Salesforce.com 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

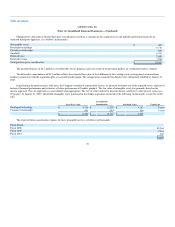

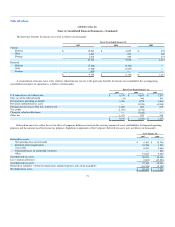

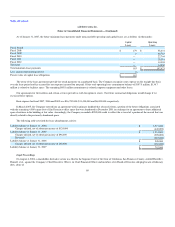

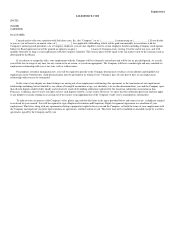

As of January 31, 2007, the future minimum lease payments under noncancelable operating and capital leases are as follows (in thousands):

Capital

Leases

Operating

Leases

Fiscal Period:

Fiscal 2008 $ 179 $ 58,631

Fiscal 2009 6 48,763

Fiscal 2010 — 22,744

Fiscal 2011 — 18,181

Fiscal 2012 — 14,304

Thereafter — 34,850

Total minimum lease payments 185 $ 197,473

Less: amount representing interest (3)

Present value of capital lease obligations $ 182

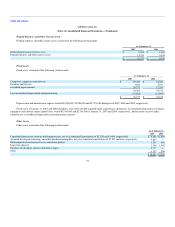

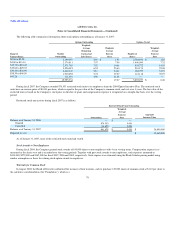

The terms of the lease agreements provide for rental payments on a graduated basis. The Company recognizes rent expense on the straight-line basis

over the lease period and has accrued for rent expense incurred but not paid. Of the total operating lease commitment balance of $197.5 million, $136.7

million is related to facilities space. The remaining $60.8 million commitment is related computer equipment and other leases.

Our agreements for the facilities and certain services provide us with the option to renew. Our future contractual obligations would change if we

exercised these options.

Rent expense for fiscal 2007, 2006 and 2005 was $16,782,000, $11,434,000 and $6,490,000, respectively.

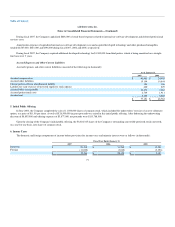

In March 2005, the Company entered into an agreement with its primary landlord that released it from a portion of the future obligations associated

with the remaining 4,000 square feet of San Francisco office space that was abandoned in December 2001 in exchange for an agreement to lease additional

space elsewhere in the building at fair value. Accordingly, the Company recorded a $285,000 credit to reflect the reversal of a portion of the accrual that was

directly related to the previously abandoned space.

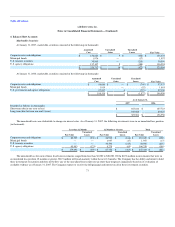

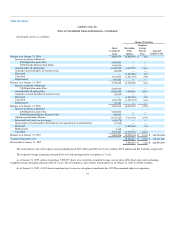

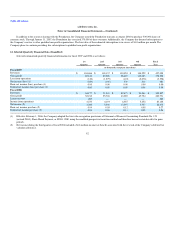

The following table sets forth the lease abandonment activity:

Liability balance at January 31, 2004 $ 1,971,000

Charges utilized, net of subtenant income of $124,000 (440,000)

Liability balance at January 31, 2005 $ 1,531,000

Charges utilized, net of subtenant income of $96,000 (298,000)

Reversals (285,000)

Liability balance at January 31, 2006 $ 948,000

Charges utilized, net of subtenant income of 202,000 (186,000)

Liability balance at January 31, 2007 $ 762,000

Legal Proceedings

On August 6, 2004, a shareholder derivative action was filed in the Superior Court of the State of California, San Francisco County, entitled Borrelli v.

Benioff, et al., against the Company's Chief Executive Officer, its Chief Financial Officer and members of its Board of Directors alleging breach of fiduciary

duty, abuse of

80