Saks Fifth Avenue 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAKS INCORPORATED & SUBSIDIARIES

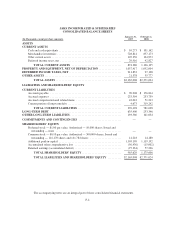

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

accounting and store planning services, among others. Bon-Ton compensated the Company for these services, as

outlined in the NDSG TSA. The results of the NDSG operations are reflected as discontinued operations in the

accompanying consolidated statement of income and the consolidated statement of cash flows for fiscal year

2006.

On October 2, 2006, the Company sold to Belk of all of the outstanding equity interests of the Company’s

subsidiaries that conducted the Parisian specialty department store business (“Parisian”). The consideration

received consisted of $285,000 in cash (increased in accordance with a working capital adjustment described

below). In addition, Belk reimbursed the Company at closing for $6,700 in capital expenditures incurred in

connection with the construction of four new Parisian stores. Belk also paid the Company a premium associated

with the purchase of accounts and accounts receivable from Household Bank (SB), N.A. (now known as HSBC

Bank Nevada, N.A., “HSBC”), in the amount of $2,300. A working capital adjustment based on working capital

as of the effective time of the transaction increased the amount of cash proceeds by $14,200 resulting in total net

cash proceeds of $308,200.

The disposition included Parisian’s operations consisting of, among other things, the following: real and

personal property, operating leases and inventory associated with 38 Parisian stores (which generated fiscal 2005

revenues of approximately $740,000), a 125,000 square foot administrative/headquarters facility in Birmingham,

Alabama and a 180,000 square foot distribution center located in Steele, Alabama. The Company realized a net

loss of $12,811 on the sale.

In connection with the consummation of the Parisian transaction, the Company entered into a Transition

Services Agreement with Belk (“Parisian TSA”). Pursuant to the Parisian TSA, the Company provided, for

varying transition periods, back-office services related to the Company’s former Parisian specialty department

store business. The back-office services included information technology, telecommunications, credit, accounting

and store planning services, among others. The results of the Parisian operations are reflected as discontinued

operations in the accompanying consolidated statements of income and the consolidated statements of cash flows

for fiscal year 2006.

As of January 31, 2009, the Company discontinued the operations of its CLL business, which consisted of

98 leased, mall-based specialty stores, targeting girls aged 4-12 years old. Charges incurred during 2008

associated with the closing of the stores included inventory liquidation costs of approximately $6,965, asset

impairments charges of $16,993, lease termination costs of $14,045, severance and personnel related costs of

$5,074 and other closing costs of $1,444. These amounts and the results of operations of CLL are included in

discontinued operations in the consolidated statements of income and the consolidated statements of cash flows

for fiscal years 2008, 2007, and 2006.

Net sales of the aforementioned businesses that are included within discontinued operations in the

accompanying Consolidated Statements of Income are $52,231, $58,564, and $675,866 for 2008, 2007, and

2006, respectively.

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The preparation of financial statements in conformity with generally accepted accounting principles

(“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets

F-8