Saks Fifth Avenue 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At January 31, 2009, the conversion criteria with respect to the credit rating requirements were met,

however the share price was significantly below the conversion price. Due to the share price being significantly

below the conversion price, the Company has classified the convertible notes in “long-term debt” on the

Company’s balance sheet as of January 31, 2009. At February 2, 2008, the holders of the convertible notes had

the ability to exercise their conversion rights as a result of the Company’s share price exceeding 120% of the

applicable conversion price for the trading period. Therefore, the convertible notes were classified within

“current portion of long-term debt” on the Company’s balance sheet as of February 2, 2008.

At January 31, 2009, the Company had $61.1 million in capital leases covering various properties and pieces

of equipment. The terms of the capital leases provide the lessor with a security interest in the asset being leased

and require the Company to make periodic lease payments, aggregating between $4 million and $6 million per

year.

The Company is obligated to fund a cash balance pension plan. The Company’s current policy is to maintain

at least the minimum funding requirements specified by the Employee Retirement Income Security Act of 1974.

The Company expects funding requirements of up to $1.0 million in 2009. As part of the sale of NDSG to

Bon-Ton, the NDSG pension assets and liabilities were acquired by Bon-Ton. Additionally, the Company

amended the SFA Pension Plan during 2006, freezing benefit accruals for all participants except those who have

attained age 55 and completed 10 years of credited service as of January 1, 2007, who are considered to be

non-highly compensated employees. In January 2009, the Company suspended future benefit accruals for all

remaining participants in the plan, effective March 13, 2009.

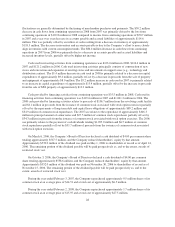

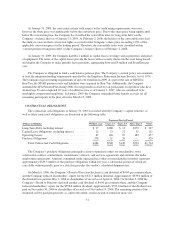

CONTRACTUAL OBLIGATIONS

The contractual cash obligations at January 31, 2009 associated with the Company’s capital structure, as

well as other contractual obligations are illustrated in the following table:

Payments Due by Period

(Dollars in Millions) Within 1 year Years 2-3 Years 4-5 After Year 5 Total

Long-Term Debt, including interest ................ $ 27 $388 $ 13 $279 $ 707

Capital Lease Obligations, including interest ........ 12 23 21 55 111

Operating Leases .............................. 67 126 95 189 477

Purchase Obligations ........................... 378 31 20 — 429

Total Contractual Cash Obligations ............ $484 $568 $149 $523 $1,724

The Company’s purchase obligations principally consist of purchase orders for merchandise, store

construction contract commitments, maintenance contracts, and services agreements and amounts due under

employment agreements. Amounts committed under open purchase orders for merchandise inventory represent

approximately $329.3 million of the purchase obligations within one year, a substantial portion of which are

cancelable without penalty prior to a date that precedes the vendor’s scheduled shipment date.

On March 6, 2006, the Company’s Board of Directors declared a cash dividend of $4.00 per common share,

and the Company reduced shareholders’ equity for the $547.5 million dividend. Approximately $539.0 million of

the dividend was paid on May 1, 2006 to shareholders of record as of April 14, 2006. On October 3, 2006 the

Company’s Board of Directors declared another cash dividend of $4.00 per common share, and the Company

reduced shareholders’ equity for the $558.6 million dividend. Approximately $552.0 million of the dividend was

paid on November 30, 2006 to shareholders of record as of November 15, 2006. The remaining portion of the

dividends will be paid prospectively as, and to the extent, certain awards of restricted stock vest.

31