Salesforce.com 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

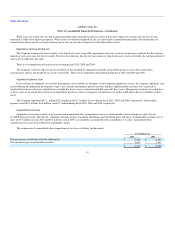

During fiscal 2010, the Company acquired two privately-held companies for $12.0 million in cash. The Company accounted for these transactions as

business combinations. Of the $12.0 million, the Company allocated $7.6 million to acquired developed technology with a useful lives of 3 years and $4.1

million to goodwill. The Company does not believe that these transactions were material.

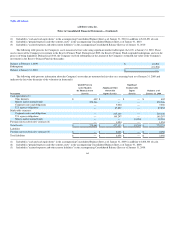

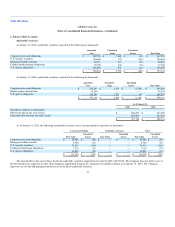

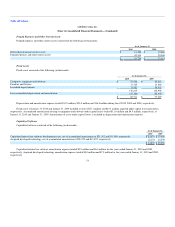

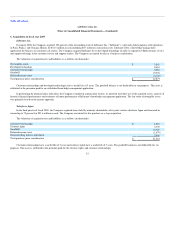

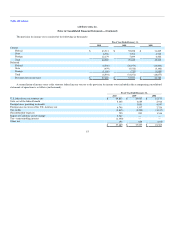

Other Assets, net

Other assets consisted of the following (in thousands):

As of January 31,

2010 2009

Deferred professional services costs, noncurrent portion $ 5,639 $ 4,185

Long-term deposits 11,084 8,447

Purchased intangible assets, net of accumulated amortization of $5,815 and $2,573, respectively 6,746 9,679

Investments in privately-held companies 6,288 2,400

Other 10,008 5,416

$ 39,765 $ 30,127

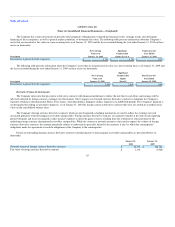

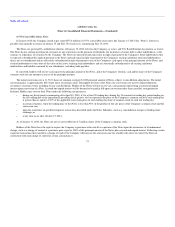

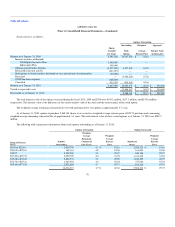

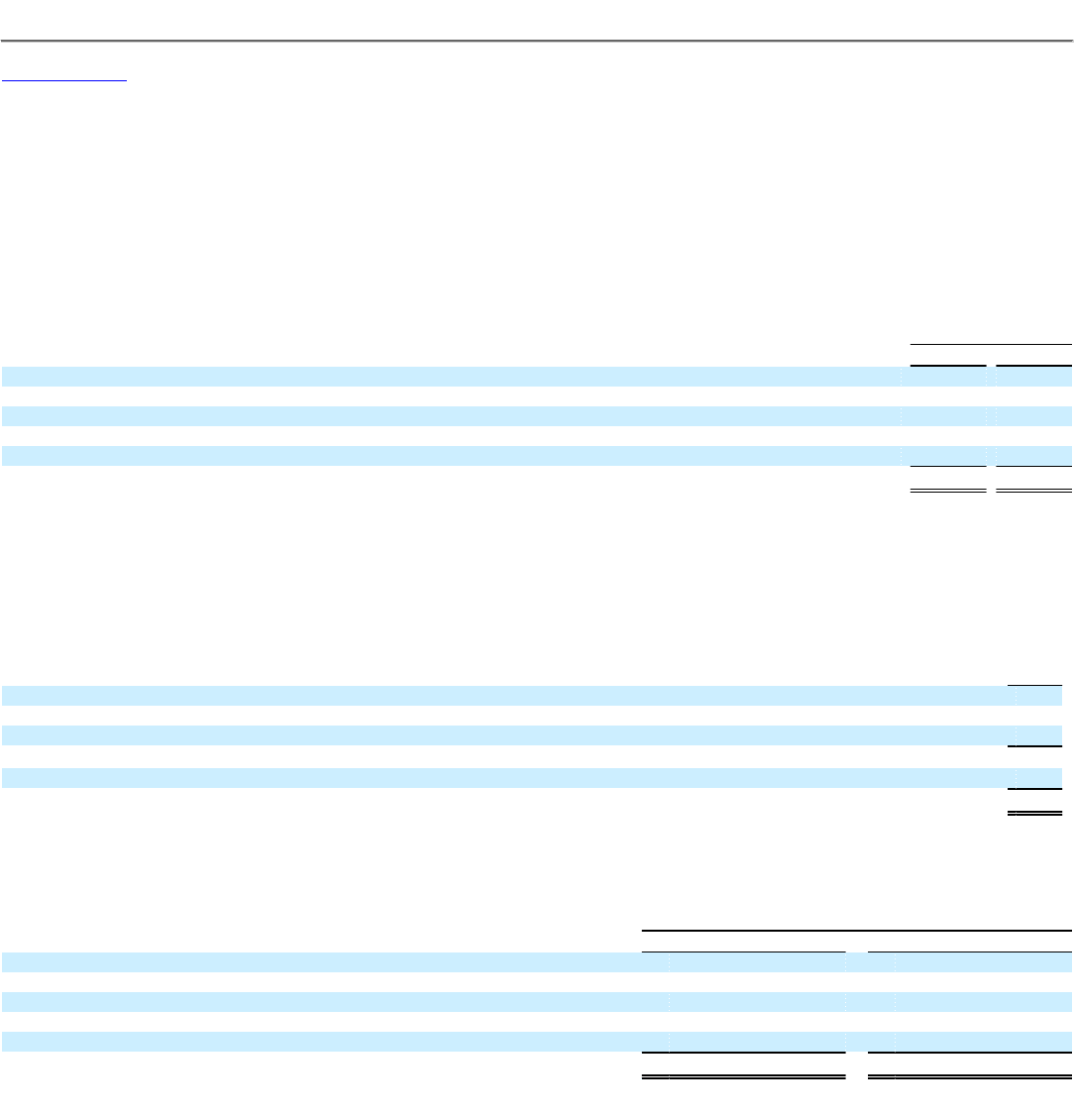

Goodwill

Goodwill represents the excess of the purchase price in a business combination over the fair value of net tangible and intangible assets acquired.

Goodwill amounts are not amortized, but rather tested for impairment at least annually during the fourth quarter. There was no impairment of goodwill during

fiscal 2010 and 2009.

Goodwill consists of the following (in thousands):

Total

Balance as of January 31, 2008 $ 8,556

Salesforce Japan (See Note 6) 16,340

InStranet, Inc. (See Note 6) 19,976

Balance as of January 31, 2009 44,872

Other acquisitions 4,083

Balance as of January 31, 2010 $48,955

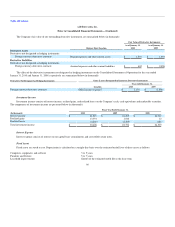

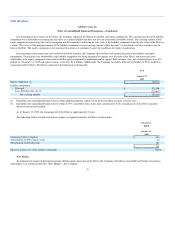

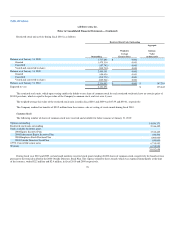

Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following (in thousands):

As of January 31,

2010 2009

Accrued compensation $ 90,223 $ 74,355

Accrued other liabilities 46,188 39,886

Accrued other taxes payable 27,757 27,596

Accrued professional costs 10,740 3,950

Accrued rent 19,830 17,418

$ 194,738 $ 163,205

74