Proctor and Gamble 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 The Procter & Gamble Company

regions from reduced shipments as a result of price gaps

versus competition. Global market share of the hair care and

color category was down more than half a point. Volume in

Beauty Care was in line with the prior year period. A low

single-digit volume increase in personal cleansing and a

mid-single-digit increase in deodorants, driven by innovation

and market growth in developing regions, was offset by a

mid-single-digit decline in facial skin care, where global

market share decreased about a point. Volume in Salon

Professional was in line with the prior year period due to

mid-single-digit growth in developing markets behind new

innovations, offset by a low single-digit decline in developed

regions from market contraction. Volume in Prestige was in

line with the prior year period due to minor brand

divestitures and market contraction in Western Europe,

offset by innovation and market growth in developing

markets. Organic volume in Prestige increased low single

digits.

Net earnings increased 4% to $2.5 billion, as lower net sales

were more than offset by a 60-basis point increase in net

earnings margin. Net earnings margin increased due to gross

margin expansion, a decrease in SG&A as a percentage of

sales and a lower effective tax rate. Gross margin increased

behind manufacturing cost savings and higher pricing.

SG&A as a percentage of net sales declined largely due to

reduced overhead spending. The effective tax rate declined

due to the geographic mix of earnings.

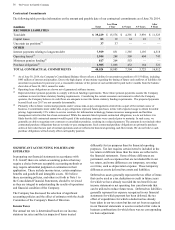

GROOMING

($ millions) 2014

Change vs

2013 2013

Change vs

2012

Volume n/a +1% n/a -1%

Net sales $8,009 —% $8,038 -4%

Net earnings $1,954 +6% $1,837 +2%

% of Net Sales 24.4% 150 bps 22.9% 120 bps

Fiscal year 2014 compared with fiscal year 2013

Grooming net sales were flat at $8.0 billion in 2014 on a 1%

increase in unit volume. Organic sales were up 3%. Price

increases in Blades and Razors andAppliances contributed 4%

to net sales growth. Unfavorable geographic and product mix

reduced net sales by 2% due to disproportionate growth in

developing regions and mid-tier products, both of which have

lower than segment average selling prices. Unfavorable

foreign exchange reduced net sales by 3%. Global market share

of the Grooming segment increased 0.2 points. Volume

increased mid-single digits in developing regions partially

offset by a low single digit decrease in developed regions.

Shave Care volume increased low single digits due to a mid-

single-digit growth in developing regions from innovation and

market growth, partially offset by a low single-digit decrease

in developed regions due to market contraction. Global market

share of the blades and razors category was up slightly. Volume

in Appliances decreased low single digits due to the sale of the

Braun household appliances business. Organic volume

increased mid-single digits driven by developing markets due

to market growth, product innovation on men's shavers and

shipments to build inventory to support initiatives and new

distributors. Global market share of the appliances category

was down less than half a point.

Net earnings increased 6% to $2.0 billion due to a 150 basis-

point increase in net earnings margin. Net earnings margin

increased primarily due to a reduction in SG&A spending

which was driven by a decrease in marketing spending. Gross

margin increased slightly as the benefits of pricing and

manufacturing cost savings more than offset the negative

impacts of foreign exchange and geographic and product mix.

Fiscal year 2013 compared with fiscal year 2012

Grooming net sales decreased 4% to $8.0 billion in 2013 on

a 1% decrease in unit volume. Organic sales were up 2% on

organic volume that was in line with the prior year period.

Price increases contributed 2% to net sales growth.

Unfavorable foreign exchange reduced net sales by 4%. The

impact of the Braun household appliances business

divestiture reduced net sales by 1%. Global market share of

the Grooming segment increased 0.4 points. Volume

increased low single digits in developing regions and

decreased mid-single digits in developed regions. Shave

Care volume increased low single digits due to low single-

digit growth in developing regions, primarily behind market

growth and innovation expansion, partially offset by a low

single-digit decrease in developed regions primarily due to

market contraction in Western Europe. Global market share

of the blades and razors category was up less than half a

point. Volume in Appliances decreased double digits due to

the sale of the Braun household appliances business,

competitive activity and market contraction. Organic

volume in Appliances declined high single digits. Global

market share of the appliances category decreased nearly

half a point.

Net earnings increased 2% to $1.8 billion due to a 120-basis

point increase in net earnings margin, partially offset by the

decrease in net sales. Net earnings margin increased

primarily due to gross margin expansion. Gross margin

increased due to pricing and manufacturing cost savings.

SG&A as a percentage of net sales decreased nominally as

increased marketing spending was offset by reduced

overhead costs.

HEALTH CARE

($ millions) 2014

Change vs

2013 2013

Change vs

2012

Volume n/a +2% n/a +5%

Net sales $7,798 +1% $ 7,684 +6%

Net earnings $1,083 -1% $ 1,093 +7%

% of Net Sales 13.9% (30) bps 14.2% 10 bps

Fiscal year 2014 compared with fiscal year 2013

Health Care net sales increased 1% to $7.8 billion in 2014

on a 2% increase in unit volume. Organic sales increased

2%. Price increases across the businesses contributed 1% to