Qantas 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

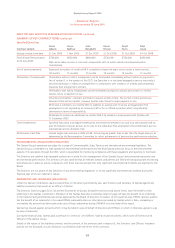

57

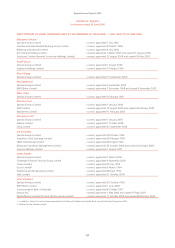

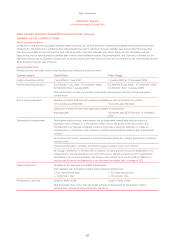

Description Rationale

LEGACY PLANS

Senior Manager Long-Term Incentive Plan2

Certain Executives were awarded a number of shares subject to a

four-year holding lock provided the Executive remains employed

by the Qantas Group. These shares will be held on behalf of each

Executive by the Trustee until the expiry of the holding lock period.

Any dividends paid on the shares will be distributed to the relevant

Executive.

This was an interim plan following the suspension of the Qantas

Long-Term Executive Incentive Plan. No awards have been made

since April 2003.

2002 Performance Bonus Plan

In 2001/02, the CEO, CFO and select Executives were required to

salary sacrifice at least 10 per cent of their bonus into deferred

shares (Shares). Under a matching award, participants were

granted one Right for every nine Shares allocated.

The program aligned remuneration and growth in shareholder

value. No Shares have been allocated under this Plan since October

2002.

Qantas Long-Term Executive Incentive Plan – suspended in 2002

Under QLTEIP, Executives were granted Entitlements to unissued

shares in Qantas in the years ended 30 June 2000, 2001 and

2002. Vesting is based on Qantas relative TSR compared to ASX

200 Industrials Index and a basket of global airlines. Entitlements

vest between three and five years following award date and are

generally conditional on the Executive remaining employed. To

the extent that Entitlements vest, they may be converted into

ordinary shares within eight years of the award date in proportion

to the gain in share price. Entitlements will lapse on the eighth

anniversary of the date of award.

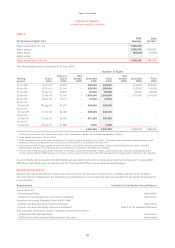

The first index is determined as the percentile performance of

Qantas (based on average Relative TSR) within a modified S&P/

ASX 200 Industrials Index. The index excludes Banks, Infrastructure

and Utilities, Insurance, Investments and Financial Services, Media,

Property Trusts and Telecommunications. At grant date, it included

86 stocks.

At grant date, the basket of global airlines included Air Canada,

Air New Zealand, AMR Corporation (American Airlines), British

Airways, Cathay Pacific, Delta Airlines, Japan Airlines, KLM Royal

Dutch Airlines (data no longer applicable), Lufthansa, Northwest

Airlines, Singapore Airlines and UAL Corporation (United Airlines).

For further details of QLTEIP, see page 49.

This performance condition aligns remuneration and growth in

shareholder value. The plan was suspended in July 2002.

2 The relevant plan for the Executive Directors is the 2002 Executive Director Long-Term Incentive Plan.

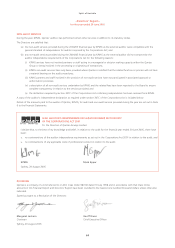

Qantas Annual Report 2005

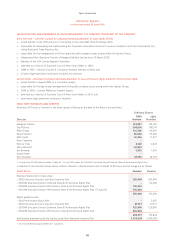

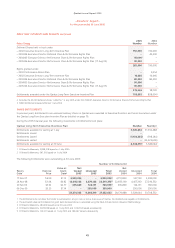

~Directors’ Report~

for the year ended 30 June 2005

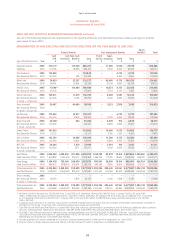

DIRECTOR AND EXECUTIVE REMUNERATION DISCLOSURES continued