Qantas 2005 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2005 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

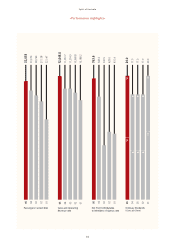

In an industry that has lost more than US$35 billion

since 2001, Qantas is one of a very small number of

airlines that has been consistently profitable.

Qantas is as committed to providing good returns for

shareholders as it is to providing the best product and

service for its customers.

Because growth is fundamental to our business,

Qantas is looking for profitable expansion in high-yield

full-service markets in Australia and internationally.

At the same time, we are growing our value-based

airlines, such as Jetstar, to compete effectively in

leisure markets.

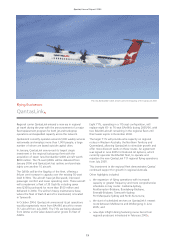

Qantas is also pursuing growth opportunities in

associated businesses to diversify earnings sources

and provide a buffer against the cyclical nature of

its flying businesses.

We realise that cost control is essential to our business

and have achieved cost and efficiency savings of

$1 billion in the past two years. We will continue to

target a further $2 billion in savings over the next

three years.

Since listing on the Australian Stock Exchange in 1995,

Qantas has provided total shareholder return of more

than 340 per centx

Being a

good business

is as important

as being a

great airlinex

5~

Qantas Annual Report 2005

~Our Business~