Proctor and Gamble 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 33

net sales growth. Disproportionate growth in developing

regions drove unfavorable geographic mix reducing net sales

by 1%. Unfavorable foreign exchange reduced net sales by

1%. Global market share of the Health Care segment

increased 0.2 points. Volume increased low single digits in

both developed and developing regions. Oral Care volume

increased low single digits due to a mid-single digit increase

in developing regions behind geographic market expansion

and market growth and a low single-digit increase in

developed regions from innovation. Global market share of

the oral care category increased less than half a point.

Volume in Personal Health Care decreased low single digits

due to a weak cough and cold season which was only

partially offset by innovation and market expansion.

Net earnings decreased 1% to $1.1 billion as increased net

sales was more than offset by a 30-basis point decrease in

net earnings margin. Net earnings margin decreased due to

gross margin contraction partially offset by lower overheads.

Gross margin decreased due to the impact of foreign

exchange and negative geographic and product mix, partially

offset by manufacturing cost savings and pricing.

Fiscal year 2013 compared with fiscal year 2012

Health Care net sales increased 6% to $7.7 billion in 2013

on a 5% increase in unit volume. Organic sales were up 7%.

Unfavorable foreign exchange reduced net sales by 3%.

Price increases across all regions contributed 1% to net sales

growth. Favorable geographic and product mix increased net

sales by 2%. The mix impact from acquisitions and

divestitures increased net sales by 1%. Global market share

of the Health Care segment decreased 0.2 points. Volume

increased high single digits in developing regions and

increased low single digits in developed regions. Oral Care

volume increased mid-single digits due to geographic

expansion, innovation and market growth. Global market

share of the oral care category was down slightly. Volume in

Personal Health Care increased mid-single digits partially

due to a net increase from prior year acquisition and

divestiture activity (the addition of the PGT Healthcare

partnership and New Chapter VMS, partially offset by the

divestiture of the PuR business). Organic volume increased

low single digits primarily due to the launch of ZzzQuil and

geographic expansion for Vicks.

Net earnings increased 7% to $1.1 billion due to higher net

sales and a 10-basis point increase in net earnings margin.

Net earnings margin increased due to a reduction in

overhead spending partially offset by gross margin

contraction. Gross margin decreased due to increased

commodity costs and supply chain investments, partially

offset by higher pricing and manufacturing cost savings.

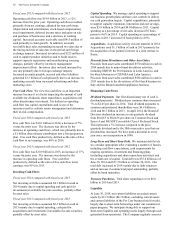

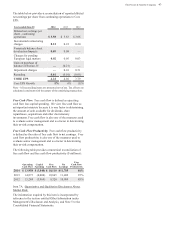

FABRIC CARE AND HOME CARE

($ millions) 2014

Change vs

2013 2013

Change vs

2012

Volume n/a +5% n/a +3%

Net sales $26,060 +1% $ 25,862 +1%

Net earnings $3,039 -2% $ 3,089 +10%

% of Net Sales 11.7% (20) bps 11.9% 90 bps

Fiscal year 2014 compared with fiscal year 2013

Fabric Care and Home Care net sales increased 1% to $26.1

billion in 2014 on a 5% increase in unit volume. Organic sales

were up 4%. Unfavorable foreign exchange reduced net sales

by 3%. Unfavorable geographic and product mix decreased

net sales by 1%. Global market share of the Fabric Care and

Home Care segment increased 0.2 points. Volume increased

high single digits in developing regions and low single digits

in developed regions. Fabric Care volume increased mid-

single digits driven by a high single digit volume increase in

developing regions behind market growth and innovation, and

a low single digit increase in developed regions due to product

innovation. Global market share of the fabric care category

was flat. Home Care volume increased mid-single digits driven

by a high single digit increase in developing markets from

distribution expansion and market growth, and from a low

single digit increase in developed regions due to product

innovation. Global market share of the home care category

was up less than half a point. Batteries volume increased mid-

single digits due to new customer distribution in developed

regions and market growth in developing regions. Global

market share of the batteries category was up more than a point.

Net earnings decreased 2% to $3.0 billion as net sales growth

was more than offset by a 20-basis point decrease in net

earnings margin. Net earnings margin decreased due to gross

margin contraction partially offset by a decrease in SG&A as

a percentage of sales. Gross margin decreased due to

unfavorable geographic and product mix and the impact of

foreign exchange, which was partially offset by manufacturing

cost savings. SG&A as a percentage of net sales decreased due

to marketing and overhead efficiencies.

Fiscal year 2013 compared with fiscal year 2012

Fabric Care and Home Care net sales increased 1% in 2013

to $25.9 billion on a 3% increase in unit volume. Organic

sales were up 4%. Price increases contributed 1% to net

sales growth. Unfavorable foreign exchange reduced net

sales by 3%. Global market share of the Fabric Care and

Home Care segment decreased 0.3 points. Volume increased

mid-single digits in developing regions and low single digits

in developed regions. Fabric Care volume increased low

single digits behind low single-digit growth in developed

regions and mid-single-digit growth in developing regions,

driven primarily by Asia. Overall growth due to innovation

and market growth was partially offset by the impacts of

competitive activity. Global market share of the fabric care

category decreased more than half a point. Home Care

volume increased mid-single digits driven by a high single-