Proctor and Gamble 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The manliest grooming brand is also the smartest.

Old Spice Re-Fresh* Body Spray’s unique Re-Fresh Technology

releases bursts of fragrance throughout the day, giving guys

superior freshness when they need it most.

Introduced in the U.K. in July 2014 and North America in

August 2014, Always Discreet* marks our signifi cant entry

into the Adult Incontinence category

—

revolutionizing

the way women manage sensitive bladders.

We are consumer led. Their needs and wants come fi rst. We meet

those needs with differentiated brands and better-performing

products

—

priced to deliver real and perceived consumer value.

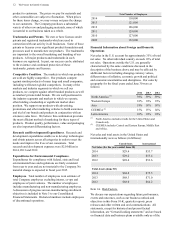

In all four industry sectors and in most of our businesses, there is

as much, and often more, sales growth and value creation

—

profi t and cash

—

in the premium and super-premium segments.

We’ve been very successful in these segments.

In the grooming market, premium products generate about %

of sales. Gillette has an % share of this segment. Four years ago,

we introduced Fusion ProGlide, priced at the higher end of the

premium segment. Fusion grew global share for consecutive

quarters, reaching $ billion in sales faster than any other P&G

brand in history. Last month, we launched the newest product in

the Fusion line-up

—

Fusion ProGlide with FlexBall* Technology,

the fi rst razor designed to respond to the contours of a man’s

face, maintaining maximum contact and delivering a closer, more

complete and comfortable shave. Men prefer this new razor

-to- versus the best-selling razor in the world

—

our own Fusion

ProGlide. FlexBall is off to a very good start, and appears to be

revitalizing consumer interest in the category, driving an increase

in U.S. male razor market sales, and acceleration in Gillette’s

sales and shares.

Crest D White*, a premium oral care regimen, was also launched

in the U.S. and has grown market share for consecutive quarters.

On its own worldwide, D White is a billion-dollar business.

DWhite has also been an important driver of toothpaste market

share growth in developing or emerging markets, for example,

adding about a point-and-a-half share in Brazil and one point in

Mexico last year. We recently launched D White in Europe,

driving category growth in a region where many other

categories are declining. Following the D White launch, we

introduced Crest D White Luxe* toothpaste and Whitestrips*.

The Luxe Glamorous White* toothpaste removes up to %

of surface stains on teeth in just fi ve days and protects against

future stains with our proprietary WHITELOCK* technology.

The Whitestrips with FlexFit* Technology stretch and mold to

your teeth for a completely custom fi t.

Tide, Gain and Ariel three-chamber unit dose laundry detergents

have been an innovation breakthrough in the laundry detergent

category

—

resetting the bar for delightful consumer usage

experience, product performance and convenience. Tide PODS*

are priced at a % premium to liquid Tide and have grown to

more than % of the laundry category. In March, we launched

Gain Flings!*

—

priced at a % per use premium to Gain liquid

detergent. Combined, Tide PODS and Gain Flings! now hold more

P&G launched seven of the top most successful non-food products

of the year in the U.S. (Source: 2013 IRI New Product Pacesetters list)

4 The Procter & Gamble Company