Proctor and Gamble 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

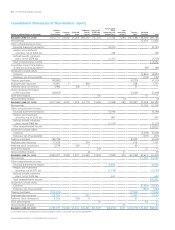

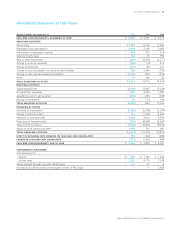

54 The Procter & Gamble Company

See accompanying Notes to Consolidated Financial Statements.

Dollarsinmillions/Sharesinthousands

Common

Shares

OutstandingCommon

StockPreferred

Stock

Additional

Paid-In

Capital

Reservefor

ESOP Debt

Retirement

Accumulated

Other

Comprehensive

Income/(loss)

Non

controlling

Interest

-

Treasury

Stock

Retained

Earnings Total

BALANCE JUNE , 3,032,717 $4,002 $1,366 $60,307 $(1,325) $ 3,746 $290 $(47,588) $48,986 $69,784

Net earnings 13,436 13,436

Other comprehensive income:

Financial statement translation (6,151)(6,151)

Hedges and investment

securities, net of $ tax 748 748

Defined benefit retirement

plans, net of $879 tax (1,701)(1,701)

Total comprehensive income $ 6,332

Cumulative impact for adoption

of new accounting guidance(1)(84)(84)

Dividends to shareholders:

Common (4,852)(4,852)

Preferred, net of tax benefits (192)(192)

Treasury purchases (98,862) (6,370)(6,370)

Employee plan issuances 16,841 5804 428 1,237

Preferred stock conversions 4,992 (42) 7 35 —

Shares tendered for Folgers

coffee subsidiary (38,653) (2,466)(2,466)

ESOP debt impacts (15)15 —

Noncontrolling interest (7)(7)

BALANCE JUNE , 2,917,035 4,007 1,324 61,118 (1,340)(3,358)283 (55,961) 57,309 63,382

Net earnings 12,736 12,736

Other comprehensive income:

Financial statement translation (4,194)(4,194)

Hedges and investment

securities, net of $520 tax 867 867

Defined benefit retirement

plans, net of $465 tax (1,137)(1,137)

Total comprehensive income $8,272

Dividends to shareholders:

Common (5,239)(5,239)

Preferred, net of tax benefits (219)(219)

Treasury purchases (96,759) (6,004)(6,004)

Employee plan issuances 17,616 1574616 1,191

Preferred stock conversions 5,579 (47) 740 —

ESOP debt impacts (10)27 17

Noncontrolling interest (2)41 39

BALANCE JUNE , 2,843,471 4,008 1,27761,697 (1,350)(7,822)324 (61,309) 64,614 61,439

Net earnings 11,797 11,797

Other comprehensive income:

Financial statement translation 6,493 6,493

Hedges and investment

securities, net of $711 tax (1,178) (1,178)

Defined benefit retirement

plans, net of $302 tax 453 453

Total comprehensive income $17,565

Dividends to shareholders:

Common (5,534) (5,534)

Preferred, net of tax benefits (233)(233)

Treasury purchases (112,729) (7,039) (7,039)

Employee plan issuances 29,729 — 702 1,033 1,735

Preferred stock conversions 5,266 (43) 6 37 —

ESOP debt impacts (7)38 31

Noncontrolling interest — 37 37

BALANCE JUNE , 2,765,737 $4,008 $1,234 $62,405 $(1,357)$(2,054)$361 $(67,278) $70,682 $68,001

(1) Cumulative impact of adopting new accounting guidance relates to split-dollar life insurance arrangements.

Consolidated Statements of Shareholders’ Equity