Proctor and Gamble 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

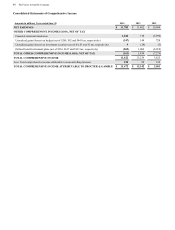

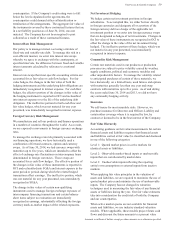

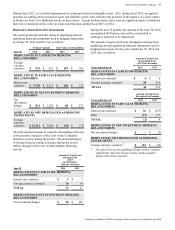

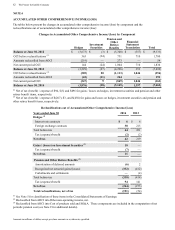

56 The Procter & Gamble Company

Amounts in millions of dollars except per share amounts or as otherwise specified.

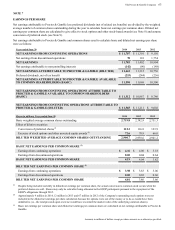

Estimated amortization expense over the next five fiscal

years is as follows:

Years ended June 30 2015 2016 2017 2018 2019

Estimated

amortization

expense $ 432 $ 393 $ 360 $ 332 $ 309

These estimates do not reflect the impact of future foreign

exchange rate changes.

NOTE 3

SUPPLEMENTAL FINANCIAL INFORMATION

The components of property, plant and equipment were as

follows:

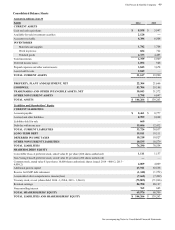

June 30 2014 2013

PROPERTY, PLANT AND

EQUIPMENT

Buildings $ 8,022 $ 7,829

Machinery and equipment 32,398 31,070

Land 893 878

Construction in progress 3,114 3,235

TOTAL PROPERTY, PLANT

AND EQUIPMENT 44,427 43,012

Accumulated depreciation (22,123) (21,346)

PROPERTY, PLANT AND

EQUIPMENT, NET 22,304 21,666

Selected components of current and noncurrent liabilities

were as follows:

June 30 2014 2013

ACCRUED AND OTHER

LIABILITIES - CURRENT

Marketing and promotion $ 3,290 $ 3,122

Compensation expenses 1,647 1,665

Restructuring reserves 381 323

Taxes payable 711 817

Legal and environmental 399 374

Other 2,571 2,527

TOTAL 8,999 8,828

OTHER NONCURRENT

LIABILITIES

Pension benefits $ 5,984 $ 6,027

Other postretirement benefits 1,906 1,713

Uncertain tax positions 1,843 2,002

Other 802 837

TOTAL 10,535 10,579

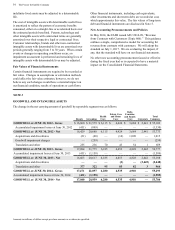

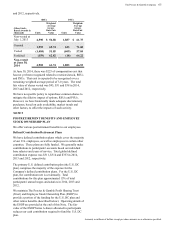

RESTRUCTURING PROGRAM

The Company has historically incurred an ongoing annual

level of restructuring-type activities to maintain a

competitive cost structure, including manufacturing and

workforce optimization. Before-tax costs incurred under the

ongoing program have generally ranged from $250 to $500

annually. In 2012, the Company initiated an incremental

restructuring program as part of a productivity and cost

savings plan to reduce costs in the areas of supply chain,

research and development, marketing and overheads. The

productivity and cost savings plan was designed to

accelerate cost reductions by streamlining management

decision making, manufacturing and other work processes in

order to help fund the Company's growth strategy.

The Company expects to incur in excess of $4.5 billion in

before-tax restructuring costs over a five year period (from

fiscal 2012 through fiscal 2016), including costs incurred as

part of the ongoing and incremental restructuring program.

Through the end of fiscal 2014, we had incurred $2.8 billion

of the total expected restructuring charges under the

program. The restructuring program plans included a

targeted net reduction in non-manufacturing overhead

enrollment of approximately 16% - 22% through fiscal 2016,

which we expect to exceed. Through fiscal 2014, the

Company has reduced non-manufacturing enrollment by

approximately 9,300, or approximately 15%. The

reductions are enabled by the elimination of duplicate work,

simplification through the use of technology, optimization of

various functional and business organizations and the

Company's global footprint. In addition, the plan includes

integration of newly acquired companies and the

optimization of the supply chain and other manufacturing

processes.

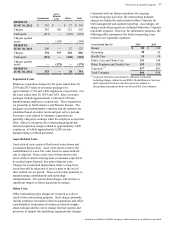

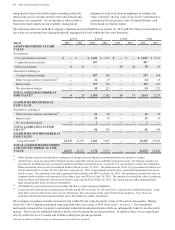

Restructuring costs incurred consist primarily of costs to

separate employees, asset-related costs to exit facilities and

other costs as outlined below. The Company incurred total

restructuring charges of approximately $806 and $956 for

the years ended June 30, 2014 and 2013, respectively.

Approximately $373 and $591 of these charges were

recorded in SG&A for the years ended June 30, 2014 and

2013, respectively. Approximately $399 and $354 of these

charges were recorded in cost of products sold for the years

ended June 30, 2014 and 2013, respectively. The remainder

is included in discontinued operations. Since the inception

of this restructuring program, the Company has incurred

charges of approximately $2.8 billion. Approximately $1.5

billion of these charges were related to separations, $666

were asset-related and $680 were related to other

restructuring-type costs. The following table presents

restructuring activity for the years ended June 30, 2014 and

2013: