Salesforce.com 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

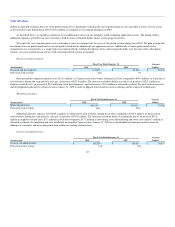

We believe our existing cash, cash equivalents and short-term marketable securities and cash provided by operating activities will be sufficient to meet

our working capital and capital expenditure needs over the next 12 months.

During fiscal 2011, we may enter into arrangements to acquire or invest in complementary businesses or joint ventures, services or technologies. While

we believe we have sufficient financial resources, we may be required to seek additional equity or debt financing. Additional funds may not be available on

terms favorable to us or at all.

Recent Accounting Pronouncements

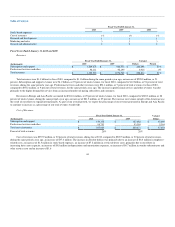

In September 2009, the Financial Accounting Standards Board, or FASB, issued Update No. 2009-13, "Revenue Recognition (Topic 605), Multiple-

Deliverable Revenue Arrangements—a consensus of the FASB Emerging Issues Task Force" (ASU 2009-13). It updates the existing multiple-element revenue

arrangements guidance currently included under ASC 605-25. The revised guidance primarily provides two significant changes: 1) eliminates the need for

objective and reliable evidence of the fair value for the undelivered element in order for a delivered item to be treated as a separate unit of accounting, and 2)

requires the use of the relative selling price method to allocate the entire arrangement consideration. In addition, the guidance also expands the disclosure

requirements for revenue recognition. ASU 2009-13 will be effective for the first annual reporting period beginning on or after June 15, 2010, with early

adoption permitted provided that the revised guidance is retroactively applied to the beginning of the year of adoption. We are currently assessing the future

impact of this new accounting pronouncement to our consolidated financial statements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Foreign currency exchange risk

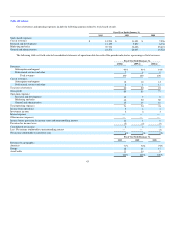

Our results of operations and cash flows are subject to fluctuations due to changes in foreign currency exchange rates, particularly changes in the Euro,

British Pound Sterling, Canadian dollar, Japanese Yen and Australian dollar. We seek to minimize the impact of certain foreign currency fluctuations by

hedging certain balance sheet exposures with foreign currency forward contracts. Any gain or loss from settling these contracts is offset by the loss or gain

derived from the underlying balance sheet exposures. The hedging contracts by policy have maturities of less than three months. Additionally, by policy, we

do not enter into any hedging contracts for trading or speculative purposes.

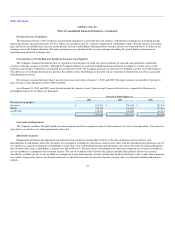

Interest rate sensitivity

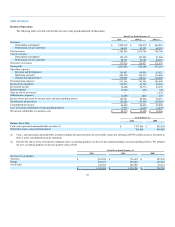

We had cash, cash equivalents and marketable securities totaling $1.7 billion at January 31, 2010. This amount was invested primarily in money market

funds, time deposits, corporate notes and bonds, government securities and other debt securities with credit ratings of at least single A or better. The cash,

cash equivalents and short-term marketable securities are held for working capital purposes. Our investments are made for capital preservation purposes. We

do not enter into investments for trading or speculative purposes.

Our cash equivalents and our portfolio of marketable securities are subject to market risk due to changes in interest rates. Fixed rate interest securities

may have their market value adversely impacted due to a rise in interest rates, while floating rate securities may produce less income than expected if interest

rates fall. Due in part to these factors, our future investment income may fall short of expectation due to changes in interest rates or we may suffer losses in

principal if we are forced to sell securities that decline in the market value due to changes in interest rates. However because we classify our debt securities as

"available for sale," no gains or losses are recognized due to changes in interest rates unless such securities are sold prior to maturity or declines in fair value

are determined to be other-than-temporary. Our fixed-income portfolio is subject to interest rate risk.

An immediate increase or decrease in interest rates of 100-basis points at January 31, 2010 could result in a $13.1 million market value reduction or

increase of the same amount. This estimate is based on a sensitivity

52