Salesforce.com 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

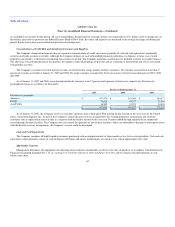

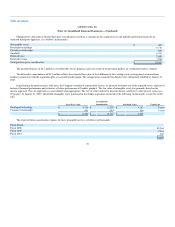

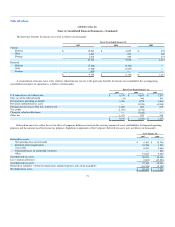

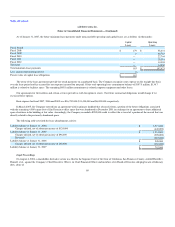

Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets consisted of the following (in thousands):

As of January 31,

2007 2006

Deferred professional services costs $ 3,898 $ 1,200

Prepaid expenses and other current assets 11,781 5,138

$ 15,679 $ 6,338

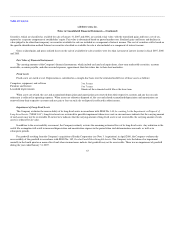

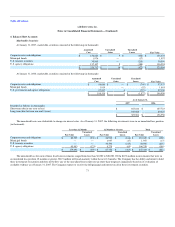

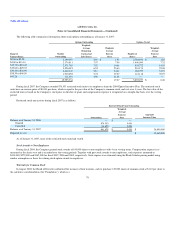

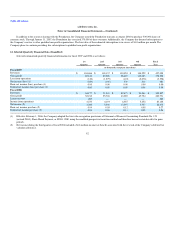

Fixed Assets

Fixed assets consisted of the following (in thousands):

As of January 31,

2007 2006

Computers, equipment and software $ 29,440 $ 24,029

Furniture and fixtures 3,866 2,831

Leasehold improvements 20,757 12,355

54,063 39,215

Less accumulated depreciation and amortization (23,908) (14,999)

$ 30,155 $ 24,216

Depreciation and amortization expense totaled $9,928,000, $5,584,000 and $2,751,000 during fiscal 2007, 2006 and 2005, respectively.

Fixed assets at January 31, 2007 and 2006 included a total of $3,616,000 acquired under capital lease agreements. Accumulated amortization relating to

equipment and software under capital leases totaled $3,364,000 and $2,765,000 at January 31, 2007 and 2006, respectively. Amortization of assets under

capital leases is included in depreciation and amortization expense.

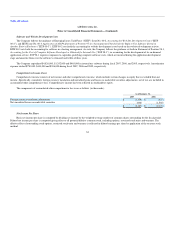

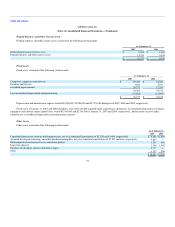

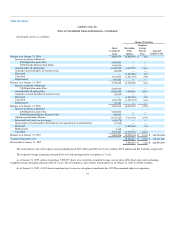

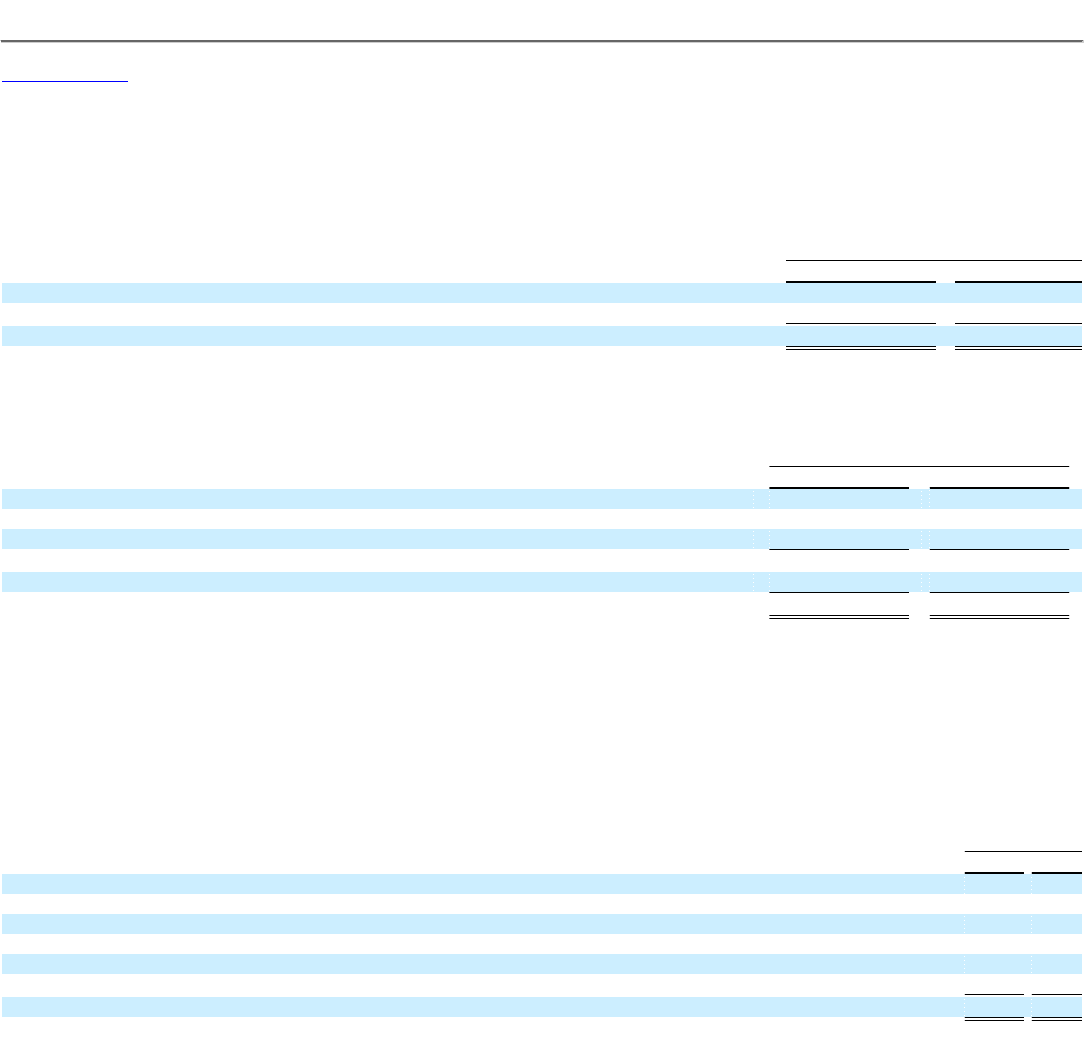

Other Assets

Other assets consisted of the following (in thousands):

As of January 31,

2007 2006

Capitalized internal-use software development costs, net of accumulated amortization of $2,150 and $1,400, respectively $ 5,626 $ 1,550

Acquired developed technology and other purchased intangibles, net of accumulated amortization of $1,837 and zero, respectively 5,863 —

Deferred professional services costs, noncurrent portion 1,334 486

Long-term deposits 1,958 1,542

Purchase of subsidiary shares in Salesforce Japan 2,777 —

Other 1,127 206

$ 18,685 $ 3,784

72