Salesforce.com 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

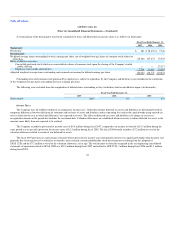

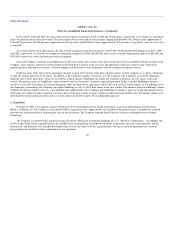

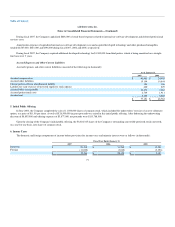

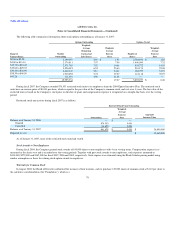

Realization of deferred tax assets is dependent on future earnings, if any, the timing and amount of which are uncertain. Accordingly, the net deferred

tax assets have been partially offset by a valuation allowance, which decreased by $40.1 million in fiscal 2007 and increased by $13.6 million in fiscal 2006.

The valuation allowance as of January 31, 2007 relates primarily to deferred tax assets arising from operating losses from foreign subsidiaries. As a result of

SFAS 123R, beginning in fiscal 2007, the excess tax benefits associated with the exercise of stock options are recorded directly to stockholders' equity when

realized. Accordingly, deferred tax assets are not recognized for net operating loss carryforwards resulting from excess tax benefits occurring in fiscal 2007

and after. Furthermore, during fiscal 2007 we derecognized approximately $40.1 million of federal and state net operating losses generated from prior-year

excess tax benefits associated with stock option exercises, the entire amount of which had been subject to a full valuation allowance.

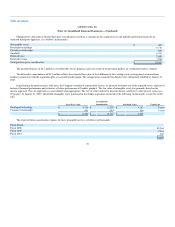

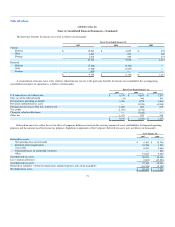

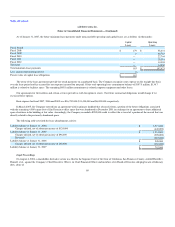

At January 31, 2007, the Company had net operating loss carryforwards for federal income tax purposes of approximately $140.8 million, which expire

in 2020 through 2027, and federal research and development tax credits of approximately $4.8 million, which expire in 2020 through 2027. The Company

also has state net operating loss carryforwards of approximately $173.2 million which expire beginning in 2012 and state research and development tax credits

of approximately $5.1 million which have no expiration date.

Utilization of the Company's net operating loss carryforwards may be subject to substantial annual limitation due to the ownership change limitations

provided by the Internal Revenue Code and similar state provisions. Such an annual limitation could result in the expiration of the net operating loss

carryforwards before utilization.

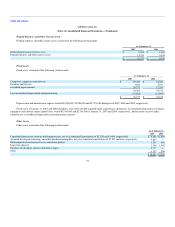

7. Preferred Stock

After the consummation of the initial public offering in June 2004 and the filing of the Company's amended and restated certificate of incorporation, the

Company's board of directors has the authority, without further action by stockholders, to issue up to 5,000,000 shares of preferred stock in one or more

series. The Company's board of directors may designate the rights, preferences, privileges and restrictions of the preferred stock, including dividend rights,

conversion rights, voting rights, terms of redemption, liquidation preference, sinking fund terms, and number of shares constituting any series or the

designation of any series. The issuance of preferred stock could have the effect of restricting dividends on the Company's common stock, diluting the voting

power of its common stock, impairing the liquidation rights of its common stock, or delaying or preventing a change in control. The ability to issue preferred

stock could delay or impede a change in control. At January 31, 2007 and 2006, no shares of preferred stock were outstanding.

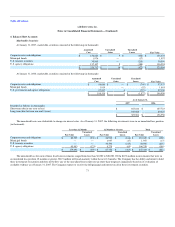

8. Stockholders' Equity

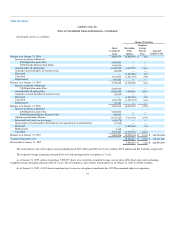

Stock Options Issued to Employees

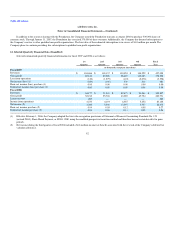

The 1999 Stock Option Plan (the "1999 Plan") provides for the issuance of incentive and nonstatutory options to employees and nonemployees of the

Company. The 1999 Plan provides for grants of immediately exercisable options; however, the Company has the right to repurchase any unvested common

stock upon the termination of employment at the original exercise price.

In addition to the 1999 Plan, the Company maintains the 2004 Equity Incentive Plan, 2004 Employee Stock Purchase Plan and the 2004 Outside

Directors Stock Plan. These plans, other than the 2004 Outside Directors Plan, provide for annual automatic increases on February 1 to the shares reserved for

issuance based on the lesser of (i) a specific percentage of the total number of shares outstanding at year end; (ii) a fixed number of shares; or (iii) a lesser

number of shares set by the Company's Board of Directors, all as specified in the respective plans.

75