Qantas 2005 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

Qantas Annual Report 2005

~Notes to the Financial Statements~

for the year ended 30 June 2005

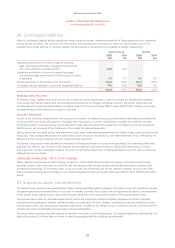

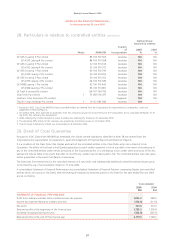

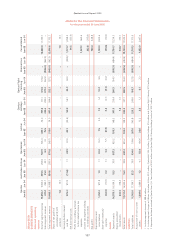

31. Financial instruments continued

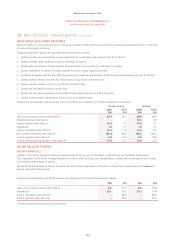

2004 Notes

Weighted

Average

Interest

Rate

(% pa)

Floating

Rate

$M

Fixed Rate Maturing in:

Non-

Interest-

Bearing

$M

Total

$M

Less

than

1 Year

$M

1 to 5

Years

$M

More

than

5 Years

$M

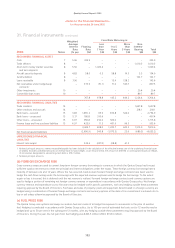

RECOGNISED FINANCIAL ASSETS

Cash 75.06335.9––––335.9

Trade debtors 8–––––1,010.31,010.3

Short-term money market securities

and term deposits

85.50–1,029.4–––1,029.4

Aircraft security deposits 8 4.83 58.0 0.5 58.8 14.3 3.3 134.9

Sundry debtors 8–––––102.7102.7

Loans receivable 87.96––15.4128.2–143.6

Net receivables under hedge/swap

contracts1

– 373.9 (51.1) 71.0 503.7 – 897.5

Other investments 10–––––20.420.4

Convertible loan notes 10–––––89.789.7

767.8 978.8 145.2 646.2 1,226.4 3,764.4

RECOGNISED FINANCIAL LIABILITIES

Trade creditors 14–––––1,697.81,697.8

Other creditors and accruals 14 – – – – – 218.1 218.1

Bank loans – secured 15 3.83 1,855.2 65.9 309.8 524.0 – 2,754.9

Bank loans – unsecured 15 5.17 186.8 310.6 – – – 497.4

Other loans – unsecured 15 6.97 956.8 250.0 509.0 – – 1,715.8

Finance lease and hire purchase liabilities 15 6.97 425.9 11.5 401.9 96.3 – 935.6

3,424.7 638.0 1,220.7 620.3 1,915.9 7,819.6

Net financial assets/(liabilities) (2,656.9) 340.8 (1,075.5) 25.9 (689.5) (4,055.2)

UNRECOGNISED FINANCIAL

LIABILITIES

Interest rate swaps2224.6(247.0)(38.8)61.2––

1 Notional principal amounts. Interest receivable/payable has been included in the calculation of the effective interest rate of the underlying financial asset

or liability. Excludes unrealised amounts on revenue back-to-back hedges. As at 30 June 2004, the amount of deferred or unrecognised losses on hedges

of net revenue designated to service long-term debt is $19.2 million.

2 Notional principal amounts.

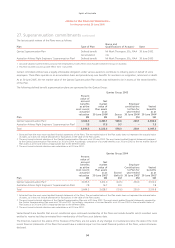

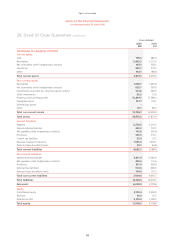

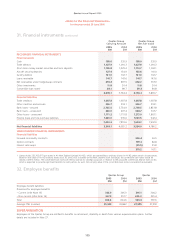

(b) FOREIGN EXCHANGE RISK

Cross-currency swaps are used to convert long-term foreign currency borrowings to currencies in which the Qantas Group has forecast

sufficient surplus net revenue to meet the principal and interest obligations under the swaps. These foreign currency borrowings have a

maturity of between one and 12 years. Where this has occurred, back-to-back forward foreign exchange contracts have been used to

hedge the cash flows arising under the borrowings with the expected revenue surpluses used to hedge the borrowings. To the extent

a gain or loss is incurred, this is deferred until the net revenue is realised. Forward foreign exchange contracts and currency options are

used to hedge a portion of remaining net foreign currency revenue or expenditure in accordance with Qantas Group policy. Net foreign

currency revenue and expenditure out to five years may be hedged within specific parameters, with any hedging outside these parameters

requiring approval by the Board of Directors. Purchases and sales of property, plant and equipment denominated in a foreign currency are

hedged using a combination of forward foreign exchange contracts and currency options at the date a firm commitment is entered into to

buy or sell unless otherwise approved by the Board of Directors.

(c) FUEL PRICE RISK

The Qantas Group uses options and swaps on aviation fuel and crude oil to hedge the exposure to movements in the price of aviation

fuel. Hedging is conducted in accordance with Qantas Group policy. Up to 100 per cent of estimated fuel costs out to 12 months may be

hedged and up to 50 per cent in the subsequent 12 months, with any hedging outside these parameters requiring approval by the Board

of Directors. During the year, the net gain from fuel hedging was $403.5 million (2004: $118.0 million).