Proctor and Gamble 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 73

Amounts in millions of dollars except per share amounts or as otherwise specified.

than obligations recorded as liabilities at the time of

divestiture, we have not made significant payments for these

indemnifications. We believe that if we were to incur a loss

on any of these matters, the loss would not have a material

effect on our financial position, results of operations or cash

flows.

In certain situations, we guarantee loans for suppliers and

customers. The total amount of guarantees issued under

such arrangements is not material.

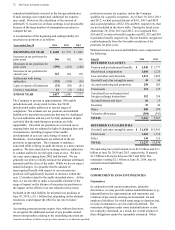

Off-Balance Sheet Arrangements

We do not have off-balance sheet financing arrangements,

including variable interest entities, that have a material

impact on our financial statements.

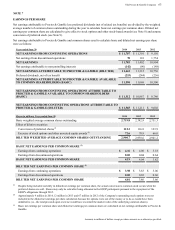

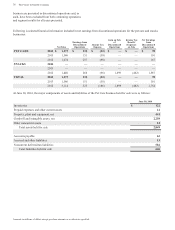

Purchase Commitments and Operating Leases

We have purchase commitments for materials, supplies,

services and property, plant and equipment as part of the

normal course of business. Commitments made under take-

or-pay obligations are as follows:

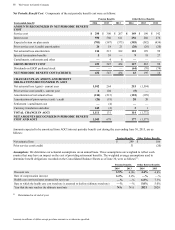

Years ended

June 30 2015 2016 2017 2018 2019

There

after

Purchase

obligations $ 1,068 $ 268 $ 164 $ 92 $ 72 $ 321

Such amounts represent future purchases in line with

expected usage to obtain favorable pricing. Approximately

19% of our purchase commitments relate to service contracts

for information technology, human resources management

and facilities management activities that have been

outsourced to third-party suppliers. Due to the proprietary

nature of many of our materials and processes, certain

supply contracts contain penalty provisions for early

termination. We do not expect to incur penalty payments

under these provisions that would materially affect our

financial position, results of operations or cash flows.

We also lease certain property and equipment for varying

periods. Future minimum rental commitments under non-

cancelable operating leases, net of guaranteed sublease

income, are as follows:

Years ended

June 30 2015 2016 2017 2018 2019

There

after

Operating

leases $ 288 $ 273 $ 236 $ 216 $ 188 $ 743

Litigation

We are subject to various legal proceedings and claims

arising out of our business which cover a wide range of

matters such as antitrust, trade and other governmental

regulations, product liability, patent and trademark matters,

advertising, contracts, environmental issues, labor and

employments matters and income and other taxes.

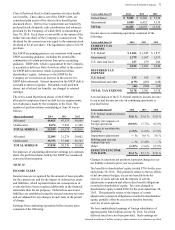

As previously disclosed, the Company has had a number of

antitrust matters in Europe. These matters involve a number

of other consumer products companies and/or retail

customers. Several regulatory authorities in Europe have

issued separate decisions pursuant to their investigations

alleging that the Company, along with several other

companies, engaged in violations of competition laws in

those countries. Many of these matters have concluded and

the fines have been paid. For ongoing matters, the Company

has accrued liabilities for competition law violations totaling

$225 as of June 30, 2014. While the ultimate resolution of

these matters may result in fines or costs in excess of the

amounts reserved, we do not expect any such incremental

losses to materially impact our financial statements in the

period in which they are accrued and paid, respectively.

With respect to other litigation and claims, while

considerable uncertainty exists, in the opinion of

management and our counsel, the ultimate resolution of the

various lawsuits and claims will not materially affect our

financial position, results of operations or cash flows.

We are also subject to contingencies pursuant to

environmental laws and regulations that in the future may

require us to take action to correct the effects on the

environment of prior manufacturing and waste disposal

practices. Based on currently available information, we do

not believe the ultimate resolution of environmental

remediation will have a material effect on our financial

position, results of operations or cash flows.

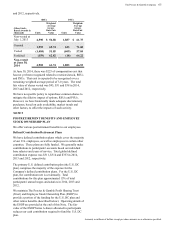

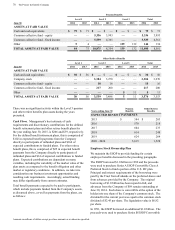

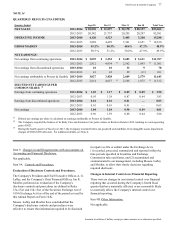

NOTE 12

SEGMENT INFORMATION

Effective July 1, 2013, we reorganized our Global Business

Unit (GBU) structure, which resulted in changes to our

reporting segments. We reorganized our GBUs into four

industry-based sectors, comprised of 1) Global Beauty, 2)

Global Health and Grooming, 3) Global Fabric and Home

Care and 4) Global Baby, Feminine and Family Care. In

April 2014, we announced our decision to exit our Pet Care

business. On July 31, 2014, the Company completed the

divestiture of its Pet Care operations in North America, Latin

America and other selected markets. The Company is

pursuing alternate plans to sell its Pet Care business in the

other markets, primarily the European Union countries. This

GBU is reported as a discontinued operation for all periods

presented.

Under U.S. GAAP, the remaining GBUs underlying the four

sectors are aggregated into five reportable segments: 1)

Beauty, 2) Grooming, 3) Health Care, 4) Fabric Care and

Home Care and 5) Baby, Feminine and Family Care. As a

result of the organizational changes, Feminine Care

transitioned from Health Care to Baby, Feminine and Family

Care for all periods presented. Our five reportable segments

are comprised of:

•Beauty: Beauty Care (Antiperspirant and Deodorant,

Cosmetics, Personal Cleansing, Skin Care); Hair Care

and Color; Prestige (SKII, Fragrances); Salon

Professional;