Qantas 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

Description Rationale

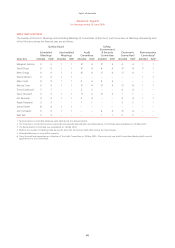

EQUITY BENEFITS continued

Performance Rights Plan1

2004/05 and 2005/06 Awards

Rights are awarded to selected Executives. Subject to achievement

of the Performance Hurdle, Rights may be converted (on a one-for-

one basis) to ordinary Qantas shares.

The Performance Hurdle set by the Board for these awards is the

Total Shareholder Return (TSR) of Qantas in comparison to:

x companies with ordinary shares included in the S&P/ASX 100

Index excluding NewsCorp and Qantas in relation to one-half

of the Rights; and

x a basket of global listed airlines comprising Air France-KLM,

Air New Zealand, AMR Corporation (American Airlines),

British Airways, Cathay Pacific, Delta Airlines, Japan Airlines,

Lufthansa, Ryan Air, Singapore Airlines, Southwest Airlines and

Virgin Blue in relation to the other half of the Rights.

The TSR will be first tested as at 30 June 2007 for the 2004/05

award and 30 June 2008 for the 2005/06 award and, if required,

re-tested quarterly over the subsequent two years.

The Performance Hurdle will be considered satisfied in accordance

with the following table:

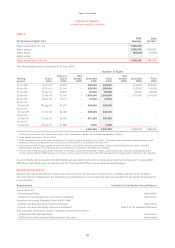

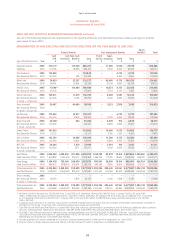

Qantas TSR Performance

Compared to the Satisfaction of the

Relevant Target Performance Hurdle

0 to 24th percentile Nil

25th to 49th percentile Default nil, but subject

to Board discretion

50th to 74th percentile 50% to 99% satisfied

75th to 100th percentile 100% satisfied

Generally, any Rights which have not vested will lapse if the

relevant Executive ceases employment with the Qantas Group.

Rights will also lapse if the Executive is guilty of gross misconduct

in relation to the Qantas Group.

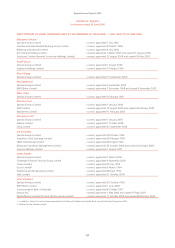

In relation to the Chief Executive Officer, Geoff Dixon, the

Performance Hurdle will be tested initially as at 30 June 2007 (the

same date as the first testing of the Hurdle for Qantas Executives).

However, given Mr Dixon’s contract expiry of 1 July 2007, it will

be tested again once each quarter over 2007/08, with the last test

to occur, if required, as at 30 June 2008. These tests will occur

regardless of whether Mr Dixon is an employee during 2007/08.

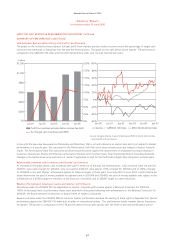

In August 2004, Qantas changed its long-term incentive

performance condition from RoTGA to relative TSR. Relative TSR is

a commonly used performance condition in Australia.

The relative TSR performance condition provides reward to the

Executive only if the return to shareholders has been positive

relative to other airlines and other large Australian companies.

Qantas believes that these two peer groups are the most

appropriate peer groups against which to assess its TSR growth.

The S&P/ASX 100 Index represents the broader Australian

market, whilst the basket of global airlines represents Qantas’

key competitors. NewsCorp’s ordinary and preference shares

were excluded as at the time of approval in October 2004 it

was assumed that NewsCorp would be successful in moving

its exchange in attendant index domicile to the United States.

NewsCorp continues to be excluded to ensure consistency.

The vesting scale is widely used in Australian industry. It prevents

payment for below median performance (except in unusual

circumstances at Board discretion), and does not deliver full reward

until 75th percentile performance is achieved.

It is considered this is appropriate as the strategy implemented by

Mr Dixon during his tenure as Chief Executive Officer may take

some time to be reflected in Qantas’ TSR.

2003/04 Awards

Vesting for the 2003/04 grants is based on the achievement of

average annual RoTGA targets over the three years to 30 June

2006. If the target is not met or the Executive ceases employment

prior to vesting, all of the Rights granted will lapse.

The performance condition of target RoTGA was chosen in

2003/04 as it measures financial performance that reflects an

appropriate return on capital. The RoTGA target was achieved in

both 2003/04 and 2004/05.

1 Refer footnote 1 on page 54.

Spirit of Australia

~Directors’ Report~

for the year ended 30 June 2005

DIRECTOR AND EXECUTIVE REMUNERATION DISCLOSURES continued