Qantas 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

Spirit of Australia

~Notes to the Financial Statements~

for the year ended 30 June 2005

1. Statement of significant accounting policies continued

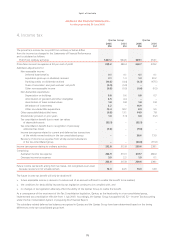

(f) GOODS AND SERVICES TAX

Revenues, expenses and assets are recognised net of the amount of GST, except where the amount of GST incurred is not recoverable

from the taxation authority. In these circumstances, the GST is recognised as part of the cost of acquisition of the asset or as part of the

expense.

Receivables and payables are stated with the amount of GST included.

The net amount of GST recoverable from, or payable to, the taxation authority is included as a current asset or liability in the Statements

of Financial Position.

Cash flows are included in the Statements of Cash Flows on a gross basis. The GST components of cash flows arising from investing and

financing activities which are recoverable from, or payable to, the taxation authority are classified as operating cash flows.

(g) TAXATION

The Qantas Group adopts the income statement liability method of tax-effect accounting.

Income tax expense is calculated on profit from ordinary activities adjusted for permanent differences between taxable and accounting

income.

The tax effect of timing differences, which arise from items being brought to account in different years for income tax and accounting

purposes, is carried forward in the Statements of Financial Position as a deferred tax asset or a deferred tax liability.

Future income tax benefits relating to timing differences are not brought to account as an asset unless realisation is assured beyond

reasonable doubt. Future income tax benefits relating to tax losses are only brought to account as an asset when their realisation is

considered to be virtually certain.

Capital gains tax, if applicable, is provided for in establishing income tax expense when an asset is sold.

Qantas is taxed as a public company and provides for income tax in overseas jurisdictions where a liability exists. Generally, these taxes are

assessed on a formula or percentage of sales basis.

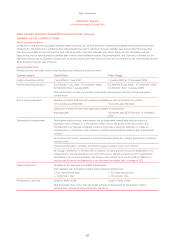

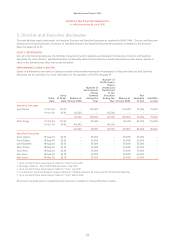

(h) TAX CONSOLIDATION

Qantas is the head entity in the tax-consolidated group comprising all the Australian wholly-owned entities1 set out in Note 28. The

implementation date for the tax-consolidated group was 1 July 2003. The head entity recognises all of the current and deferred tax assets

and liabilities of the tax-consolidated group (including intra-group transactions as allowed for in the financial year ended 30 June 2005).

The Qantas Group determined that wholly-owned entities will recognise an income tax expense referable to the tax arising on their profits

adjusted for permanent differences with a consequential adjustment to intercompany assets and liabilities.

The tax-consolidated group has entered into a tax sharing agreement given the joint and several income tax-related liability assumed by

all entities comprising the tax-consolidated group. In the opinion of the Directors, the tax sharing agreement is also a valid agreement

under the Tax Consolidation legislation and limits the joint and several income tax-related liability of the wholly-owned entities of the tax-

consolidated group in the case of default by Qantas.

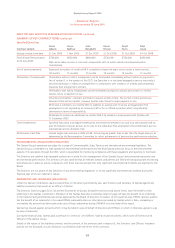

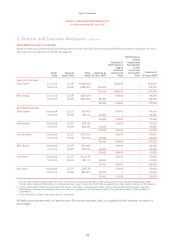

(i) RECEIVABLES

Receivables are recognised and carried at original invoice amount less a provision for any uncollectable debts. An estimate for doubtful

debts is made when collection of the full amount is no longer probable. Bad debts are written-off as incurred.

(j) INVENTORIES

Engineering expendables, consumable stores and work in progress are valued at weighted average cost, less any applicable allowance for

obsolescence. Inventories held for sale are valued at the lower of cost and net realisable value.

(k) RECOVERABLE AMOUNT OF NON-CURRENT ASSETS

The carrying amounts of non-current assets valued on the cost basis are reviewed regularly to determine whether they are in excess of

their recoverable amount at balance date. Assets which primarily generate cash flows, such as aircraft, are assessed on an individual basis

whereas infrastructure assets are examined on a class-by-class basis and compared to net surplus cash inflows. Expected net cash flows

used in determining recoverable amounts have been discounted to their net present value, using a rate reflecting the cost of funds.

An appropriate writedown is made if the carrying amount of a non-current asset exceeds its recoverable amount. The writedown is

expensed in the financial year in which it occurs.

1 The tax-consolidated group also includes the partnership between Qantas and AAL Aviation Limited and between Qantas Flight Catering Limited and

AAL Aviation Limited.