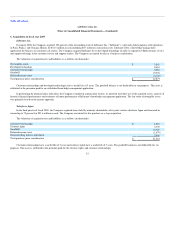

In accounting for the issuance of the Notes, the Company separated the Notes into liability and equity components. The carrying amount of the liability

component was calculated by measuring the fair value of a similar liability that does not have an associated convertible feature. The carrying amount of the

equity component representing the conversion option was determined by deducting the fair value of the liability component from the par value of the Notes as

a whole. The excess of the principal amount of the liability component over its carrying amount ("debt discount") is amortized to interest expense over the

term of the Note. The equity component is not remeasured as long as it continues to meet the conditions for equity classification.

In accounting for the transaction costs related to the Note issuance, the Company allocated the total amount incurred to the liability and equity

components. Transaction costs attributable to the liability component are being amortized to expense over the term of the Notes, and transaction costs

attributable to the equity component were netted with the equity component in additional paid-in capital. Debt issuance costs, net of amortization, were $7.1

million as of January 31, 2010 and equity issuance costs were $1.8 million. Additionally, the Company recorded a deferred tax liability of $51.1 million in

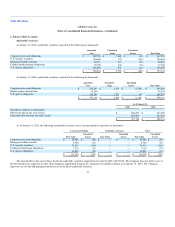

connection with the Notes. The Notes consisted of the following (in thousands):

As of

January 31,

2010

Equity component (1) $ 125,530

Liability component :

Principal $ 575,000

Less: debt discount, net (2) (124,802)

Net carrying amount $ 450,198

(1) Included in the consolidated balance sheets within additional paid-in capital, net of the $1.8 million in equity issuance costs.

(2) Included in the consolidated balance sheets within 0.75% convertible senior notes and is amortized over the remaining life of the Notes using the

effective interest rate method.

As of January 31, 2010, the remaining life of the Notes is approximately 5 years.

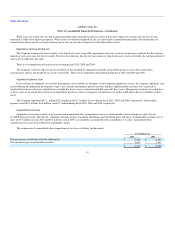

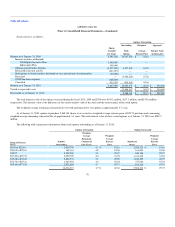

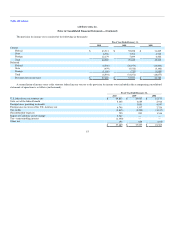

The following table sets forth total interest expense recognized related to the Notes (in thousands):

Fiscal Year

Ended

January 31,

2010

Contractual interest expense $ 144

Amortization of debt issuance costs 59

Amortization of debt discount 728

$ 931

Effective interest rate of the liability component 5.86%

Note Hedges

To minimize the impact of potential economic dilution upon conversion of the Notes, the Company entered into convertible note hedge transactions

with respect to its common stock (the "Note Hedges"). The Company

76