Proctor and Gamble 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 43

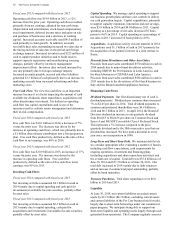

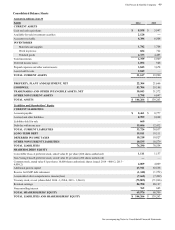

The table below provides a reconciliation of reported diluted

net earnings per share from continuing operations to Core

EPS:

Years ended June 30 2014 2013 2012

Diluted net earnings per

share - continuing

operations $ 3.98 $ 3.83 $ 3.06

Incremental restructuring

charges 0.12 0.18 0.20

Venezuela balance sheet

devaluation Impacts 0.09 0.08 —

Charges for pending

European legal matters 0.02 0.05 0.03

Gain on purchase of

balance of Iberian JV —(0.21) —

Impairment charges —0.10 0.51

Rounding 0.01 (0.01) (0.01)

CORE EPS 4.22 4.02 3.79

Core EPS Growth 5% 6% (1)%

Note - All reconciling items are presented net of tax. Tax effects are

calculated consistent with the nature of the underlying transaction.

Free Cash Flow. Free cash flow is defined as operating

cash flow less capital spending. We view free cash flow as

an important measure because it is one factor in determining

the amount of cash available for dividends, share

repurchases, acquisitions and other discretionary

investments. Free cash flow is also one of the measures used

to evaluate senior management and is a factor in determining

their at-risk compensation.

Free Cash Flow Productivity. Free cash flow productivity

is defined as the ratio of free cash flow to net earnings. Free

cash flow productivity is also one of the measures used to

evaluate senior management and is a factor in determining

their at-risk compensation.

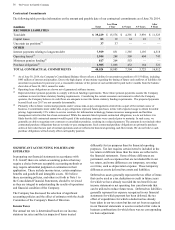

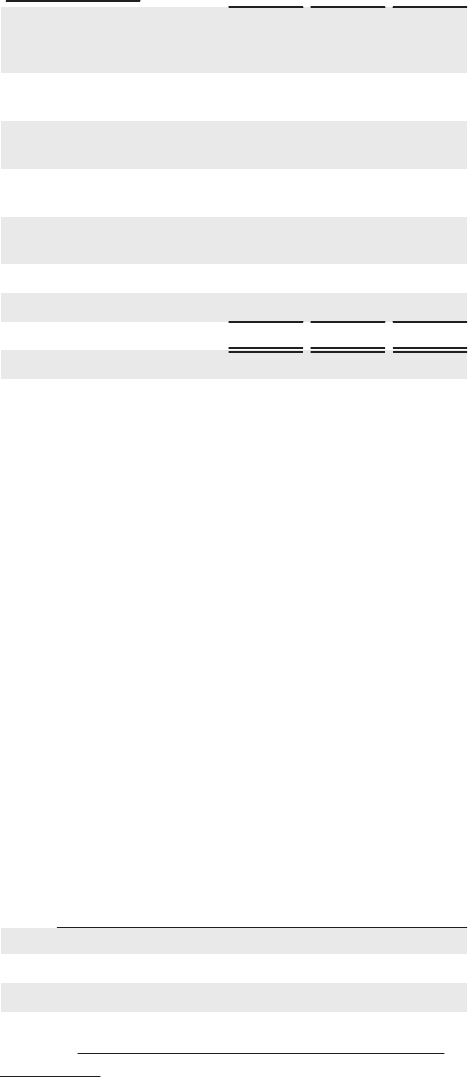

The following table provides a numerical reconciliation of

free cash flow and free cash flow productivity ($ millions):

Operating

Cash Flow

Capital

Spending

Free

Cash Flow

Net

Earnings

Free

Cash Flow

Productivity

2014 $ 13,958 $ (3,848) $ 10,110 $11,785 86%

2013 14,873 (4,008) 10,865 11,402 95 %

2012 13,284 (3,964) 9,320 10,904 85 %

Item 7A. Quantitative and Qualitative Disclosures About

Market Risk.

The information required by this item is incorporated by

reference to the section entitled Other Information under

Management's Disclosure and Analysis, and Note 5 to the

Consolidated Financial Statements.