Proctor and Gamble 2014 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2014 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 25

SUMMARY OF 2014 RESULTS

Amounts in millions, except per share amounts 2014

Change vs.

Prior Year 2013

Change vs.

Prior Year 2012

Net sales $ 83,062 1% $ 82,581 1% $ 82,006

Operating income 15,288 7% 14,330 10% 13,035

Net earnings from continuing operations 11,707 4% 11,301 24% 9,150

Net earnings from discontinued operations 78 (23)% 101 (94)% 1,754

Net earnings attributable to Procter & Gamble 11,643 3% 11,312 5% 10,756

Diluted net earnings per common share 4.01 4% 3.86 5% 3.66

Diluted net earnings per share from continuing operations 3.98 4% 3.83 25% 3.06

Core earnings per common share 4.22 5% 4.02 6% 3.79

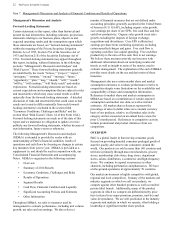

• Net sales increased 1% to $83.1 billion including a

negative 2% impact from foreign exchange.

Organic sales increased 3%.

Unit volume increased 3%. Volume grew mid-

single digits for Fabric Care and Home Care and

Baby, Feminine and Family Care. Volume

increased low single digits for Grooming and

Health Care. Volume was unchanged for Beauty.

• Net earnings attributable to Procter & Gamble were

$11.6 billion, an increase of $331 million or 3% versus

the prior year period.

Net earnings from continuing operations increased

$406 million or 4% largely due to net sales growth

and net earnings margin expansion behind reduced

selling, general and administrative costs (SG&A),

partially offset by gross margin contraction.

Foreign exchange impacts negatively impacted net

earnings by approximately 9%.

Net earnings from discontinued operations

decreased $23 million due to reduced earnings in

Pet Care from ongoing impacts of prior year

product recalls.

• Diluted net earnings per share increased 4% to $4.01.

Diluted net earnings per share from continuing

operations increased 4% to $3.98

Core EPS increased 5% to $4.22.

• Cash flow from operating activities was $14.0 billion.

Free cash flow was $10.1 billion.

Free cash flow productivity was 86%.

ECONOMIC CONDITIONS, CHALLENGES AND

RISKS

We discuss expectations regarding future performance,

events and outcomes, such as our business outlook and

objectives, in annual and quarterly reports, press releases

and other written and oral communications. All such

statements, except for historical and present factual

information, are "forward-looking statements" and are based

on financial data and our business plans available only as of

the time the statements are made, which may become out-of-

date or incomplete. We assume no obligation to update any

forward-looking statements as a result of new information,

future events or other factors. Forward-looking statements

are inherently uncertain and investors must recognize that

events could be significantly different from our expectations.

For more information on risks that could impact our results,

refer to Item 1A Risk Factors in this 10-K.

Ability to Achieve Business Plans. We are a consumer

products company and rely on continued demand for our

brands and products. To achieve business goals, we must

develop and sell products that appeal to consumers and retail

trade customers. Our continued success is dependent on

innovation with respect to both products and operations and

on the continued positive reputations of our brands. This

means we must be able to obtain and maintain patents and

trademarks and respond to technological advances and

patents granted to competition. Our success is also

dependent on effective sales, advertising and marketing

programs in a more fast-paced and rapidly changing

environment. Our ability to innovate and execute in these

areas will determine the extent to which we are able to grow

existing net sales and volume profitably, especially with

respect to the product categories and geographic markets

(including developing markets) in which we have chosen to

focus. There are high levels of competitive activity in the

markets in which we operate. To address these challenges,

we must respond to competitive factors, including pricing,

promotional incentives, trade terms and product initiatives.

We must manage each of these factors, as well as maintain

mutually beneficial relationships with our key customers, in

order to effectively compete and achieve our business plans.

As a company that manages a portfolio of consumer brands,

our ongoing business model involves a certain level of

ongoing acquisition, divestiture and joint venture activities.

We must be able to successfully manage the impacts of these

activities, while at the same time delivering against base

business objectives.

Daily conduct of our business also depends on our ability to

maintain key information technology systems, including

systems operated by third-party suppliers and to maintain

security over our data.