Salesforce.com 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

are included in net income for the period. All assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the exchange rate on

the balance sheet date as quoted on the Federal Reserve Bank of New York. Revenues and expenses are translated at the average exchange rate during the

period. Equity transactions are translated using historical exchange rates.

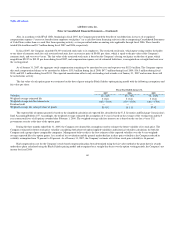

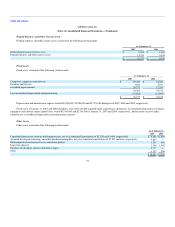

Concentrations of Credit Risk and Significant Customers and Suppliers

The Company's financial instruments that are exposed to concentrations of credit risk consist primarily of cash and cash equivalents, marketable

securities and trade accounts receivable. Although the Company deposits its cash with multiple financial institutions, its deposits, at times, may exceed

federally insured limits. Collateral is not required for accounts receivable. The Company maintains an allowance for doubtful accounts receivable balances.

The allowance is based upon historical loss patterns, the number of days that billings are past due and an evaluation of the potential risk of loss associated

with problem accounts.

The Company's accounts receivable and net revenues are derived from a large number of direct customers. No customer accounted for more than 5

percent of accounts receivable at January 31, 2007 and 2006. No single customer accounted for 5 percent or more of total revenue during fiscal 2007, 2006

and 2005.

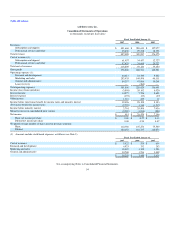

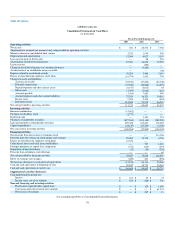

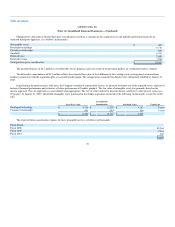

As of January 31, 2007 and 2006, assets located outside the Americas were 12 percent and 6 percent of total assets, respectively. Revenues by

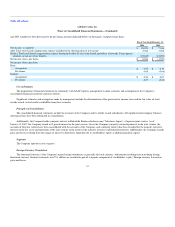

geographical region are as follows (in thousands):

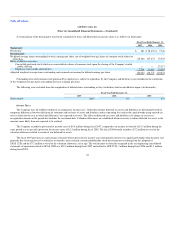

Fiscal Year Ended January 31,

2007 2006 2005

Revenues by geography:

Americas $ 387,570 $ 247,009 $ 140,871

Europe 75,026 43,577 25,201

Asia Pacific 34,502 19,271 10,303

$ 497,098 $ 309,857 $ 176,375

As of January 31, 2007, the Company serves its customers and users from a third-party Web hosting facility located on the west coast of the United

States, leased from Equinix, Inc. As part of the Company's current disaster recovery arrangements, the existing production environment and all of the

customers' data is replicated in near real-time in a separate back-up facility located on the east coast. Features added through acquisition are temporarily

served through alternate facilities. The Company does not control the operation of any of these facilities, which are vulnerable to damage or interruption. Even

with the disaster recovery arrangements, the Company's service could be interrupted.

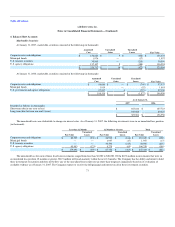

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. Cash and cash

equivalents, which primarily consist of cash on deposit with banks and money market funds, are stated at cost, which approximates fair value.

Marketable Securities

Management determines the appropriate classification of investments in marketable securities at the time of purchase in accordance with Statement of

Financial Accounting Standards No. 115, Accounting for Certain Investments in Debt and Equity Securities and reevaluates such determination at each

balance sheet date.

62