Proctor and Gamble 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40 The Procter & Gamble Company

Unanticipated market or macroeconomic events and

circumstances may occur, which could affect the accuracy or

validity of the estimates and assumptions.

Determining the useful life of an intangible asset also

requires judgment. Certain brand intangible assets are

expected to have indefinite lives based on their history and

our plans to continue to support and build the acquired

brands. Other acquired intangible assets (e.g., certain

trademarks or brands, customer relationships, patents and

technologies) are expected to have determinable useful lives.

Our assessment as to brands that have an indefinite life and

those that have a determinable life is based on a number of

factors including competitive environment, market share,

brand history, underlying product life cycles, operating plans

and the macroeconomic environment of the countries in

which the brands are sold. Our estimates of the useful lives

of determinable-lived intangible assets are primarily based

on these same factors. All of our acquired technology and

customer-related intangible assets are expected to have

determinable useful lives.

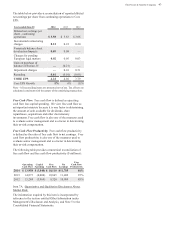

The costs of determinable-lived intangible assets are

amortized to expense over their estimated lives. The value

of indefinite-lived intangible assets and residual goodwill is

not amortized, but is tested at least annually for impairment.

Our impairment testing for goodwill is performed separately

from our impairment testing of indefinite-lived intangible

assets. We test goodwill for impairment by reviewing the

book value compared to the fair value at the reporting unit

level. We test individual indefinite-lived intangible assets by

comparing the book values of each asset to the estimated fair

value. We determine the fair value of our reporting units and

indefinite-lived intangible assets based on the income

approach. Under the income approach, we calculate the fair

value of our reporting units and indefinite-lived intangible

assets based on the present value of estimated future cash

flows. Considerable management judgment is necessary to

evaluate the impact of operating and macroeconomic

changes and to estimate future cash flows to measure fair

value. Assumptions used in our impairment evaluations,

such as forecasted growth rates and cost of capital, are

consistent with internal projections and operating plans. We

believe such assumptions and estimates are also comparable

to those that would be used by other marketplace

participants.

With the exception of our Appliances, Batteries and Salon

Professional businesses, all of our reporting units have fair

values that significantly exceed recorded values. However,

future changes in the judgments, assumptions and estimates

that are used in our impairment testing for goodwill and

indefinite-lived intangible assets, including discount and tax

rates or future cash flow projections, could result in

significantly different estimates of the fair values. In

addition, any potential change in the strategic plans for these

businesses due to the refocusing of our business portfolio

could impact these judgments, assumptions, and estimates,

in turn, impacting our fair value. A significant reduction in

the estimated fair values could result in impairment charges

that could materially affect the financial statements in any

given year. The recorded value of goodwill and intangible

assets from recently impaired businesses and recently

acquired businesses are derived from more recent business

operating plans and macroeconomic environmental

conditions and therefore are more susceptible to an adverse

change that could require an impairment charge.

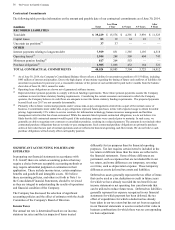

The results of our impairment testing during fiscal 2012

indicated that the estimated fair values of our Appliances and

Salon Professional reporting units were less than their

respective carrying amounts. Therefore, we recorded a non-

cash before- and after-tax impairment charge of $1.3 billion

in fiscal 2012. Additionally, our impairment testing for

indefinite-lived intangible assets during fiscal 2012 indicated

a decline in the fair value of our Koleston Perfect and Wella

trade name intangible assets below their respective carrying

values. This resulted in a non-cash, before-tax impairment

charge of $246 million ($173 million after-tax) to reduce the

carrying amounts of these assets to their estimated fair

values.

During the fourth quarter of fiscal 2013, the estimated fair

value of our Appliances reporting units declined further,

below the carrying amount resulting from the fiscal 2012

impairment. Therefore, we recorded an additional non-cash

before and after-tax impairment charge of $259 million in

fiscal 2013. Additionally, our fourth quarter 2013

impairment testing for Appliances indicated a decline in the

fair value of our Braun trade name intangible asset below its

carrying value. This resulted in a non-cash, before-tax

impairment charge of $49 million ($31 million after-tax) to

reduce the carrying amount of this asset to its estimated fair

value.

The Appliances business was acquired as part of the Gillette

acquisition in 2005 and the Salon Professional business

consists primarily of operations acquired in the Wella

acquisition in 2004. Both businesses are stand-alone

reporting units. These businesses represent some of our

more discretionary consumer spending categories. Because

of this, their operations and underlying fair values were

disproportionately impacted by the economic downturn that

began in fiscal 2009, which led to a reduction in home and

personal grooming appliance purchases and in visits to hair

salons that drove the fiscal 2012 impairment. The additional

impairment of the Appliances business in fiscal 2013 was

due to the devaluation of currency in Japan, a key country

that generates a significant portion of the earnings of the

Appliances business, relative to the currencies in which the

underlying net assets are recorded. As of June 30, 2014, the

Appliances business has remaining goodwill of $317 million

and remaining intangible assets of $875 million, while the

Salon Professional business has remaining goodwill of $436

million and remaining intangible assets of $726 million. As

a result of the impairments, the estimated fair value of our

Appliances business and the Salon Professional business

slightly exceed their respective carrying values. Our fiscal

2014 valuations of the Appliances and Salon Professional

businesses has them returning to sales and earnings growth