Saks Fifth Avenue 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

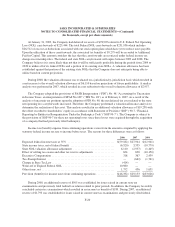

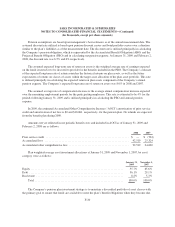

At January 31, 2009, the Company had deferred tax assets of $78,905 related to U.S. Federal Net Operating

Loss (NOL) carryforwards of $225,444. The total Federal NOL carryforwards are $251,956 which includes

$26,512 of excess tax deductions associated with our stock option plans which have yet to reduce taxes payable.

Upon the utilization of these carryforwards, the associated tax benefits of $9,279 will be recorded to Additional

Paid-in-Capital. This amount considers the fact that the carryforwards are restricted under federal income tax

change-in-ownership rules. The federal and state NOL carryforwards will expire between 2009 and 2028. The

Company believes it is more likely than not that it will be sufficiently profitable during the periods from 2009 to

2028 to utilize all of its federal NOLs and a portion of its existing state NOLs. A valuation allowance has been

established against that portion of the existing state NOLs that the Company does not anticipate being able to

utilize based on current projections.

During 2008, the valuation allowance was evaluated on a jurisdiction-by-jurisdiction basis which resulted in

a net increase to the overall valuation allowance of $6,110 based on projections of future profitability. A similar

analysis was performed in 2007, which resulted in a net reduction to the overall valuation allowance of $2,957.

The Company adopted the provisions of FASB Interpretation (“FIN”) No. 48 “Accounting for Uncertainty

in Income Taxes, an interpretation of SFAS No.109” (“FIN No. 48”) as of February 4, 2007. As a result of the

analysis of uncertain tax positions upon the adoption of FIN No. 48, the net deferred tax asset related to the state

net operating loss carryforwards increased. Therefore, the Company performed a valuation allowance analysis to

determine the realization of this asset. This analysis resulted in an additional valuation allowance of $19,258 with

the offset recorded to shareholders’ equity in accordance with Statement of Position (“SOP”) 90-7, “Financial

Reporting by Entities in Reorganization Under the Bankruptcy Code”(“SOP 90-7”). The Company is subject to

the provisions of SOP 90-7 for these net operating losses since these losses were acquired through the acquisition

of a company that had previously filed bankruptcy.

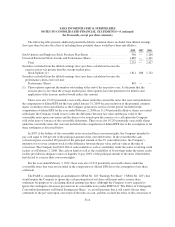

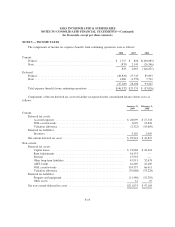

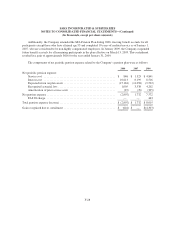

Income tax (benefit) expense from continuing operations varies from the amounts computed by applying the

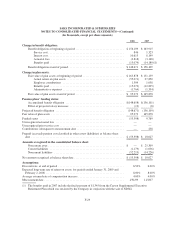

statutory federal income tax rate to income before taxes. The reasons for these differences were as follows:

2008 2007 2006

Expected federal income taxes at 35% ................................. $(59,182) $27,944 $(12,941)

State income taxes, net of federal benefit ............................... (6,520) 3,335 (10,779)

State NOL valuation allowance adjustment ............................. 6,110 (2,957) (1,465)

Effect of settling tax exams and other tax reserve adjustments .............. 624 690 (10,150)

Executive Compensation ............................................ 318 367 2,439

Tax-Exempt Interest ............................................... — (662) (1,761)

Change in State Tax Law ............................................ (414) — —

Write-off of Expired Federal NOL .................................... 10,980 — —

Other items, net ................................................... 1,752 436 1,631

Provision (benefit) for income taxes from continuing operations ............. $(46,332) $29,153 $(33,026)

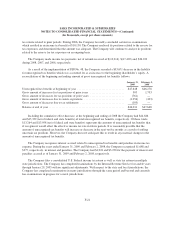

During 2008, an additional reserve of $505 was established for issues raised in current state tax

examinations and previously filed federal tax returns related to prior periods. In addition, the Company favorably

concluded certain tax examinations which resulted in an income tax benefit of $189. During 2007, an additional

reserve of $1,793 was established for issues raised in current state tax examinations and previously filed federal

F-20