Proctor and Gamble 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and AnalysisThe Procter & Gamble Company 51

Measures Not Defined By U.S. GAAP

Our discussion of financial results includes several “non-GAAP” finan-

cial measures. We believe these measures provide our investors with

additional information about our underlying results and trends, as

well as insight to some of the metrics used to evaluate management.

When used in MD&A, we have provided the comparable GAAP

measure in the discussion. These measures include:

Organic Sales Growth. Organic sales growth is a non-GAAP measure

of sales growth excluding the impacts of acquisitions, divestitures and

foreign exchange from year-over-year comparisons. We believe this

provides investors with a more complete understanding of underlying

sales trends by providing sales growth on a consistent basis. Organic

sales is also one of the measures used to evaluate senior management

and is a factor in determining their at-risk compensation.

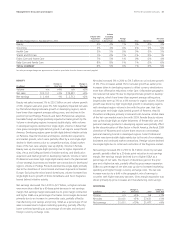

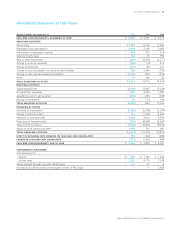

The following tables provide a numerical reconciliation of organic

sales growth to reported net sales growth:

Year ended June, 2011

NetSales

Growth

Foreign

Exchange

Impact

Acquisition

Divestiture

Impact

/

*

Organic

Sales

Growth

Beauty 3% -1%1% 3%

Grooming 5% 0% 0% 5%

Health Care5% 0% 0% 5%

Snacks and Pet Care1% -1%-5% -5%

Fabric Care and Home Care4% 1% -2% 3%

Baby Care and Family Care6% 1% 0% 7%

TOTAL P&G 5% 0% -1%4%

Year ended June30,2010

NetSales

Growth

Foreign

Exchange

Impact

Acquisition

Divestiture

Impact

/

*

Organic

Sales

Growth

Beauty 3% 0% 0% 3%

Grooming 3% 0% 0% 3%

Health Care2% 0% 0% 2%

Snacks and Pet Care1% -1%0% 0%

Fabric Care and Home Care3% 1% 0% 4%

Baby Care and Family Care4% 1% 0% 5%

TOTAL P&G 3% 1% -1%3%

* Acquisition/Divestiture Impact includes rounding impacts necessary to reconcile net sales to

organic sales.

Core EPS. This is a measure of the Company’s diluted net earnings

per share from continuing operations excluding certain items that are

not judged to be part of the Company’s sustainable results or trends.

This includes a significant benefit in from the settlement of U.S. tax

litigation primarily related to the valuation of technology donations,

charges in both and related to pending European legal

matters, a charge related to a tax provision for retiree healthcare

subsidy payments in the U.S. healthcare reform legislation, and

incremental restructuring charges in 2009 to offset dilution caused by

the Folgers divestiture. We do not view these items to be part of our

sustainable results. We believe the Core EPS measure provides an

important perspective of underlying business trends and results and

provides a more comparable measure of year-on-year earnings per

share growth. Core EPS is also one of the measures used to evaluate

senior management and is a factor in determining their at-risk compen-

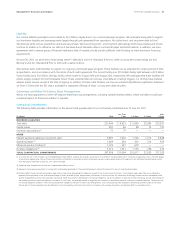

sation. The table below provides a reconciliation of reported diluted

net earnings per share from continuing operations to Core EPS:

Years ended June30 2011 2010 2009

Diluted Net Earnings Per Share—

Continuing Operations $3.93 $ 3.53 $ 3.39

Settlement from U.S. TaxLitigation (0.08)— —

Charges for Pending European

Legal Matters 0.10 0.09 —

Charge for Taxation of Retiree

Healthcare Subsidy —0.05 —

Incremental Folgers-related

Restructuring Charges—— 0.09

Rounding Impacts ——(0.01)

CORE EPS$3.95 $ 3.67 $ 3.47

Core EPS Growth 8% 6%

Note —All reconciling items are presented net of tax. Tax effects are calculated consistent with

the nature of the underlying transaction. The significant adjustment to an income tax reserve

was tax expense. There was no tax impact on EPS due to the charges for pending European

legal matters.

Free Cash Flow.Free cash flow is defined as operating cash flow less

capital spending. We view free cash flow as an important measure

because it is one factor in determining the amount of cash available

for dividends and discretionary investment. Free cash flow is also one

of the measures used to evaluate senior management and is a factor

in determining their at-risk compensation.

Free Cash Flow Productivity. Free cash flow productivity is defined as

the ratio of free cash flow to net earnings. Free cash flow productivity

is also one of the measures used to evaluate senior management and is

a factor in determining their at-risk compensation.

The following table provides a numerical reconciliation of free cash

flow and free cash flow productivity:

($ millions)

Operating

CashFlow

Capital

Spending

Free

CashFlow

Net

Earnings

Free

CashFlow

Productivity

2011 $13,231 $(3,306) $ 9,925 $11,797 84%

2010 16,072 (3,067)13,005 12,736 102%

2009 14,919 (3,238)11,681 13,436 87%