Proctor and Gamble 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and AnalysisThe Procter & Gamble Company 49

expense by less than $ million. The average discount rate on the

OPEB plan of .% reflects the higher interest rates generally applicable

in the U.S., which is where a majority of the plan participants receive

benefits. A basis point change in the discount rate would impact

annual after-tax OPEB expense by less than $35 million.

Acquisitions, Goodwill and Intangible Assets

We account for acquired businesses using the purchase method of

accounting. Under the purchase method, our Consolidated Financial

Statements reflect the operations of an acquired business starting

from the completion of the acquisition. In addition, the assets acquired

and liabilities assumed must be recorded at the date of acquisition

at their respective estimated fair values, with any excess of the pur-

chase price over the estimated fair values of the net assets acquired

recorded as goodwill.

Significant judgment is required in estimating the fair value of intan-

gible assets and in assigning their respective useful lives. Accordingly,

we typically obtain the assistance of third-party valuation specialists

for significant items. The fair value estimates are based on available

historical information and on future expectations and assumptions

deemed reasonable by management, but are inherently uncertain.

We typically use an income method to estimate the fair value of

intangible assets, which is based on forecasts of the expected future

cash flows attributable to the respective assets. Significant estimates

and assumptions inherent in the valuations reflect a consideration of

other marketplace participants, and include the amount and timing of

future cash flows (including expected growth rates and profitability),

the underlying product or technology life cycles, economic barriers to

entry, a brand’s relative market position and the discount rate applied

to the cash flows. Unanticipated market or macroeconomic events and

circumstances may occur, which could affect the accuracy or validity

of the estimates and assumptions.

Determining the useful life of an intangible asset also requires judgment.

Certain brand intangibles are expected to have indefinite lives based

on their history and our plans to continue to support and build the

acquired brands. Other acquired intangible assets (e.g., certain trade-

marks or brands, customer relationships, patents and technologies)

are expected to have determinable useful lives. Our assessment as to

brands that have an indefinite life and those that have a determinable

life is based on a number of factors including competitive environment,

market share, brand history, underlying product life cycles, operating

plans and the macroeconomic environment of the countries in which

the brands are sold. Our estimates of the useful lives of determinable-

lived intangibles are primarily based on these same factors. All of our

acquired technology and customer-related intangibles are expected

to have determinable useful lives.

The costs of determinable-lived intangibles are amortized to expense

over their estimated life. The value of indefinite-lived intangible assets

and residual goodwill is not amortized, but is tested at least annually

for impairment. Our impairment testing for goodwill is performed

separately from our impairment testing of indefinite-lived intangibles.

We test goodwill for impairment by reviewing the book value com-

pared to the fair value at the reportable unit level. We test individual

indefinite-lived intangibles by reviewing the individual book values

compared to the fair value. We determine the fair value of our report-

ing units and indefinite-lived intangible assets based on the income

approach. Under the income approach, we calculate the fair value of

our reporting units and indefinite-lived intangible assets based on the

present value of estimated future cash flows. Considerable manage-

ment judgment is necessary to evaluate the impact of operating and

macroeconomic changes and to estimate future cash flows to measure

fair value. Assumptions used in our impairment evaluations, such as

forecasted growth rates and cost of capital, are consistent with internal

projections and operating plans. We believe such assumptions and

estimates are also comparable to those that would be used by other

marketplace participants. When certain events or changes in operating

conditions occur, indefinite-lived intangible assets may be reclassified

to a determinable life asset and an additional impairment assessment

may be performed. We did not recognize any material impairment

charges for goodwill or intangible assets during the years presented.

Our annual impairment testing for both goodwill and indefinite-lived

intangible assets indicated that all reporting unit and indefinite-lived

intangible asset fair values exceeded their respective recorded values.

However, future changes in the judgments, assumptions and estimates

that are used in our impairment testing for goodwill and indefinite-

lived intangible assets, including discount and tax rates or future cash

flow projections, could result in significantly different estimates of the

fair values. A significant reduction in the estimated fair values could

result in impairment charges that could materially affect the financial

statements in any given year. The recorded value of goodwill and

intangible assets from recently acquired businesses are derived from

more recent business operating plans and macroeconomic environ-

mental conditions and therefore are more susceptible to an adverse

change that could require an impairment charge.

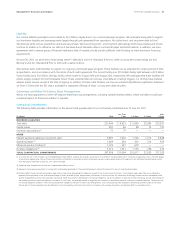

For example, the Gillette intangible and goodwill amounts represent

values as of a relatively more recent acquisition date, and as such,

theamounts are more susceptible to an impairment risk if business

operating results or macroeconomic conditions deteriorate. Gillette

indefinite-lived intangible assets represent approximately 88% of the

$27.8billion of indefinite-lived intangible assets at June30,2011.

Goodwill allocated to stand-alone reporting units consisting primarily

of businesses purchased as part of the Gillette acquisition represents

42% of the $57.6billion of goodwill at June30,2011. This includes

the Male Grooming and Appliance businesses, which are components

of the Grooming segment, and the Batteries business, which is part

of the Fabric Care and Home Care segment.

With the exception of our Appliances and Salon Professional businesses,

all of our other reporting units have fair values that significantly

exceed recorded values. As noted above, the Appliances business was

acquired as part of the Gillette acquisition and is a stand-alone good-

will reporting unit. The Salon Professional business, which consists

primarily of operations acquired in the Wella acquisition, became a

new stand-alone goodwill reporting unit as of July 1,2009, coinciding