Proctor and Gamble 2011 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2011 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

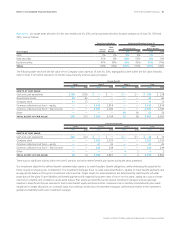

62 The Procter & Gamble CompanyNotes to Consolidated Financial Statements

Amounts in millions of dollars except per share amounts or as otherwise specified.

The Company recognizes transfers between levels within the fair value

hierarchy, if any, at the end of each quarter. There was no significant

activity within the Level 3financial assets and liabilities during the years

presented. There were no significant assets or liabilities that were

re-measured at fair value on a non-recurring basis during the years

ended June30,2011 and 2010.

Disclosures about Derivative Instruments

The notional amounts and fair values of qualifying and non-qualifying

financial instruments used in hedging transactions as of June30,2011

and 2010 are as follows:

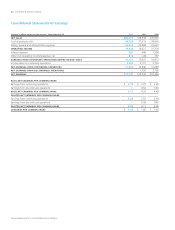

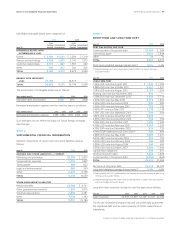

Notional Amount FairValueAsset/(Liability)

June30 2010 2010

DERIVATIVES IN CASH

FLOW HEDGING

RELATIONSHIPS

Interest rate contracts $—$—$— $—

Foreign currency contracts 831 690 (118)(177)

Commodity contracts 16 43 410

TOTAL847 733 (114)(167)

DERIVATIVES IN FAIR

VALUE HEDGING

RELATIONSHIPS

Interest rate contracts 10,308 7,942 163 191

DERIVATIVES IN NET

INVESTMENT HEDGING

RELATIONSHIPS

Net investment hedges 1,540 1,586 (138)(9)

DERIVATIVES NOT

DESIGNATED

AS HEDGING

INSTRUMENTS

Foreign currency contracts 14,957 11,845 139 (94)

Commodity contracts 39 19 (1)—

TOTAL14,996 11,864 138 (94)

The total notional amount of contracts outstanding at the end of the

period is indicative of the level of the Company’s derivative activity

during the period.

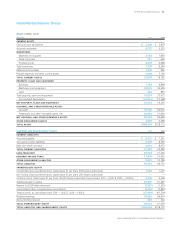

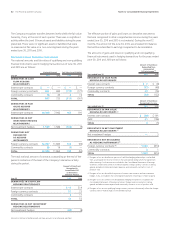

AmountofGain/(Loss)

Recognizedin

AccumulatedOCI

on Derivatives

(EffectivePortion)

June30 2010

DERIVATIVES IN CASH FLOW

HEDGING RELATIONSHIPS

Interest rate contracts $15 $19

Foreign currency contracts 32 23

Commodity contracts 311

TOTAL50 53

DERIVATIVES IN NET INVESTMENT

HEDGING RELATIONSHIPS

Net investment hedges (88) (8)

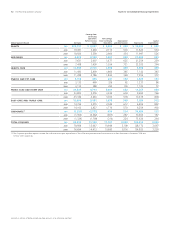

The effective portion of gains and losses on derivative instruments

that was recognized in other comprehensive income during the years

ended June 30,2011 and 2010 is not material. During the next 12

months, the amount of the June30,2011, accumulated OCI balance

that will be reclassified to earnings is expected to be immaterial.

The amounts of gains and losses on qualifying and non-qualifying

financial instruments used in hedging transactions for the years ended

June30,2011 and 2010 are as follows:

AmountofGain/(Loss)

Reclassified from

Accumulated

OCIinto Income(1)

Years ended June30 2010

DERIVATIVES IN CASH FLOW

HEDGING RELATIONSHIPS

Interest rate contracts $ 7 $(8)

Foreign currency contracts (77) (48)

Commodity contracts 20 (76)

TOTAL(50) (132)

AmountofGain/(Loss)

RecognizedinIncome

Years ended June30 2010

DERIVATIVES IN FAIR VALUE

HEDGING RELATIONSHIPS(2)

Interest rate contracts $ (28) $191

Debt 31 (196)

TOTAL3(5)

DERIVATIVES IN NET INVESTMENT

HEDGING RELATIONSHIPS(2)

Net investment hedges —3

DERIVATIVES NOT DESIGNATED

AS HEDGING INSTRUMENTS(3)

Foreign currency contracts(4)1,359 (814)

Commodity contracts 31

TOTAL1,362 (813)

(1) The gain or loss on the effective portion of cash flow hedging relationships is reclassified

from accumulated OCI into net income in the same period during which the related item

affects earnings. Such amounts are included in the Consolidated Statements of Earnings

as follows: interest rate contracts in interest expense, foreign currency contracts in selling,

general and administrative and interest expense, and commodity contracts in cost of

products sold.

(2) The gain or loss on the ineffective portion of interest rate contracts and net investment

hedges, if any, is included in the Consolidated Statements of Earnings in interest expense.

(3) The gain or loss on contracts not designated as hedging instruments is included in the

Consolidated Statements of Earnings as follows: foreign currency contracts in selling,

general and administrative expense and commodity contracts in cost of products sold.

(4) The gain or loss on non-qualifying foreign currency contracts substantially offsets the foreign

currency mark-to-market impact of the related exposure.