Salesforce.com 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

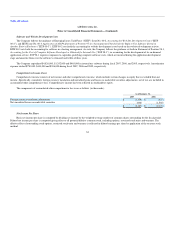

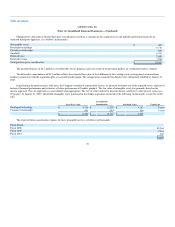

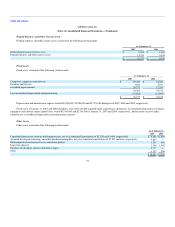

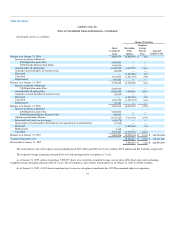

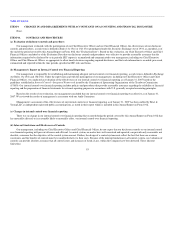

The provision (benefit) for income taxes were as follows (in thousands):

Fiscal Year Ended January 31,

2007 2006 2005

Current:

Federal $ 15,243 $ 4,835 $ 354

State 1,362 211 189

Foreign 2,514 869 674

19,119 5,915 1,217

Deferred:

Federal (7,122) (4,362) —

State (1,368) (2,863) —

Foreign (834) — —

$ 9,795 $ (1,310) $ 1,217

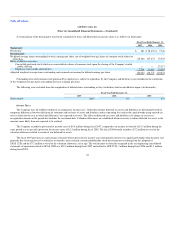

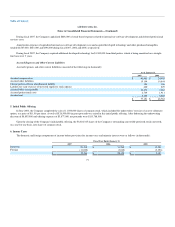

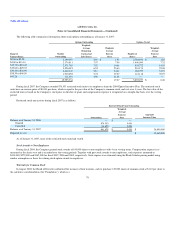

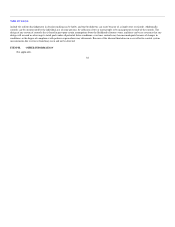

A reconciliation of income taxes at the statutory federal income tax rate to the provision (benefit) for income taxes included in the accompanying

consolidated statements of operations is as follows (in thousands):

Fiscal Year Ended January 31,

2007 2006 2005

U.S. federal taxes at statutory rate $ 4,374 $ 9,869 $ 3,207

State, net of the federal benefit (14) 360 189

Foreign losses providing no benefit 3,766 1,978 1,466

Previously unbenefitted tax assets — (5,210) (4,838)

Foreign taxes in excess of the U.S. statutory rate 1,889 280 675

Tax credits (1,691) (2,314) —

Change in valuation allowance — (7,225) —

Other, net 1,471 952 518

$ 9,795 $ (1,310) $ 1,217

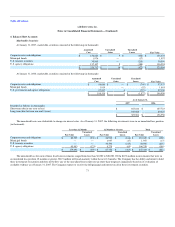

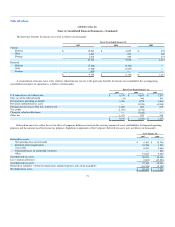

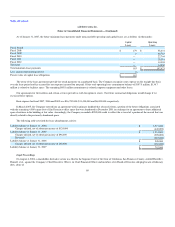

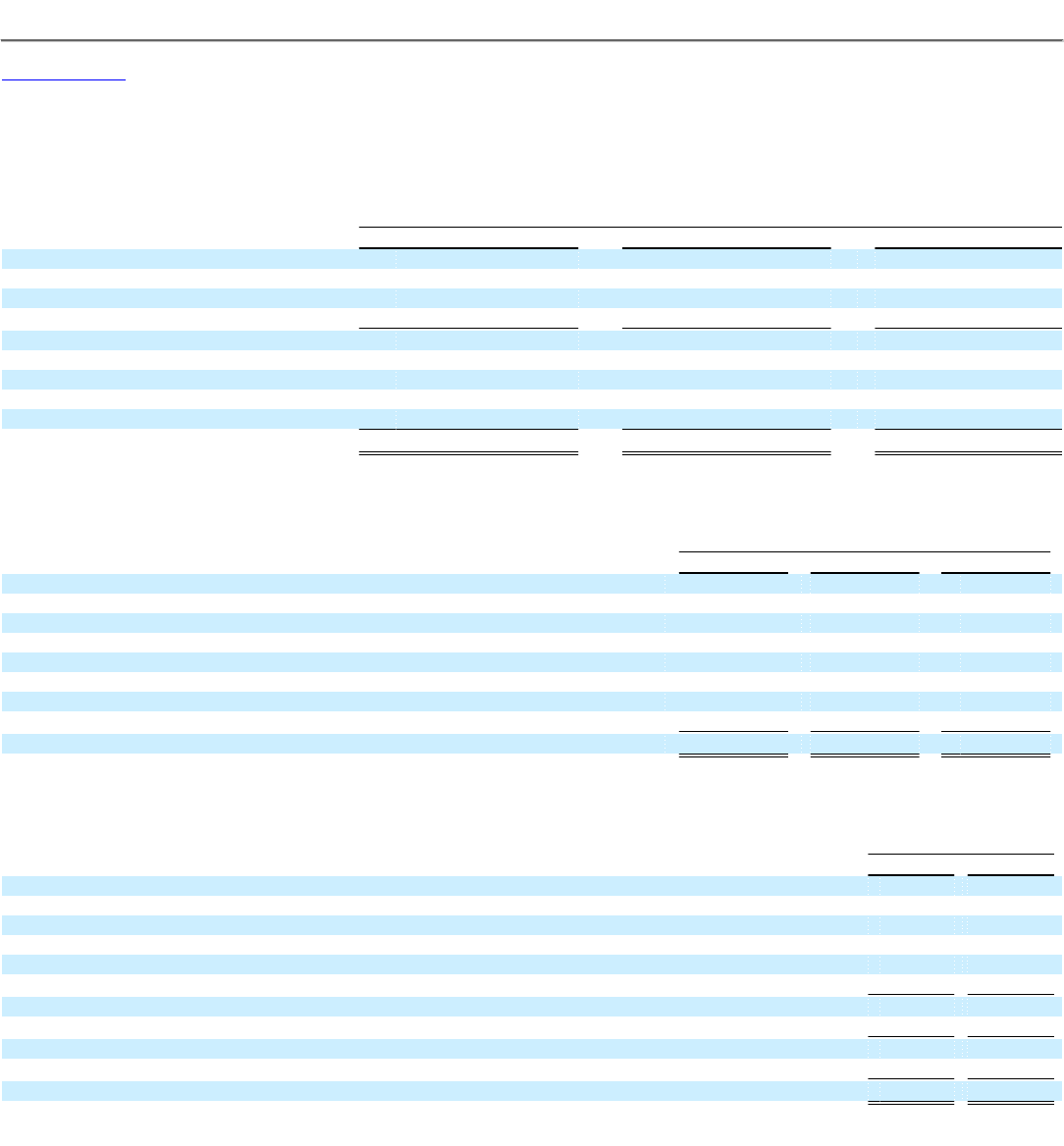

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amounts of assets and liabilities for financial reporting

purposes and the amounts used for income tax purposes. Significant components of the Company's deferred tax assets were as follows (in thousands):

As of January 31,

2007 2006

Deferred tax assets:

Net operating loss carryforwards $ 6,403 $ 38,796

Deferred stock compensation 10,786 1,324

Tax credits 6,051 4,063

Unrealized losses on marketable securities — 638

Other 15,833 9,359

Total deferred tax assets 39,073 54,180

Less valuation allowance (1,681) (41,826)

Total deferred tax assets 37,392 12,354

Deferred tax liabilities—deferred commissions, prepaid expenses and certain intangibles (16,539) (5,129)

Net deferred tax assets $ 20,853 $ 7,225

74