Saks Fifth Avenue 2008 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2008 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.300 basis point improvement in the expense rate as a percentage of sales. Additionally, the gross margin rate

improved 40 basis points for the year ended February 2, 2008. The improvement in gross margin dollars and the

gross margin rate was principally attributable to the higher sales driven by the strengthening of merchandise

assortments by store and enhancements to the merchandise planning and allocation process.

NET SALES

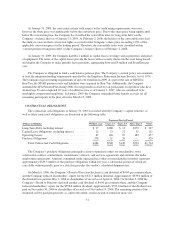

For the year ended February 2, 2008, total sales increased 11.6% to $3,224.1 million from $2,888.4 million

for the year ended February 3, 2007. The fiscal year ended February 3, 2007 included an extra week, creating a

53-week fiscal year that occurs every six years in the accounting cycle for many retailers which accounted for an

additional $42.7 million in sales. Consolidated comparable store sales increased $332.9 million, or 11.9% from

$2,805.3 million for the 52-week period ended January 27, 2007 to $3,138.2 million at February 2, 2008. The

previously mentioned 53rd week has been excluded from the comparable store sales calculation.

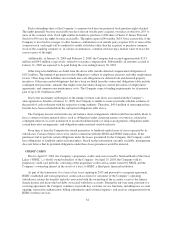

GROSS MARGIN

For the year ended February 2, 2008, gross margin was $1,251.8 million, or 38.8% of net sales, compared to

$1,108.3 million, or 38.4% of net sales, for the year ended February 3, 2007. The improvement in gross margin

dollars and gross margin rate was principally attributable to the higher sales driven by the strengthening of

merchandise assortments by store and enhancements to the merchandise planning and allocation process.

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

For the year ended February 2, 2008, SG&A was $827.6 million, or 25.7% of net sales, compared to $799.3

million, or 27.7% of net sales, for the year ended February 3, 2007. The net increase of $28.3 million in expenses

was primarily driven by higher variable expenses associated with the year over year sales increase of $335.6

million. The fiscal 2006 period included a $33.4 million charge associated with the anti-dilution adjustment made

to outstanding options related to the Company’s $4 per share dividend paid on May 1, 2006 and the $4 per share

dividend paid on November 30, 2006. As a percentage of sales, SG&A decreased by 200 basis points from the

year ended February 3, 2007; however, excluding the anti-dilution adjustment noted above, SG&A expense as a

percentage of sales declined 80 basis points over the same period.

Amounts received from vendors in conjunction with compensation programs and cooperative advertising

were consistent with the related gross compensation and cooperative advertising expenditures and therefore had

no impact on SG&A expense, in dollars or as a percentage of net sales.

OTHER OPERATING EXPENSES

For the year ended February 2, 2008, other operating expenses were $317.0 million, or 9.8% of net sales,

compared to $312.5 million, or 10.8% of net sales, for the year ended February 3, 2007. The increase of $4.5

million was principally driven by higher depreciation and amortization expense of $5.9 million and an increase in

taxes other than income taxes of $5.9 million. This is partially offset by a decrease in property and equipment

rentals of $7.5 million for the year ended February 2, 2008. As a percentage of sales, other operating expenses

decreased slightly, reflecting the ability to leverage expenses as store sales increased.

IMPAIRMENTS AND DISPOSITIONS

For the year ended February 2, 2008, the Company recognized net charges from impairments and

dispositions of $4.3 million compared to net charges of $11.8 million for the year ended February 3, 2007. The

current and prior year net charges were primarily due to asset impairments in the normal course of business.

26