Proctor and Gamble 2011 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2011 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and AnalysisThe Procter & Gamble Company 43

developing regions, which have lower than segment average selling

prices. Organic sales increased %. Volume grew mid-single digits in

developing regions and low single digits in developed regions. Oral

Care volume grew mid-single digits behind initiative activity in

Western Europe, Latin America and Asia. Personal Health Care volume

was up low single digits behind higher shipments of Vicks and diag-

nostic products, partially offset by a continuing decline of PrilosecOTC

in North America due to increased competitive activity. All-outlet value

share of the U.S. personal health care market declined 1-share point,

led by a 5-share point decline of Prilosec OTC’s share of the upper

stomach remedies segment. Feminine Care volume increased low single

digits behind initiative-driven growth of Always and expansion of

Naturella into China. Global market share of the feminine care category

was down about half a point.

Net earnings increased 1% to $1.9billion for 2010 on higher net sales,

partially offset by a 10-basis point reduction in net earnings margin. Net

earnings margin contracted due to higher SG&A as a percentage of net

sales, partially offset by higher gross margin. SG&A as a percentage

of net sales increased due to higher marketing and overhead spending

and incremental foreign currency exchange costs. Gross margin grew

behind price increases, lower commodity costs and manufacturing

cost savings.

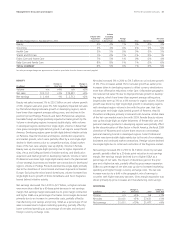

SNACKS AND PET CARE

($ millions) 2011

Changevs.

Prior Year 2010

Changevs.

Prior Year

Volume n/a +1% n/a -2%

Net sales $3,156 +1%$3,135 +1%

Net earnings $241 -26%$326 +39%

Snacks and Pet Care net sales increased 1% to $3.2billion on a 1%

increase in unit volume. Organic sales, which exclude the impacts of

foreign exchange and the Natura acquisition, were down 5% on a 2%

decline in organic volume. Price decreases, through higher promo-

tional spending, reduced net sales growth by 1%. Favorable foreign

exchange positively impacted net sales growth by 1%. Snacks volume

increased high single digits mainly due to increased distribution in

CEEMEA and Latin America, as well as initiatives and incremental

merchandising activity. Global market share of the snacks category

was up slightly. Pet Care volume was down mid-single digits mainly

due to the impacts of the recall of select dry pet food products and

the supply constraints resulting from restructuring the supply chain

following the recalls, partially offset by the impact of the Natura

acquisition in June 2010. Excluding the Natura acquisition, Pet Care

volume decreased double digits. Global market share of the pet care

category was down half a point.

Net earnings decreased 26%to $241 million as sales growth was more

than offset by a 280-basis point decrease in net earnings margin.

Netearnings margin decreased due to operating margin contraction

partially offset by a lower effective tax rate. The operating margin

reduction was driven by lower gross margin and increased SG&A as

apercentage of net sales. Gross margin declined behind incremental

costs and reduced scale leverage related to the pet food recall and

supply chain restructuring efforts. SG&A as a percentage of net sales

increased due to costs related to the select dry pet food products

recall. The tax rate decrease was due to a shift in the geographic mix

of earnings to countries with lower statutory tax rates.

In April 2011, we announced plans to divest the Company’s Snacks

business through a merger with Diamond Foods, Inc. in an all-stock

Reverse Morris Trust transaction. The Snacks business had net sales

ofapproximately $1.5billion and operating income of approximately

$200 million in fiscal 2011. The Company expects the transaction

toclose by the end of the 2011 calendar year, pending necessary

regulatory approvals.

Net sales increased 1% in 2010 to $3.1billion on a 2% decline in unit

volume. Price increases, taken primarily to offset prior-year commodity

cost increases, added 3% to net sales. Favorable foreign exchange

added 1% to net sales. Mix reduced net sales by 1% due to the dis-

continuation of certain premium snack products, which have higher

than segment average selling prices, and higher shipments of large

size pet products, which have lower than segment average selling

prices. Organic sales were in line with the prior year. Volume in Snacks

was down mid-single digits behind volume share losses driven by

lower merchandising activity in North America and the discontinuation

of certain premium snack products. Global market share of the snacks

category was down half a point versus the prior year. Volume in Pet

Care was up low single digits behind the continued success of product

initiatives, increased marketing support and incremental merchandising

activity.

Net earnings increased 39% to $326 million in 2010 driven by higher

net sales and a 290-basis point increase in net earnings margin. Net

earnings margin expanded due to higher gross margin and a lower

tax rate, partially offset by higher SG&A as a percentage of net sales.

Gross margin expanded behind price increases, commodity cost declines

and manufacturing cost savings. The tax rate declined due to a shift

in the geographic mix of earnings to countries with lower statutory

tax rates. SG&A as a percentage of net sales increased due to higher

marketing and overhead spending.

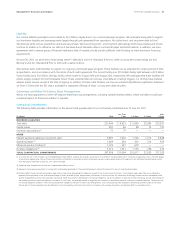

FABRIC CARE AND HOME CARE

($ millions) 2011

Changevs.

PriorYear 2010

Changevs.

Prior Year

Volume n/a +7%n/a +6%

Net sales $24,837 +4%$23,805 +3%

Net earnings $3,009 -10%$3,339 +10%

Fabric Care and Home Care net sales increased 4% to $24.8billion

ona7% increase in unit volume. Organic sales were up 3%. Organic

volume, which excludes the impact of the Ambi Pur acquisition,

increased 5%. Mix negatively impacted net sales growth by 2% due

to disproportionate growth of mid-tier product lines and powdered

laundry detergents, which have lower than segment average selling

prices. Unfavorable foreign exchange reduced net sales by 1%. Volume

in developing regions was up high single digits, while volume in

developed regions grew mid-single digits. Fabric Care volume increased