Qantas 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.72

Spirit of Australia

~Notes to the Financial Statements~

for the year ended 30 June 2005

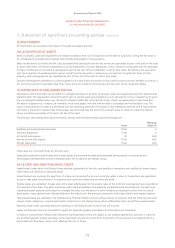

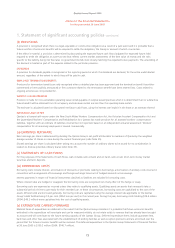

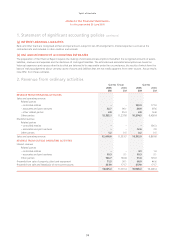

1. Statement of significant accounting policies continued

(p) INTANGIBLE ASSETS

GOODWILL

Goodwill, representing the excess of the purchase consideration plus incidental costs over the fair values of identifiable net assets

acquired, is amortised on a straight-line basis over the period in which future benefits are expected to arise, or 20 years, whichever is the

shorter.

The unamortised balance of goodwill is reviewed at least each balance date. Where the balance exceeds the value of expected future

benefits, the difference is charged to the Statements of Financial Performance.

For associates and joint ventures, the consolidated Financial Statements include the carrying amount of goodwill in the equity accounted

investments’ carrying amounts.

OTHER INTANGIBLES

Airport landing slots represent the purchase consideration of the identifiable intangibles acquired and are amortised on a straight-line

basis over the asset’s estimated useful life, not exceeding 20 years. The unamortised balance of other intangibles is reviewed at least each

balance date. Where the balance exceeds the value of expected future benefits, the difference is charged to the Statements of Financial

Performance.

(q) PAYABLES

Liabilities for trade creditors and other amounts are carried at cost, which is the fair value of the consideration to be paid in the future for

goods and services received, whether or not billed to the Qantas Group.

Deferred cash settlements are recognised at the present value of the outstanding consideration payable on the acquisition of an asset

discounted at prevailing commercial borrowing rates.

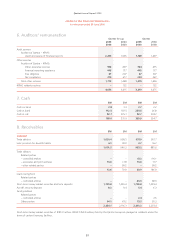

(r) FREQUENT FLYER ACCOUNTING

The Qantas Group receives revenue from the sale of Frequent Flyer points to third parties. This revenue is recognised in the Statements

of Financial Performance when it is received. The obligation to provide travel rewards to members of the Qantas Frequent Flyer program

is progressively accrued as points are accumulated, net of estimated points that will not be redeemed. This accrual is based on the

incremental cost (being the cost of meals, fuel and passenger expenses) of providing the travel rewards. The accrual is reduced as

members redeem awards or their entitlements expire.

(s) EMPLOYEE BENEFITS

WAGES AND SALARIES, ANNUAL LEAVE AND SICK LEAVE

Liabilities for employee benefits for wages, salaries, annual leave (including leave loading) and sick leave vesting to employees expected

to be settled within 12 months of the year end represent present obligations resulting from employees’ services provided to balance date.

These are calculated at undiscounted amounts based on remuneration wage and salary rates that the Qantas Group expects to pay as at

balance date including related on-costs, such as workers’ compensation insurance and payroll tax.

LONG SERVICE LEAVE

The provision for employee benefits to long service leave represents the present value of the estimated future cash outflows to be made

resulting from employees’ services provided to balance date.

The provision is calculated using expected future increases in wage and salary rates including related on-costs and expected settlement

dates based on turnover history and is discounted using the rates attaching to national government bonds at balance date which most

closely match the terms of maturity of the related liabilities. The unwinding of the discount is treated as long service leave expense.

EMPLOYEE SHARE PLANS

A liability is recognised for employee share plans, including benefits based on the future value of equity instruments and benefits under

plans allowing the Qantas Group to settle in either cash or shares.

SUPERANNUATION

The Qantas Group contributes to employee superannuation funds. Contributions to these funds are recognised in the Statements of

Financial Performance as they are made. Further details are disclosed in Note 27.