Proctor and Gamble 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 77

Amounts in millions of dollars except per share amounts or as otherwise specified.

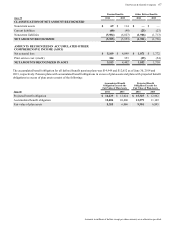

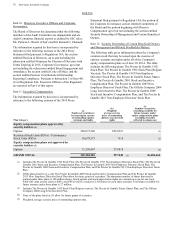

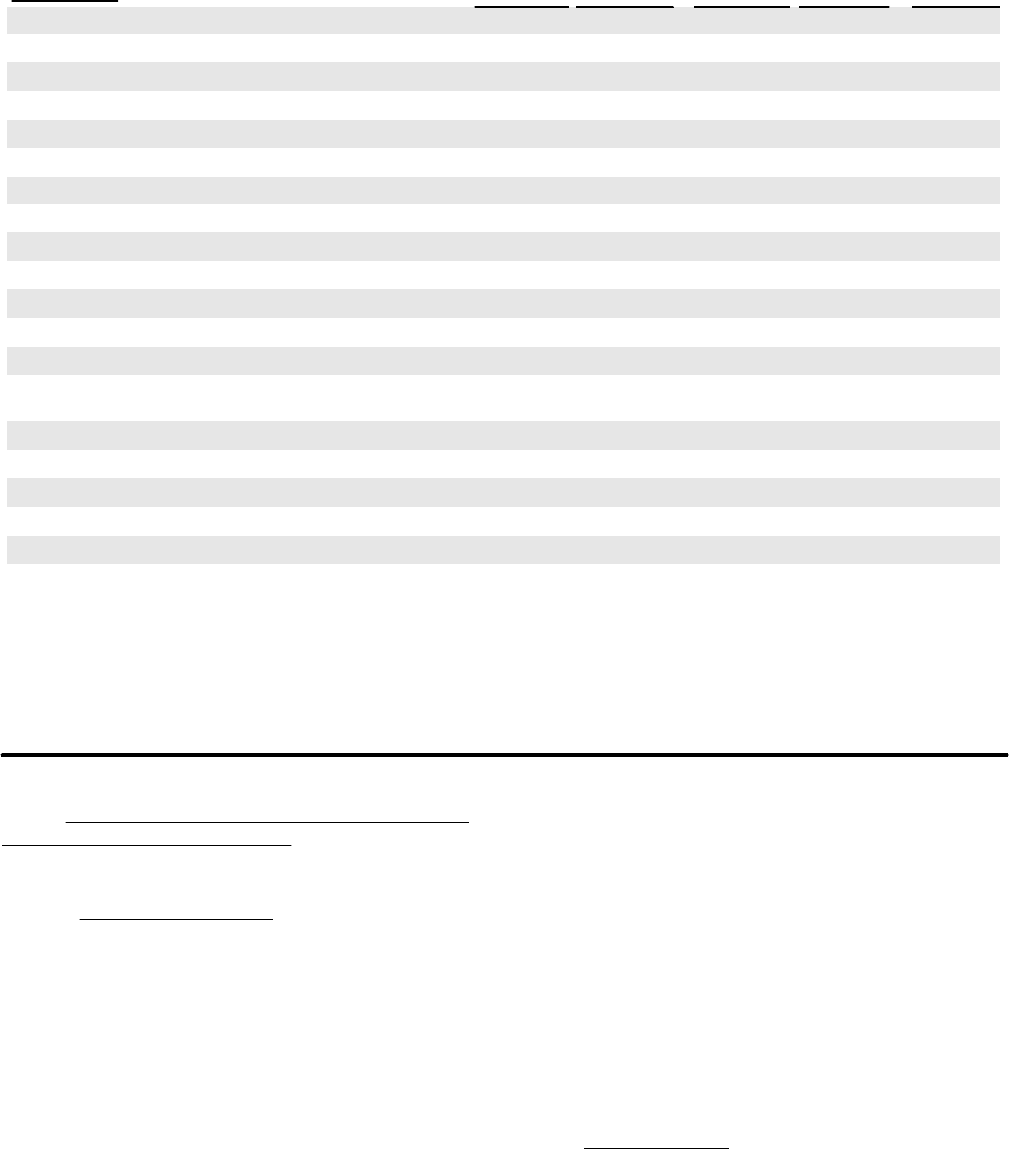

NOTE 14

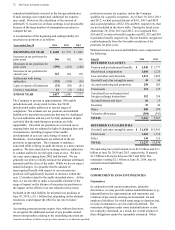

QUARTERLY RESULTS (UNAUDITED)

Quarters Ended Sept 30 Dec 31 Mar 31 Jun 30 Total Year

NET SALES 2013-2014 $ 20,830 $ 21,897 $ 20,178 $ 20,157 $83,062

2012-2013 20,342 21,737 20,205 20,297 82,581

OPERATING INCOME 2013-2014 4,120 4,523 3,405 3,240 15,288

2012-2013 3,889 4,429 3,361 2,651 (3) 14,330

GROSS MARGIN 2013-2014 49.2% 50.3% 48.6% 47.2% 48.9%

2012-2013 50.3 % 51.2 % 50.0 % 47.9 % 49.9 %

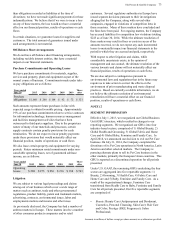

NET EARNINGS:

Net earnings from continuing operations 2013-2014 $ 3,039 $ 3,454 $ 2,603 $ 2,611 $11,707

2012-2013 2,812 4,034 (2) 2,562 1,893 (3) 11,301

Net earnings from discontinued operations 2013-2014 18 18 33 9 78

2012-2013 41 42 29 (11) 101

Net earnings attributable to Procter & Gamble 2013-2014 3,027 3,428 2,609 2,579 11,643

2012-2013 2,814 4,057 (2) 2,566 1,875 (3) 11,312

DILUTED NET EARNINGS PER

COMMON SHARE: (1)

Earnings from continuing operations 2013-2014 $ 1.03 $ 1.17 $ 0.89 $ 0.89 $ 3.98

2012-2013 0.95 1.38 0.87 0.64 3.83

Earnings from discontinued operations 2013-2014 0.01 0.01 0.01 — 0.03

2012-2013 0.01 0.01 0.01 — 0.03

Net earnings 2013-2014 1.04 1.18 0.90 0.89 4.01

2012-2013 0.96 1.39 0.88 0.64 3.86

(1) Diluted net earnings per share is calculated on earnings attributable to Procter & Gamble.

(2) The Company acquired the balance of its Baby Care and Feminine Care joint venture in Iberia in October 2012 resulting in a non-operating

gain of $623.

(3) During the fourth quarter of fiscal year 2013, the Company recorded before-tax goodwill and indefinite-lived intangible assets impairment

charges of $308 ($290 after-tax). For additional details, see Note 2.

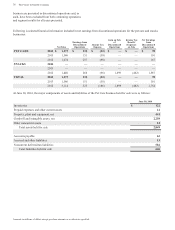

Item 9. Changes in and Disagreements with Accountants on

Accounting and Financial Disclosure.

Not applicable.

Item 9A. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures.

The Company's President and Chief Executive Officer, A. G.

Lafley, and the Company's Chief Financial Officer, Jon R.

Moeller, performed an evaluation of the Company's

disclosure controls and procedures (as defined in Rules

13a-15(e) and 15d-15(e) of the Securities Exchange Act of

1934 (Exchange Act)) as of the end of the period covered by

this Annual Report on Form 10-K.

Messrs. Lafley and Moeller have concluded that the

Company's disclosure controls and procedures were

effective to ensure that information required to be disclosed

in reports we file or submit under the Exchange Act is

(1) recorded, processed, summarized and reported within the

time periods specified in Securities and Exchange

Commission rules and forms, and (2) accumulated and

communicated to our management, including Messrs. Lafley

and Moeller, to allow their timely decisions regarding

required disclosure.

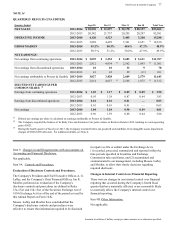

Changes in Internal Control over Financial Reporting.

There were no changes in our internal control over financial

reporting that occurred during the Company's fourth fiscal

quarter that have materially affected, or are reasonably likely

to materially affect, the Company's internal control over

financial reporting.

Item 9B. Other Information.

Not applicable.