Proctor and Gamble 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

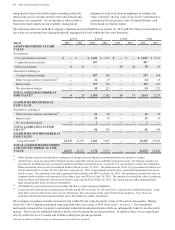

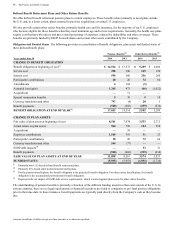

The Procter & Gamble Company 61

Amounts in millions of dollars except per share amounts or as otherwise specified.

During fiscal 2013, we recorded impairments of certain goodwill and intangible assets. Also, during fiscal 2013, we applied

purchase accounting and re-measured assets and liabilities at fair value related to the purchase of the balance of a joint venture

in Iberia (see Note 2 for additional details on these items). Except for these items, there were no significant assets or liabilities

that were re-measured at fair value on a non-recurring basis during fiscal 2013 or 2014.

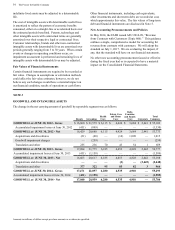

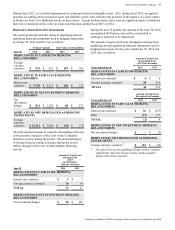

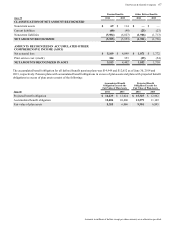

Disclosures about Derivative Instruments

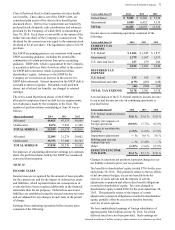

The notional amounts and fair values of qualifying and non-

qualifying financial instruments used in hedging transactions

as of June 30, 2014 and 2013 are as follows:

Notional Amount Fair Value Asset/(Liability)

June 30 2014 2013 2014 2013

DERIVATIVES IN CASH FLOW HEDGING

RELATIONSHIPS

Foreign

currency

contracts $ 951 $ 951 $ 187 $ 168

DERIVATIVES IN FAIR VALUE HEDGING

RELATIONSHIPS

Interest rate

contracts $ 9,738 $ 9,117 $ 168 $ 132

DERIVATIVES IN NET INVESTMENT HEDGING

RELATIONSHIPS

Net

investment

hedges $ 831 $ 1,303 $ 48 $ 233

DERIVATIVES NOT DESIGNATED AS HEDGING

INSTRUMENTS

Foreign

currency

contracts $ 12,111 $ 7,080 $ (42) $ (71)

The total notional amount of contracts outstanding at the end

of the period is indicative of the level of the Company's

derivative activity during the period. The notional balance

of foreign currency contracts changes during the period

reflects changes in the level of intercompany financing

activity.

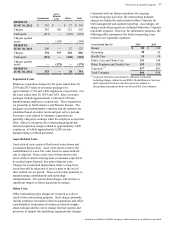

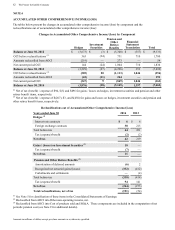

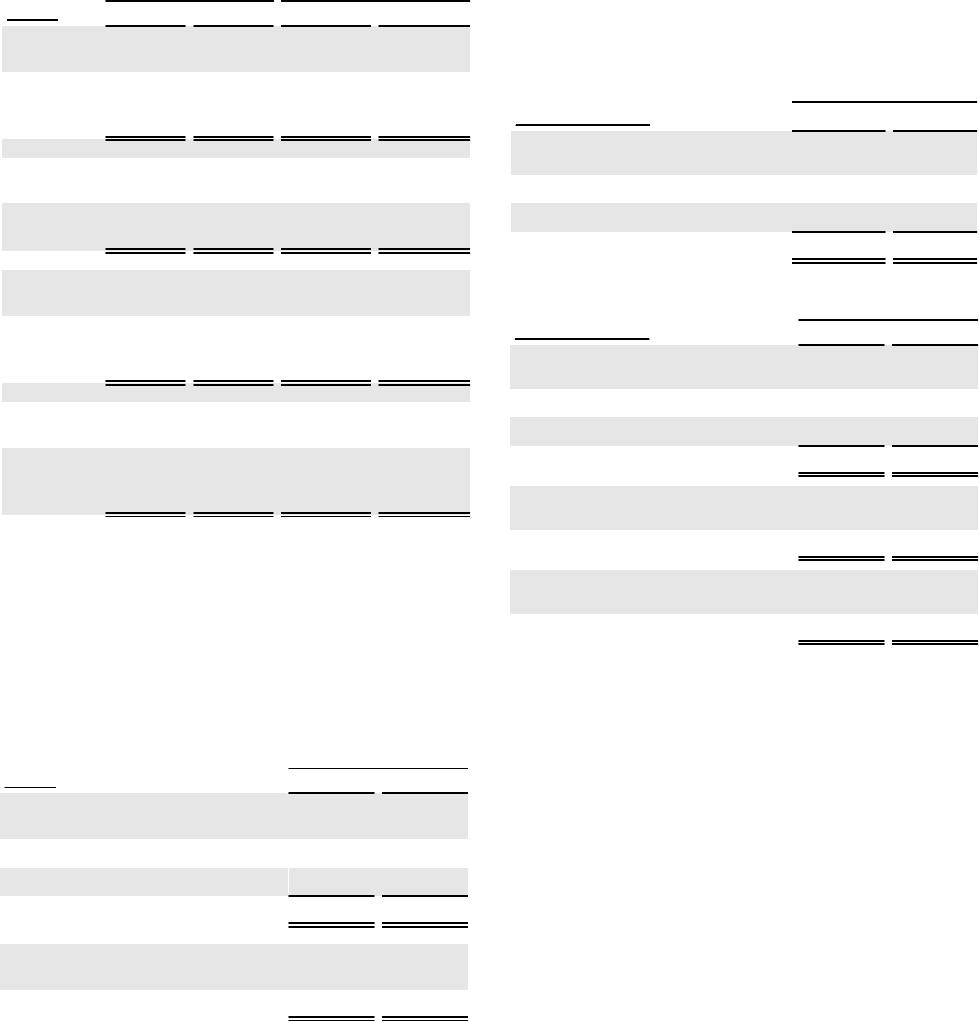

Amount of Gain/(Loss)

Recognized in

AOCI

on Derivatives

(Effective Portion)

June 30 2014 2013

DERIVATIVES IN CASH FLOW HEDGING

RELATIONSHIPS

Interest rate contracts $3

$7

Foreign currency contracts 14 14

TOTAL 17 21

DERIVATIVES IN NET INVESTMENT HEDGING

RELATIONSHIPS

Net investment hedges $ 30 $ 145

During the next 12 months, the amount of the June 30, 2014,

accumulated OCI balance that will be reclassified to

earnings is expected to be immaterial.

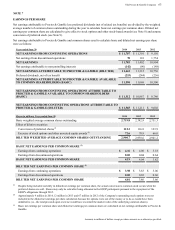

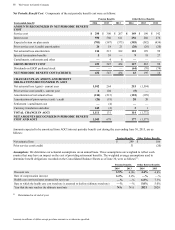

The amounts of gains and losses included in earnings from

qualifying and non-qualifying financial instruments used in

hedging transactions for the years ended June 30, 2014 and

2013 were as follows:

Amount of Gain/(Loss)

Reclassified from

AOCI into Earnings

Years ended June 30 2014 2013

DERIVATIVES IN CASH FLOW HEDGING

RELATIONSHIPS

Interest rate contracts $6

$6

Foreign currency contracts 38 215

TOTAL 44 221

Amount of Gain/(Loss)

Recognized in Earnings

Years ended June 30 2014 2013

DERIVATIVES IN FAIR VALUE HEDGING

RELATIONSHIPS

Interest rate contracts $ 36 $ (167)

Debt (37) 171

TOTAL (1) 4

DERIVATIVES IN NET INVESTMENT HEDGING

RELATIONSHIPS

Net investment hedges $—

$ (2)

DERIVATIVES NOT DESIGNATED AS HEDGING

INSTRUMENTS

Foreign currency contracts(1) $ 123 $ (34)

(1) The gain or loss on non-qualifying foreign currency contracts

substantially offsets the foreign currency mark-to-market

impact of the related exposure.