Salesforce.com 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

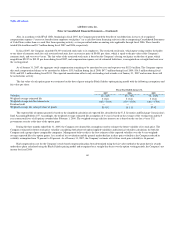

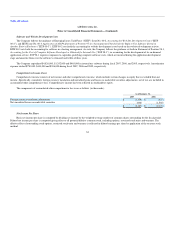

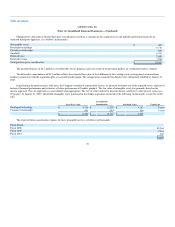

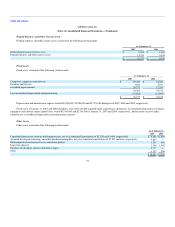

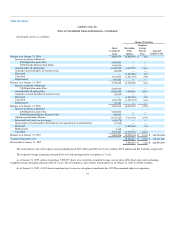

Management's allocation of the purchase price consideration, based on a valuation of the acquired assets and liabilities performed in part by an

unrelated third-party appraiser, is as follows (in thousands):

Net tangible assets $ 447

Developed technology 5,710

Customer relationships 690

Goodwill 6,705

Deferred taxes 2,650

Deferred revenue (700)

Total purchase price consideration $ 15,502

The goodwill balance of $6.7 million is not deductible for tax purposes and is the result of the premium paid for an established wireless solution.

The deferred revenue balance of $0.7 million reflects the estimated fair value of the fulfillment of the existing service arrangements assumed from

Sendia in connection with the acquisition plus a reasonable profit margin. The arrangements assumed from Sendia were substantially fulfilled by January 31,

2007.

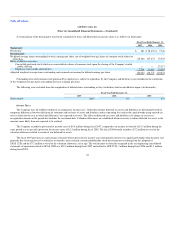

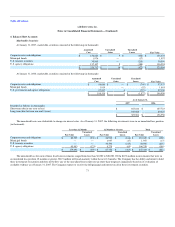

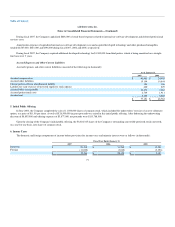

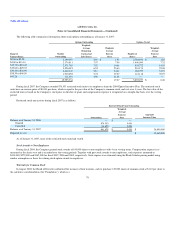

In performing the purchase price allocation, the Company considered, among other factors, its intention for future use of the acquired assets, analyses of

historical financial performance and estimates of future performance of Sendia's products. The fair value of intangible assets was primarily based on the

income approach. The cost approach was also utilized when appropriate. The rate of return utilized to discount the net cash flows to their present values was

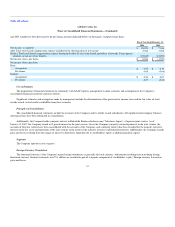

25 percent. At January 31, 2007, identifiable intangible assets purchased in the Sendia acquisition consisted of the following (in thousands, except for useful

life):

Gross Fair Value

Accumulated

Amortization Net Book Value Useful Life

Developed technology $ 5,710 $ (1,528) $ 4,182 3 years

Customer relationships 690 (184) 506 3 years

$ 6,400 $ (1,712) $ 4,688

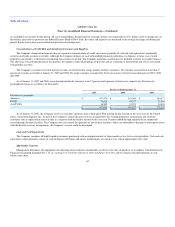

The expected future amortization expense for these intangible assets is as follows (in thousands):

Fiscal Period:

Fiscal 2008 $2,164

Fiscal 2009 2,164

Fiscal 2010 360

$4,688

70