Saks Fifth Avenue 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

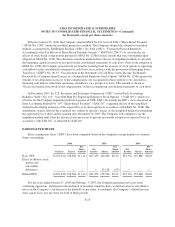

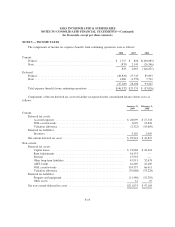

The following table presents additional potentially dilutive common shares excluded from diluted earnings

(loss) per share because the effect of including these potential shares would have been anti-dilutive:

2008 2007 2006

Stock Options and Employee Stock Purchase Plan Shares .......................... 346 — 1,266

Unvested Restricted Stock Awards and Performance Shares ......................... 1,889 — 1,161

Total ................................................................ 2,235 — 2,427

Securities excluded from the diluted earnings (loss) per share calculation because the

exercise prices was greater than the average market price

Stock Options (1) ...................................................... 1,811 688 1,722

Securities excluded from the diluted earnings (loss) per share calculation because the

performance criteria were not met:

Performance Shares .................................................... 845 — —

(1) These options represent the number outstanding at the end of the respective year. At the point that the

exercise price is less than the average market price, these options have the potential to be dilutive and

application of the treasury method would reduce this amount.

There were also 19,219 potentially exercisable shares under the convertible notes that were not included in

the computation of diluted EPS for the year ended January 31, 2009 because inclusion of the potential common

shares would have been anti-dilutive as the Company generated a net loss for the period. Included in the

computation of diluted EPS for the year ended February 2, 2008 are 11,190 potentially dilutive shares associated

with shares the Company would issue to settle the difference between fair value and the par value of the

convertible notes upon conversion and the shares to be issued upon the exercise of a call option the Company

sold at the time of issuance of the convertible debentures. There were also 19,219 potentially exercisable shares

under the convertible notes that were not included in the computation of diluted EPS due to the assumption of net

share settlement as discussed below.

In 2007, if the holders of the convertible notes exercised their conversion rights, the Company intended to

pay cash equal to 100 percent of the principal amount of the convertible notes. In the event that the cash

conversion price exceeded 100 percent of the principal amount of the 2% convertible notes, the Company’s

intention was to issue common stock for the difference between the par value and fair value at the time of

conversion. The Company had $101,162 of cash available as well as availability under the senior revolving credit

facility as of February 2, 2008. The cash on hand as well as the availability of borrowings under the senior credit

facility provided an adequate source of liquidity to pay 100% of the principal amount of the notes if the holders

had elected to exercise their conversion rights.

For the year ended February 3, 2007, there were also 19,219 potentially exercisable shares under the

convertible notes that were not included in the computation of diluted EPS due to the assumption of net share

settlement.

The FASB is contemplating an amendment to SFAS No. 128 “Earnings Per Share” (“SFAS No. 128”) that

would require the Company to ignore the cash presumption of net share settlement and to assume share

settlement for purposes of calculating diluted earnings per share. Although the Company is now required to

ignore the contingent conversion provision on its convertible notes under EITF 04-8 “The Effect of Contingently

Convertible Instruments on Diluted Earnings per Share,” it can still presume that it will satisfy the net share

settlement of the par value upon conversion of the notes in cash, and thus exclude the effect of the conversion of

F-14