Proctor and Gamble 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 The Procter & Gamble Company

digit increase in developing markets, behind innovation and

distribution expansion, and a low single-digit increase in

developed markets primarily due to the impact of reduced

pricing in North America. Global market share of the home

care category was unchanged. Batteries volume increased

low single digits due to a mid-single-digit increase in

developing regions from market growth and geographic

expansion, partially offset by a low single-digit decrease in

developed markets due to market contraction and share

losses, primarily behind higher pricing in Western Europe to

improve the margin structure. Global market share of the

batteries category was unchanged.

Net earnings increased 10% to $3.1 billion due to a 90-basis

point increase in net earnings margin and the increase in net

sales. Net earnings margin increased due to gross margin

expansion. Gross margin increased due to higher pricing and

manufacturing cost savings, partially offset by higher

commodity costs. SG&A as a percentage of net sales was

unchanged as higher marketing spending was offset by

reduced overhead costs.

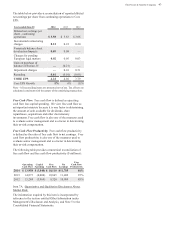

BABY, FEMININE AND FAMILY CARE

($ millions) 2014

Change vs

2013 2013

Change vs

2012

Volume n/a +4% n/a +5%

Net sales $20,950 +2% $ 20,479 +4%

Net earnings $2,940 -4% $ 3,047 +4%

% of Net Sales 14.0% (90) bps 14.9% (10) bps

Fiscal year 2014 compared with fiscal year 2013

Baby, Feminine and Family Care net sales increased 2% to

$21.0 billion in 2014 on 4% volume growth. Organic sales

were up 4% on 3% organic volume growth. Price increases

primarily in Baby Care increased net sales by 1%. Unfavorable

foreign exchange reduced net sales by 3%. Global market share

of the Baby, Feminine and Family Care segment decreased 0.3

points. Volume increased low single digits in developed

regions and mid-single digits in developing regions. Volume

in Baby Care increased mid-single digits due to a mid-single

digit increase in developing regions, from market growth and

product innovation, and a mid-single digit increase in

developed regions due to the buyout of our joint venture partner

in Iberia and product innovation in North America, partially

offset by competitive activity. Global market share of the baby

care category decreased slightly. Volume in Feminine Care

increased mid-single digits due to a mid-single digit increase

in developed regions, from the buyout of our joint venture

partner in Iberia and innovation, and a low single digit increase

in developing regions, from market growth and innovation.

Organic volume was up low single digits. Global market share

of the feminine care category decreased less than half a point.

Volume in Family Care increased low single digits due to

product innovation on Charmin and Bounty and lower pricing,

partially offset by competitive activity. In the U.S., all-outlet

share of the family care category decreased less than half point.

Net earnings decreased 4% to $2.9 billion as the increase in

net sales was more than offset by a 90-basis point decrease in

net earnings margin. Net earnings margin decreased primarily

due to gross margin contraction. Gross margin decreased due

to the impact of foreign exchange, higher commodity costs,

and unfavorable product and geographic mix from

disproportionate growth in developing regions and mid-tier

products, both of which have lower gross margins than the

segment average, partially offset by manufacturing cost

savings and pricing.

Fiscal year 2013 compared with fiscal year 2012

Baby, Feminine and Family Care net sales increased 4% to

$20.5 billion in 2013 on 5% volume growth. Organic sales

were up 6% on 3% organic volume growth. Pricing added

2% to net sales growth. Unfavorable foreign exchange

reduced net sales by 2%. Global market share of the Baby,

Feminine and Family Care segment decreased 0.2 points.

Volume increased mid-single digits in both developing and

developed regions. Volume in Baby Care increased mid-

single digits. Excluding the buyout of our joint venture

partner in Iberia, organic volume increased low-single digits

as a mid-single digit increase in developing regions from

market growth, distribution expansion and innovation, was

partially offset by a low single-digit decrease in developed

regions due to market contraction and competitive

promotional activity, primarily in Western Europe. Global

market share of the baby care category decreased nearly half

a point. Volume in Feminine Care increased mid-single

digits from mid-single-digit growth in developing markets

behind market growth and innovation and high single-digit

increase in developed regions due to the buyout of our joint

venture partner in Iberia. Global market share of the

feminine care category was down half a point. Volume in

Family Care increased mid-single digits primarily due to

market growth and innovation on Charmin and Bounty. In

the U.S., all-outlet share of the family care category was flat.

Net earnings increased 4% to $3.0 billion due to the increase

in net sales. Net earnings margin was down slightly due to

gross margin expansion offset by a higher effective tax rate.

The increase in gross margin was driven by the impact of

higher pricing and manufacturing and commodity cost

savings, partially offset by unfavorable product and

geographic mix. The effective tax rate increased due to the

geographic mix of earnings.

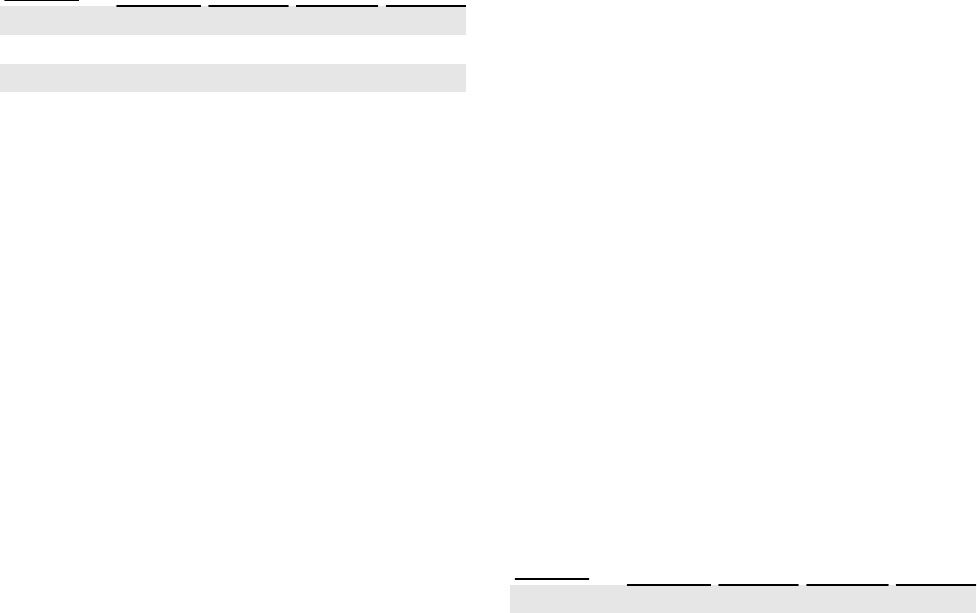

CORPORATE

($ millions) 2014

Change vs

2013 2013

Change vs

2012

Net sales $738 +31% $562 -31%

Net earnings $(48) N/A $(239) N/A

Corporate includes certain operating and non-operating

activities not allocated to specific business units. These

include: the incidental businesses managed at the corporate

level; financing and investing activities; other general

corporate items; the historical results of certain divested

brands and categories; certain asset impairment charges;