Proctor and Gamble 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 The Procter & Gamble Company

Amounts in millions of dollars except per share amounts or as otherwise specified.

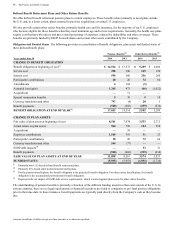

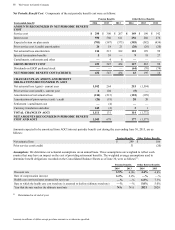

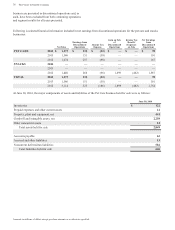

Defined Benefit Retirement Plans and Other Retiree Benefits

We offer defined benefit retirement pension plans to certain employees. These benefits relate primarily to local plans outside

the U.S. and, to a lesser extent, plans assumed in previous acquisitions covering U.S. employees.

We also provide certain other retiree benefits, primarily health care and life insurance, for the majority of our U.S. employees

who become eligible for these benefits when they meet minimum age and service requirements. Generally, the health care plans

require cost sharing with retirees and pay a stated percentage of expenses, reduced by deductibles and other coverages. These

benefits are primarily funded by ESOP Series B shares and certain other assets contributed by the Company.

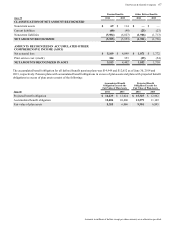

Obligation and Funded Status.The following provides a reconciliation of benefit obligations, plan assets and funded status of

these defined benefit plans:

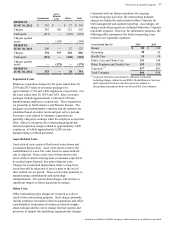

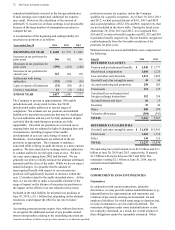

Pension Benefits(1) Other Retiree Benefits(2)

Years ended June 30 2014 2013 2014 2013

CHANGE IN BENEFIT OBLIGATION

Benefit obligation at beginning of year(3) $ 14,514 $ 13,573 $ 5,289 $ 6,006

Service cost 298 300 149 190

Interest cost 590 560 256 260

Participants' contributions 20 20 72 66

Amendments 4104 (5)—

Actuarial loss/(gain) 1,365 473 (46)(1,022)

Acquisitions —51 ——

Special termination benefits 539 918

Currency translation and other 797 (4)20 5

Benefit payments (540)(602)(239)(234)

BENEFIT OBLIGATION AT END OF YEAR(3) 17,053 14,514 5,505 5,289

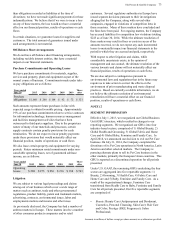

CHANGE IN PLAN ASSETS

Fair value of plan assets at beginning of year 8,561 7,974 3,553 2,713

Actual return on plan assets 964 796 124 954

Acquisitions —59 ——

Employer contributions 1,549 391 31 23

Participants' contributions 20 20 72 66

Currency translation and other 544 (77)——

ESOP debt impacts(4) ——33 31

Benefit payments (540)(602)(239)(234)

FAIR VALUE OF PLAN ASSETS AT END OF YEAR 11,098 8,561 3,574 3,553

FUNDED STATUS (5,955)(5,953)(1,931)(1,736)

(1) Primarily non-U.S.-based defined benefit retirement plans.

(2) Primarily U.S.-based other postretirement benefit plans.

(3) For the pension benefit plans, the benefit obligation is the projected benefit obligation. For other retiree benefit plans, the benefit

obligation is the accumulated postretirement benefit obligation.

(4) Represents the net impact of ESOP debt service requirements, which is netted against plan assets for other retiree benefits.

The underfunding of pension benefits is primarily a function of the different funding incentives that exist outside of the U.S. In

certain countries, there are no legal requirements or financial incentives provided to companies to pre-fund pension obligations

prior to their due date. In these instances, benefit payments are typically paid directly from the Company's cash as they become

due.