Salesforce.com 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

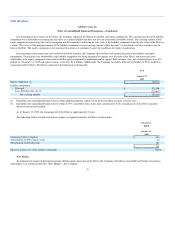

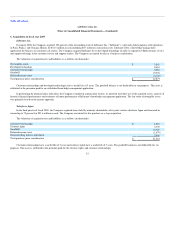

paid an aggregate amount of $126.5 million for the Note Hedges. The Note Hedges cover, approximately 6.7 million shares of the Company's common stock

at a strike price that corresponds to the initial conversion price of the Notes, also subject to adjustment, and are exercisable upon conversion of the Notes. The

Note Hedges will expire upon the maturity of the Notes. The Note Hedges are intended to reduce the potential economic dilution upon conversion of the

Notes in the event that the market value per share of the Company's common stock, as measured under the Notes, at the time of exercise is greater than the

conversion price of the Notes. The Note Hedges are separate transactions and are not part of the terms of the Notes. Holders of the Notes will not have any

rights with respect to the Note Hedges. The Company recorded a deferred tax asset of $51.4 million in connection with these Note Hedges.

Warrants

Separately, the Company also entered into warrant transactions (the "Warrants"), whereby the Company sold warrants to acquire, subject to anti-

dilution adjustments, up to 6.7 million shares of the Company's common stock at a strike price of $119.51 per share. The Company received aggregate

proceeds of $59.2 million from the sale of the Warrants. If the market value per share of the Company's common stock, as measured under the Warrants,

exceeds the strike price of the Warrants, the Warrants will have a dilutive effect on the Company's earnings per share. The Warrants are separate transactions,

entered into by the Company and are not part of the terms of the Notes or Note Hedges. Holders of the Notes will not have any rights with respect to the

Warrants.

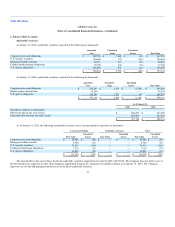

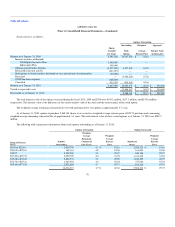

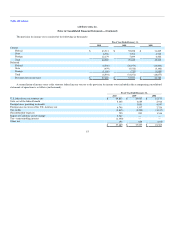

3. Stockholders' Equity

Stock Options Issued to Employees

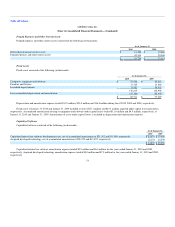

The 1999 Stock Option Plan (the "1999 Plan") provides for the issuance of incentive and non-statutory options to employees and nonemployees of the

Company. On April 30, 2009, the 1999 Plan expired. Therefore, all remaining shares available expired. The expiration of the 1999 Plan did not affect awards

outstanding under the 1999 Plan, which continue to be governed by the terms and conditions of the 1999 Plan. The Company also maintains the 2004 Equity

Incentive Plan, 2004 Employee Stock Purchase Plan and the 2004 Outside Directors Stock Plan. These plans, other than the 1999 Plan and the 2004 Outside

Directors Stock Plan, provide for annual automatic increases on February 1 to the shares reserved for issuance based on the lesser of (i) a specific percentage

of the total number of shares outstanding at year end; (ii) a fixed number of shares; or (iii) a lesser number of shares set by the Company's Board of Directors,

all as specified in the respective plans.

On February 1, 2010, 3.5 million additional shares were reserved under the 2004 Equity Incentive Plan pursuant to the automatic increase. The 2004

Employee Stock Purchase Plan will not be implemented unless and until the Company's Board of Directors authorizes the commencement of one or more

offerings under the plan. No offering periods have been authorized to date.

In April 2006, the Company's Board of Directors approved the 2006 Inducement Equity Incentive Plan (the "Inducement Plan") that allows for stock

option and other equity incentive grants to employees in connection with merger or acquisition activity. In March 2009, the Board of Directors amended the

Inducement Plan to increase the share reserve by 300,000 shares to 700,000 shares in total. As of January 31, 2010, there were 436,504 shares of common

stock available for grant under the Inducement Plan.

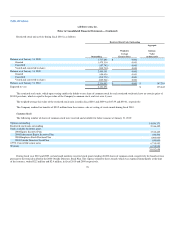

Prior to February 1, 2006, options issued under the Company's stock option plans were generally for periods not to exceed 10 years and were issued at

fair value of the shares of common stock on the date of grant as determined by the trading price of such stock on the New York Stock Exchange. After

February 1, 2006, options issued to employees are for periods not to exceed 5 years. Grants made pursuant to the 2004 Equity Incentive Plan and the

Inducement Plan do not provide for the immediate exercise of options.

77