Saks Fifth Avenue 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

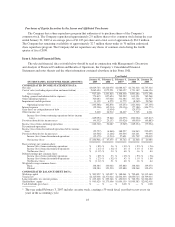

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

The Company has a share repurchase program that authorizes it to purchase shares of the Company’s

common stock. The Company repurchased approximately 2.9 million shares of its common stock during the year

ended January 31, 2009 at an average price of $11.83 per share and a total cost of approximately $34.9 million.

The Company has remaining availability of approximately 32.7 million shares under its 70 million authorized

share repurchase program. The Company did not repurchase any shares of common stock during the fourth

quarter of fiscal 2008.

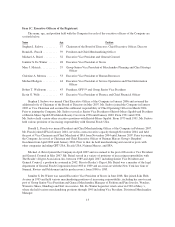

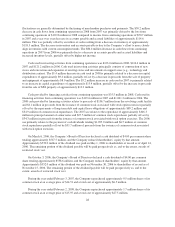

Item 6. Selected Financial Data.

The selected financial data set forth below should be read in conjunction with Management’s Discussion

and Analysis of Financial Condition and Results of Operations, the Company’s Consolidated Financial

Statements and notes thereto and the other information contained elsewhere in this Form 10-K.

Year Ended

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

January 31,

2009

February 2,

2008

February 3,

2007*

January 28,

2006

January 29,

2005

CONSOLIDATED INCOME STATEMENT DATA:

Net sales .............................................. $3,029,743 $3,224,076 $2,888,427 $2,732,428 $2,737,324

Cost of sales (excluding depreciation and amortization) ......... 2,062,494 1,972,251 1,780,127 1,731,142 1,666,126

Gross margin ...................................... 967,249 1,251,825 1,108,300 1,001,286 1,071,198

Selling, general and administrative expenses .................. 770,815 827,624 799,292 813,321 785,568

Other operating expenses ................................. 320,683 317,046 312,486 317,760 311,967

Impairments and dispositions .............................. 11,139 4,279 11,775 (8,349) 20,768

Operating income (loss) .............................. (135,388) 102,876 (15,253) (121,446) (47,105)

Interest expense ........................................ (39,306) (42,314) (50,136) (77,188) (104,773)

Gain (loss) on extinguishment of debt ....................... — (5,634) 7 (29,375) —

Other income, net ....................................... 5,600 24,912 28,407 7,705 4,061

Income (loss) from continuing operations before income

taxes ........................................... (169,094) 79,840 (36,975) (220,304) (147,817)

Provision (benefit) for income taxes ........................ (46,332) 29,153 (33,026) (90,950) (69,883)

Income (loss) from continuing operations .................... (122,762) 50,687 (3,949) (129,354) (77,934)

Discontinued operations:

Income (loss) from discontinued operations before income

taxes ............................................... (52,727) (4,860) 188,227 314,943 232,055

Provision (benefit) for income taxes ........................ (20,548) (1,646) 130,536 163,241 93,036

Income (loss) from discontinued operations .............. (32,179) (3,214) 57,691 151,702 139,019

Net income (loss) ................................... $ (154,941) $ 47,473 $ 53,742 $ 22,348 $ 61,085

Basic earnings per common share:

Income (loss) from continuing operations ................ $ (.89) $ .36 $ (.03) $ (.93) $ (.56)

Income (loss) from discontinued operations .............. $ (.23) $ (.02) $ .43 $ 1.10 $ 1.00

Net Income (loss) ................................... $ (1.12) $ .34 $ .40 $ .16 $ .44

Diluted earnings per common share:

Income (loss) from continuing operations ................ $ (.89) $ .33 $ (.03) $ (.93) $ (.56)

Income (loss) from discontinued operations .............. $ (.23) $ (.02) $ .43 $ 1.10 $ 1.00

Net Income (loss) ................................... $ (1.12) $ .31 $ .40 $ .16 $ .44

Weighted average common shares:

Basic ............................................. 138,384 140,402 135,880 138,348 139,470

Diluted ........................................... 138,384 153,530 135,880 138,348 139,470

CONSOLIDATED BALANCE SHEET DATA:

Working capital ........................................ $ 503,952 $ 345,097 $ 388,061 $ 799,601 $1,115,460

Total assets ............................................ $2,165,008 $2,371,024 $2,544,303 $3,850,725 $4,709,014

Long-term debt, less current portion ........................ $ 635,400 $ 253,346 $ 450,010 $ 722,736 $1,346,222

Shareholders’ equity ..................................... $ 965,620 $1,175,606 $1,096,139 $1,999,383 $2,062,418

Cash dividends (per share) ................................ $ — $ — $ 8.00 $ — $ 2.00

* The year ended February 3, 2007 includes an extra week, creating a 53-week fiscal year that occurs every six

years in the accounting cycle.

18